(Bloomberg) — The Financial institution of Japan’s newest coverage shock is cementing the central financial institution’s fame for utilizing the factor of shock to realize its strategic targets.

Most Learn from Bloomberg

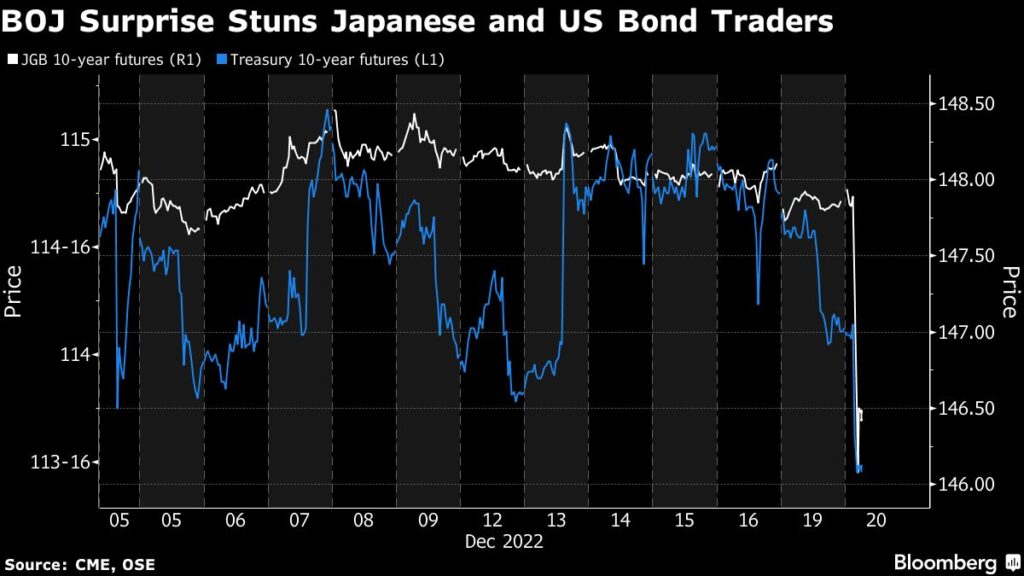

BOJ Governor Haruhiko Kuroda’s choice to widen the buying and selling band on 10-year bond yields triggered a leap within the yen and roiled world markets. The change blindsided traders, similar to Kuroda’s transfer to spice up bond purchases in 2014 and Japan’s festive season charge hike in 1989.

“It was about this time, 33 years in the past when, sad with dollar-yen, the BOJ hiked 25 foundation factors to 4.5% on Christmas Day,” Martin Whetton, head of mounted earnings and foreign money technique at Commonwealth Financial institution of Australia, wrote in a word.

The breadth and dimension of the market response underscores the BOJ’s report for surprises at a time when main friends similar to these within the US and Australia have been searching for to maneuver away from ahead steering. Kuroda’s profession has been replete with sudden shocks and lengthy pauses, indicating he could effectively decide that to be a more practical path.

“An attention-grabbing function of the Financial institution of Japan is in contrast to different central banks, they appear to love to shock the markets,” Omar Slim, a cash supervisor at PineBridge Investments in Singapore, mentioned in an interview final week. “It’s a financial coverage instrument for them within the sense it’s a really completely different philosophy. For them, that is how we have an effect versus different central banks which is to telegraph.”

Hypothesis of some kind of change had been effervescent in markets on Monday, after Kyodo reported that the federal government was planning to revise an inflation accord with the BOJ. Nonetheless, it was simply weeks in the past that Kuroda had insisted that Japan’s inflation — although on the rise — fell effectively wanting the sustainable enhance that would justify a coverage shift.

The BOJ chief is about to depart workplace in April when his second time period expires, with markets anticipated to weigh the success of his decades-long experiment with rock-bottom rates of interest. The coverage tweak could proceed to roil markets within the coming days, though some analysts warning that the transfer might not be the pivot that merchants say it’s.

All 47 economists surveyed by Bloomberg had forecast no change in coverage at Tuesday’s assembly.

Up till now, the largest shock delivered in latest instances by the BOJ was in all probability the Oct. 31, 2014 choice to develop its easing program. That transfer was predicted by three of the 32 economists surveyed on the time.

(Provides context from fourth paragraph.)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.