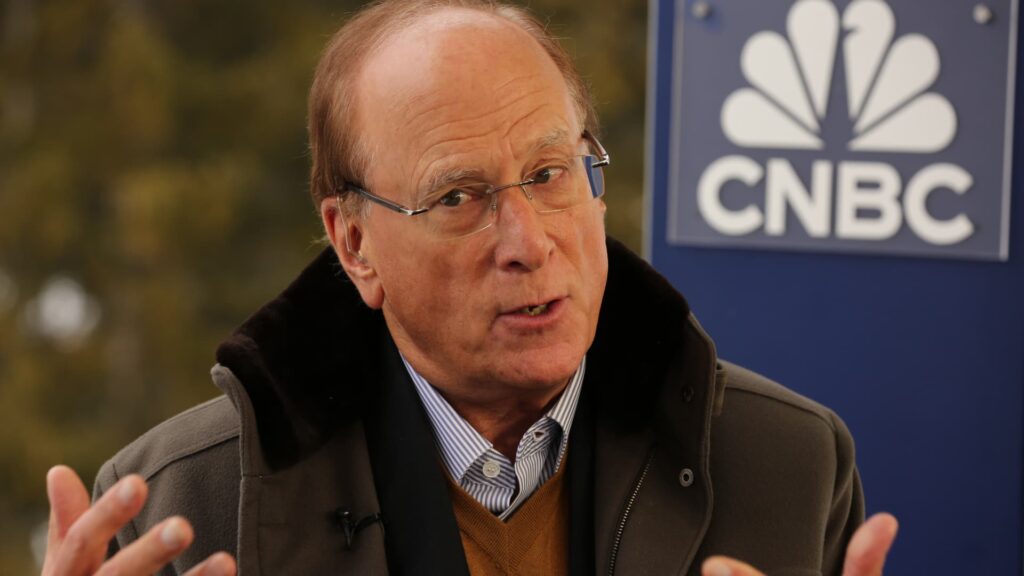

BlackRock CEO Larry Fink mentioned President Donald Trump’s efforts to unleash capital within the non-public sector may have unintended penalties that may damage the inventory market.

“I am cautiously optimistic. That being mentioned, I’ve eventualities the place it might be fairly unhealthy,” Fink mentioned Thursday on CNBC’s “Squawk Field” from the World Financial Discussion board in Davos, Switzerland. “I consider if it’s going to unlock all this non-public capital, we’ll have huge progress. On the similar time, a few of that is going to create new inflationary pressures. I do consider that is in all probability the chance that’s not factored into the markets. I believe the bond market goes to inform us the place we’re going.”

The 72-year-old chief of the world’s largest asset supervisor mentioned a lot will rely on how rapidly the non-public sector can put capital to work. Trump has already touted huge non-public sector guarantees to spend within the U.S., the newest instance being the Stargate three way partnership, the place SoftBank, OpenAI and Oracle would make investments $100 billion instantly for synthetic intelligence infrastructure within the nation. Plans name for the mission to finally make investments a complete of $500 billion.

“There are some very giant inflationary pressures that all of us have to pay attention to,” Fink mentioned. “And relying on how this performs out, there’s a state of affairs the place we’ll have rather more elevated rates of interest due to inflation. And that is going to have a really destructive influence on the fairness market.”

Fink mentioned there’s a chance that the 10-year Treasury yield may retest the 5% stage and even attain 5.5% if inflation reaccelerates in a significant means. If that occurs, Fink mentioned it could “shock” the fairness market.

The benchmark 10-year observe yield final traded at 4.62%.