Financial institution of America high banker Rick Sherlund sees a serious market shift forward.

In keeping with Sherlund, optimism surrounding know-how shares will make a comeback this 12 months — however the bottom line is weathering upcoming earnings season first.

“What we have to do is de-risk 2023 numbers,” the agency’s vice chair of know-how funding banking advised CNBC’s “Quick Cash” on Thursday. “After we undergo fourth quarter earnings, I believe corporations will point out a discount in drive. They will discuss slicing again on go-to-market spending… That is all encouraging.”

Sherlund’s experience is software program. He hit No. 1 on Institutional Investor’s all-star analyst record 17 instances in a row when he was an analyst.

And, he is identified for main Goldman Sachs’ know-how analysis crew by means of the 2000 dot-com bubble, a time he calls “breathtaking.” The newest market backdrop reminds him of prior downturns.

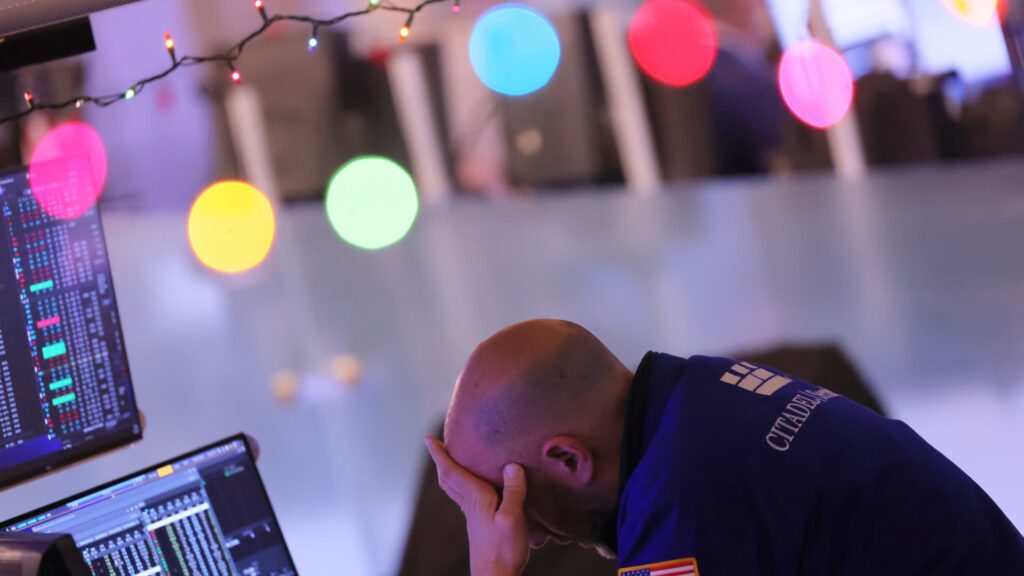

“2022 was a horrible 12 months for these [software] shares,” stated Sherlund. “We have seen great compression in valuation. The excellent news is that downturns are in the end adopted by upturns. So, we have simply obtained plenty of crosscurrents near-term.”

His newest market forecast coincides with the tech-heavy Nasdaq‘s newest struggles. It fell 1.47% to 10,305.24 on Thursday, and it is on the cusp of a five-week dropping streak.

Sherlund’s base case is the transfer to high-growth areas such because the cloud will present a long-term increase to software program shares.

“Individuals have to acknowledge that that is an economically delicate sector,” he stated. “Among the demand might have been pulled ahead through the pandemic interval and when charges have been zero.”

Sherlund contends highly effective secular tailwinds will in the end carry the group. And, it ought to assist kick off consolidation within the type of mergers and acquisitions within the 12 months’s second half.

“There will probably be an inclination to select up the cellphone and have that M&A dialog the place previously it was in all probability little incentive to do this,” stated Sherlund. “There’s an terrible lot of dry powder on the market.”

He believes stability later this 12 months within the Federal Reserve’s rate of interest hike trajectory will spark deal-making by serving to the challenged leveraged finance market.

“That would finance much more M&A and LBOs [leveraged buyouts],” Sherlund stated.

Disclaimer