(Bloomberg) — Bond-market bulls are getting an early style of what they count on to be a profitable commerce of 2023.

Most Learn from Bloomberg

On Friday, shorter-dated Treasuries led a broad market rally after the roles report for December confirmed a slowdown in wage development and a gauge of the service-sector economic system unexpectedly shrank. The info stoked hypothesis that the Federal Reserve is nearing the tip of its most aggressive rate-hiking cycle in many years and should begin easing financial coverage by yr finish.

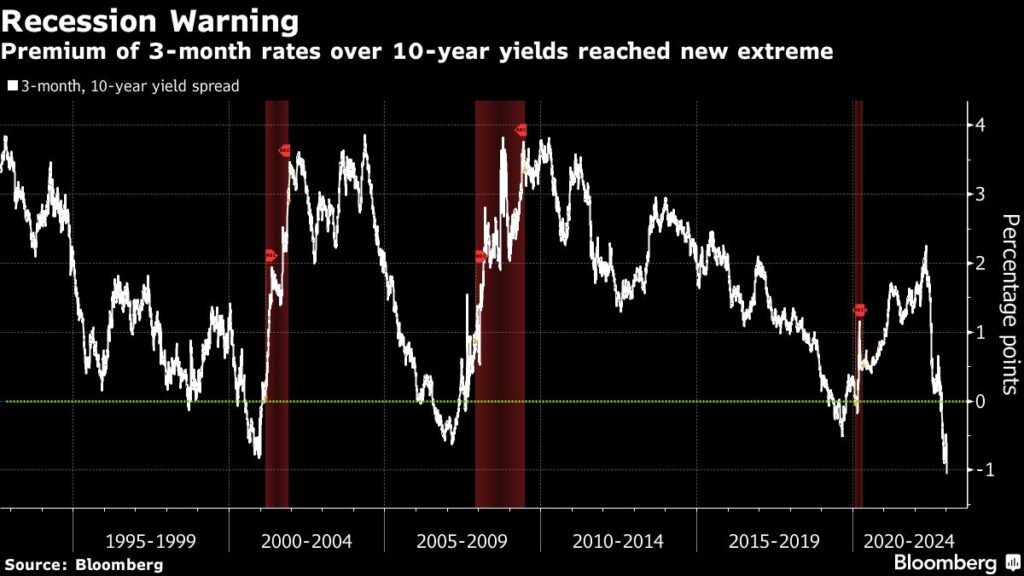

The rally lessened the inversion of key Treasury yield curves — the gaps between shorter- and longer-term charges which might be watched carefully as potential recession alerts. Such strikes, referred to in market parlance as a curve steepening, have been extensively anticipated to happen this yr, offering at the very least a brief victory to buyers roiled by market volatility.

“The yield-curve steepening we’ve seen publish payrolls displays a sigh of reduction that robust wage positive aspects are in all probability behind us, which is nice information for the Fed,” stated Alex Li, head of US charges technique at Credit score Agricole. “They’re in all probability nearer to the tip of the tightening cycle, although they nonetheless have work to do.”

It’s removed from sure that the Treasury market’s current strikes might be sustained, given how unstable the market has been, and lengthy yields are nonetheless considerably beneath quick ones amid uncertainty in regards to the outlook. Furthermore, there stays a big disconnect between the monetary markets and Fed officers, who’re emphasizing that they’re prone to maintain elevating charges — and maintain them there — till inflation attracts again towards the central financial institution’s 2% goal.

Priya Misra, head of world charges technique at TD Securities, stated the market is fallacious to be pricing in a return to Fed charge cuts. In her view, the Fed is prone to increase its key charge to round 5.5% and maintain it there all yr, which she stated might drive the 10-year yield even deeper beneath the 2-year benchmark than it was earlier than. The Fed’s charge is presently in a spread of 4.25-4.5%.

“Recession fears will improve demand for the lengthy finish,” Misra stated.

There’s one other danger that might upend bullish bets throughout the yield curve. If knowledge exhibits that inflation stays sticky and the economic system resilient, Treasury yields could take one other leg up because the now-expected easing is priced out of the market.

That’s not what merchants have arrange for. Each 2-year and 10-year yields — now round 4.25% and three.56% respectively, are each properly beneath the place the Fed funds charge is anticipated to peak this yr. On Friday, yields on Treasuries due from 2 to five years tumbled 21 foundation factors or extra, round twice the drop for 30-year yields.

Swap merchants are pricing in that the Fed will maintain lifting its benchmark charge till it’s slightly below 5% round June earlier than bringing it right down to round 4.5% by yr’s finish.

That view could also be examined within the coming week if the December client value index exhibits inflation was sooner than anticipated, with economists forecasting it will likely be unchanged from the month earlier than. Buyers will even be carefully listening to public appearances by Fed officers, together with Chair Jerome Powell.

“If the economic system can deal with increased charges and doesn’t roll over as soon as the Fed finishes tightening, then the again finish will normalize as recession fears abate,” stated Greg Peters, co-chief funding officer of fastened revenue at PGIM. That “is a potential situation and nobody is speaking about it.”

What to Watch

Financial calendar:

-

Jan. 9: Client credit score

-

Jan. 10: NFIB small enterprise optimism; wholesale commerce gross sales and inventories

-

Jan. 11: Mortgage purposes

-

Jan. 12: Client-price index; weekly jobless claims

-

Jan. 13: Import and export value indexes; College of Michigan sentiment survey

-

Fed calendar:

-

Jan. 9: Atlanta Fed President Raphael Bostic

-

Jan. 10: Chair Powell at RiksBank occasion

-

Jan. 12: Philadelphia Fed President Patrick Harker; St Louis Fed President James Bullard

-

-

Public sale calendar:

-

Jan. 9: 13-week, 26-week payments

-

Jan. 10: 3-year notes

-

Jan. 11: 10-year notes; 17-week payments

-

Jan. 12: 30-year bonds; 4-week, 8-week payments

-

–With help from Elizabeth Stanton.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.