-

Bitcoin stays above $65,000 regardless of highest-ever GBTC outflows.

-

GBTC outflows are occurring on account of excessive charges and ETF competitors.

Bitcoin {{BTC}} is down 4% and buying and selling above $65,000 because the promoting of Grayscale Bitcoin Belief (GBTC) shares hit its highest degree ever.

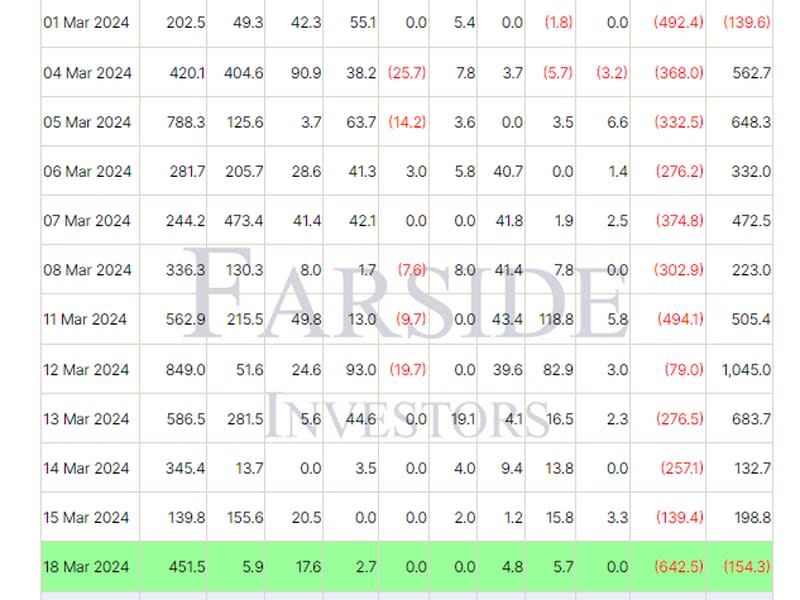

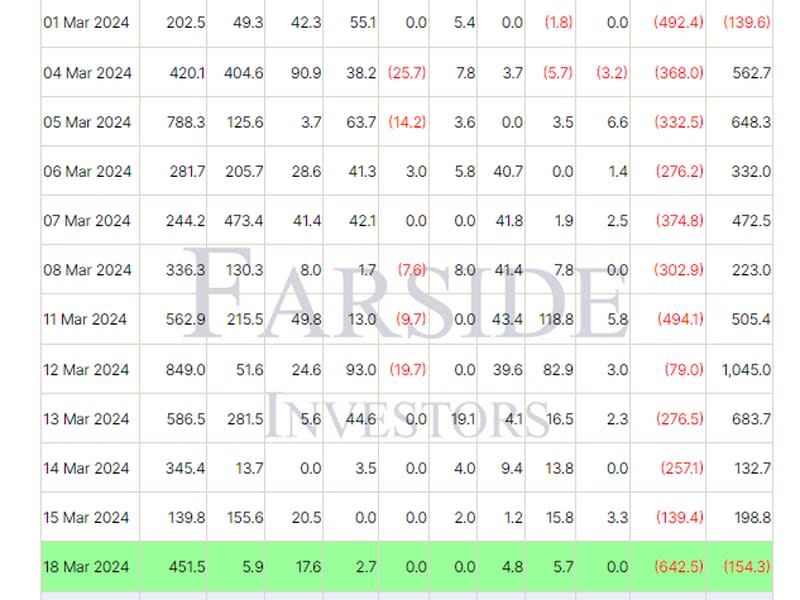

In line with information compiled by BitMEX analysis, outflow from GBTC hit $643 million on March 18.

Bitcoin ETF Move – 18 March 2024

GBTC Outflow $643m

— BitMEX Analysis (@BitMEXResearch) March 18, 2024

Information from funding agency Farside reveals that there is a internet outflow from bitcoin ETFs basically to the tune of $154 million. The iShares bitcoin ETF (IBIT) noticed essentially the most influx of $451.5 million, whereas the remaining merchandise had influx of roughly $36.7 million.

For the reason that launch of bitcoin exchange-traded funds (ETFs) earlier this 12 months, there have been important outflows from GBTC – which not too long ago transformed into an ETF – due to its greater charges. This promoting places strain on the worth of bitcoin.

A latest word from CryptoQuant says that promoting strain can be coming from quick time period holders of bitcoin taking revenue on latest features.

During the last week bitcoin is down 8.5%, in accordance with CoinDesk Indicies information, however stays up 27% over the previous 30 days.