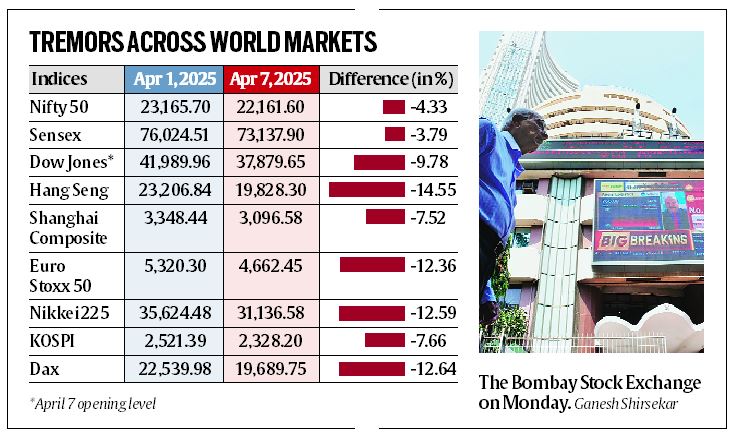

Warnings a few Black Monday crash are turning out to be prescient, with a world inventory market massacre unfolding after the Dow Jones and S&P Futures fell sharply on Sunday within the wake of final week’s meltdown over US President Donald Trump’s tariffs.

On Monday, Tokyo’s Nikkei 225 index misplaced almost 9 per cent shortly after the market opened whereas earlier within the day, buying and selling in Japanese futures was suspended because of the market hitting circuit breakers. Hong Kong’s Hold Seng index was down 8 per cent in early commerce.

The Indian inventory markets, after holding off promoting stress Friday, tracked Asian shares to plunge 5 per cent in early commerce Monday, amid escalation considerations. This got here even because the American President defended his tariffs over the weekend whereas he was headed for a {golfing} occasion, claiming a whole lot of nations are ‘dying to make a deal’ and that any adjustment within the inventory markets is transitory.

The seemingly tariff endgame

Whereas analysts who stated Trump is unlikely to stroll his tariff discuss have now been confirmed incorrect, there’s a rising view that these tariff is not going to final. There are maybe a number of alternative ways wherein the endgame may ultimately play out. One risk is that the reverses within the American inventory markets and stress from his personal supporters would power Trump to mood the tariff push.

Secondly, the American president may certainly handle to get concessions from some nations corresponding to Vietnam or Cambodia. As soon as that occurs, Trump may declare victory of kinds and pull again, no less than partly.

One other risk going ahead is that the US Congress may step in to take again the ability accorded to the White Home on tariffs. There are seemingly authorized challenges too over the invocation of presidential emergency powers over what’s evidently not an emergency.

Simplistic tariff Calculations, however a number of rollout issues

The market woes have been compounded by Trump’s intention to remain on with the tariffs, regardless of the ostensibly over simplistic method wherein they have been calculated and the issue seemingly in its implementation. In reality, a question to Chat GPT asking for a formulation to calculate reciprocal tariffs {that a} nation can impose on its buying and selling companions having surpluses with it, leads to the AI bot throwing up a prescription that mainly strives to even out the commerce imbalance:

Story continues beneath this advert

T=(commerce surplus of the buying and selling companion/commerce deficit the nation imposing the tariff)×Base Tariff Price.

This isn’t too far off from the formulation utilized by the Trump White Home. Whereas this isn’t to assertively counsel that somebody within the Trump White Home might have used an LLM to provide you with its moderately over simplistic tariff methodology, most commerce consultants concur that the formulation is inherently flawed because it assumes that the truthful commerce stability is zero. Which is exactly what the OpenAI bot tried to do whereas arising with this formulation. That comes from the AI bot trying a mathematical resolution to the issue, moderately than fixing the issue with any understanding of the nuances of commerce.

Whereas the prescriptive formulation could also be over simplistic, the execution of the formulation is more likely to be fairly sophisticated for the American Division of Commerce, provided that Trump has chosen to slap differential tariffs on nearly all of its commerce companions. All of it’s based mostly merely on only one 12 months’s commerce pattern.

For example, the tariff on the EU is 20 whereas, simply throughout the English Channel, the UK is confronted with a ten per cent tariff. What would stop a German firm to first ship its product to a port in Britain, after which reship the product into the US. To keep away from this, the US commerce division would want to attract up completely different guidelines of origin for every nation and US customs must guarantee adherence to it. That might be a possible minefield.

Story continues beneath this advert

The inherent assumption in Trump’s tariff spectacle was that it’ll not elicit tit-for-tat responses from its main buying and selling companions. Whereas economists would attest to this, saying it doesn’t make sensible sense to resort to retaliation, there’s an argument on the opposite facet: that each nation has its personal political compulsions and there is a component of nationwide value concerned when one thing of this type occur, which might power the type of response that has are available in from China and is predicted from the European Union.

Additionally, provided that the US runs a commerce surplus in providers with most nations, the latter may train the choice of imposing a big reciprocal tariff towards American providers. Brussels may find yourself attempting that possibility.

Apart from the tariffs slapped on uninhabited islands with simply penguins as residents, there are different ironies within the primary assemble of the Trump tariffs. Landlocked Lesotho, one of many poorest nations in Africa with simply $2.4 billion in annual GDP, has been hit with a 50 per cent tariff fee, the best fee amongst all nations on the record, solely as a result of it exports diamonds to the US and its persons are too poor to afford American items and providers. Madagascar too has confronted the brunt, as a result of it export vanilla to America, alongside Bangladesh, one other comparatively poor garmenting nation. Taiwan, a standard American ally that’s in an existential battle for survival towards an more and more belligerent Beijing, has been slapped with a tariff, though chips — its largest exports — may very well be exempt. The nation exemption record, paradoxically, consists of Russia and North Korea.

The aims of those tariffs, as acknowledged by Washington over a interval of lower than a month, too have been shifting: starting from nationwide safety considerations (fentanyl and immigrant inflows), to the modified narrative of a must stability commerce deficits and placing a cease to America being shortchanged. Another excuse being provided by the Trump administration is that the train will deliver within the cash for the proposed tax minimize anticipated later this 12 months.

Story continues beneath this advert

Home backlash mounts

Increased tariffs and the commerce conflict ensuing from Trump’s actions would most actually result in increased inflation within the US, and that’s leading to a brewing opposition domestically, together with inside sections of the Republican Occasion.

This, mixed with runaway deficits and a doable dilution of institutional autonomy, may result in foreigners starting to rethink whether or not they need to lend limitless cash to the US Treasury — which has been a given to this point — analysts say. That would mark the start of the top of an enormous benefit Washington DC has had to this point – the benefit of getting the worldwide reserve forex and the power to reside past its means.

Such a shift may mark a doable watershed second — of the size, maybe, of the choice in early 2022 to freeze Russian overseas property, which pressured central banks world wide, together with RBI, to purchase bodily gold moderately than derivatives or exchange-traded funds that observe the yellow metallic’s value. The US Federal Reserve’s resolution to proceed its rate-cut cycle depended strongly on the results of the presidential election — and consultants imagine that the complete scale of the cycle might now be in danger. Whereas Trump’s promised tax cuts and tariff limitations may find yourself stimulating the American economic system, no less than within the quick time period, analysts predict they may ultimately stoke inflation — and sure power the Fed to finish its rate-cutting cycle sooner.

Tariff ineffectiveness, retaliatory measures

A examine by economists on the Massachusetts Institute of Expertise, Harvard College, the College of Zurich and the World Financial institution had concluded that Trump’s tariffs in his final time period neither raised or lowered US employment. Regardless of Trump’s 2018 taxes on imported metal, as an example, the variety of jobs at American metal vegetation was barely impacted. Alternatively, the retaliatory taxes imposed by China and different nations on US items had “unfavorable employment impacts,’’ particularly for farmers, the examine discovered. These retaliatory tariffs have been solely partly offset by authorities assist that Trump was pressured to dole out to farmers, partly funded by the incremental revenues raised by the tariffs.

Story continues beneath this advert

This time round, China, after some preliminary restraint, has reacted to the tariffs nearly in full. There’s additionally a risk that the EU may go forward with some retaliatory curbs on digital providers coming in from the US, which may doubtlessly open up an entire new entrance on this commerce conflict. Bilateral commerce deficits are much more than simply manufacturing unit items and a digital onslaught, in some punitive method, may find yourself impacting Meta, Alphabet and different corporations which can be on the coronary heart of the American innovation story and have led the bull run in US shares during the last 12 months. Successful on these providers by Brussels may very well be troublesome for Washington, DC., provided that European regulators are already scrutinising Apple and are taking an in depth have a look at Meta’s practices, amongst different main American corporations which can be within the regulatory crosshairs throughout the Atlantic.

That would additional set off the bleeding for the American inventory markets, as some have predicted, and will have a seamless ripple impact in different markets.