Be a part of an important dialog in crypto and web3! Safe your seat in the present day

It’s been a wild week for bitcoin with the most important cryptocurrency by market capitalization reaching a number of six-month highs earlier than retreating out of the blue late Thursday, however then rallying once more.

Bitcoin (BTC) was just lately buying and selling over $24,557, up nearly 3.1% over the previous 24 hours and off a weekly excessive early Thursday when BTC surpassed $25,000 for the primary time since August.

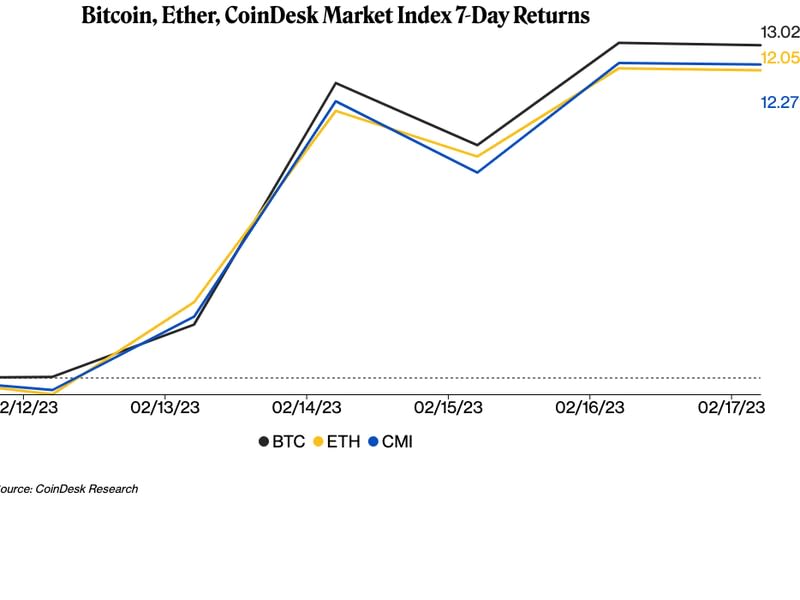

The Thursday drop however, bitcoin was nonetheless altering fingers 13% larger than it was seven days in the past. The explanations for its rebound from earlier help round $22,000, subsequent decline after which rally have diversified. They underscore cryptos’ ongoing sensitivity to macroeconomic circumstances and industry-specific occasions, even when BTC typically behaved counterintuitively.

Late Tuesday, investor optimism trumped issues a few stablecoin crackdown and tepid Client Worth Index (CPI) to ship bitcoin, ether and most different cryptos hovering. In an interview with CoinDesk, Riyad Carey, analysis analyst at crypto information agency Kaiko, mentioned that bitcoin’s upturn was “a little bit of a euphoric rally that regulatory points have cooled off briefly.”

Earlier within the week, Darius Tabatabai, co-founder of Vertex Protocol, a London-based decentralized trade, mentioned mentioned that “we might have the makings of one other bull market,”

A day later, markets turned cautious and bitcoin dropped greater than $1,000 in just a few hours amid hawkish remarks by Federal Reserve officers, the announcement of a U.S. Securities and Trade Fee (SEC) lawsuit in opposition to disgraced Terraform Labs co-founder Do Kwon, and a disappointing wholesale costs report suggesting that inflation remained stubbornly resilient.

BTC’s “intermediate-term overbought circumstances present a headwind with vital resistance round $25,200 close by, which will increase the probability of a short-term pullback. Help is close to the 200-day MA $20,000,” Katie Stockton, founding father of technical analysis-based analysis agency Fairlead Methods, wrote to CoinDesk in an e-mail.

Edward Moya, senior market analyst for overseas trade market maker Oanda, famous in an e-mail Friday that “after Bitcoin examined the $25,000 degree and failed to increase larger, many energetic merchants locked in income. Urge for food for dangerous belongings may battle over the short-term, which may help a Bitcoin consolidation so long as a regulatory crackdown doesn’t take down a key stablecoin or crypto firm.”

By Friday afternoon, buyers appeared to have shaken off the newest discouraging information to push bitcoin only a few {dollars} wanting $25,000 once more. And cryptos continued to outperform fairness markets to which they correlated for a lot of 2022. Ether (ETH), the second largest crypto in market worth, has risen greater than 12% over the previous week.

Oanda’s Moya believes that the bigger final result of the brand new U.S. crypto regulatory push will not be obvious for some time, permitting markets to type themselves out, and that the {industry} itself stays flush with attention-grabbing initiatives. “There’s all the time a interval when the regulators and lawmakers need to hear from the market that they will influence,” Moya advised CoinDesk in an interview. “However I have never seen something that take away from this market from persevering with to develop, to see funding and to have initiatives executed that might hopefully drive the use case argument for it,” he added, though he added that lot of cash may depart stablecoins for different kinds of crypto investments.

To make sure, some observers suppose that regulatory overreach may drive away funding and spook markets. “Primarily based on their unwillingness to come back to the desk, it’s clear that the SEC’s motivations of late are being pushed by a want to guard the monetary incumbents – that’s, Wall Road,” Al Morris, founding father of the decentralized publishing protocol Koii Community, advised CoinDesk in an e-mail, including that overly harsh U.S. laws may benefit different crypto hubs in Europe and Dubai.

Optimism

However buyers remained largely optimistic about crypto markets. They see the Fed approving a second consecutive 25 foundation level charge hike at its subsequent Federal Open Market Committee (FOMC) assembly in March as an alternative of returning to the extra aggressive will increase of 2022. And so they hope that any financial contraction will likely be gentle – a so-called secure touchdown that central bankers are looking for.

“Whereas forecasts of upper charges overwhelm on the values of future money flows, growing international liquidity helps increase asset costs,” Lucas Outumuro, head of analysis at blockchain analytics agency IntoTheBlock, wrote in a Friday publication.

In the meantime, Moya famous on Thursday that “bitcoin resilience” has been “spectacular” given bond market volatility and regular move of regulation headlines.”

However he added cautiously in a follow-up interview with CoinDesk: “I feel we’ve to reside week by week and proper now evidently the primary aim is to place shopper protections in place. That may finally be the place issues get fixated on these potential investigations. I feel a part of the market can be getting used to that sort of expectation.”