Nov 5 (Reuters) – Warren Buffett’s Berkshire Hathaway Inc (BRKa.N) on Saturday posted a $2.69 billion third-quarter loss as rising inflation, falling inventory investments and a giant loss from Hurricane Ian offset enchancment in most of the conglomerate’s companies.

Working revenue however rose by 20%, topping analyst forecasts.

Berkshire benefited from elevated demand and costs for brand new house gross sales, industrial merchandise and power, whereas the U.S. Federal Reserve’s inflation-fighting marketing campaign helped Berkshire generate extra revenue from insurance coverage investments.

“On stability, outcomes have been robust and demonstrated resilience given the affect of inflation, larger rates of interest and provide chain challenges,” mentioned Jim Shanahan, an Edward Jones & Co analyst with a “purchase” ranking on Berkshire.

Buffett’s firm took benefit of declining fairness markets so as to add extra shares to its $306 billion portfolio, shopping for a web $3.7 billion and constructing a now 20.9% stake in Occidental Petroleum Corp (OXY.N).

Berkshire additionally purchased again extra of its personal inventory however was cautious, repurchasing $1.05 billion, just like the second quarter. It additionally purchased again some inventory in October.

The conservatism could mirror the “important disruptions” that Berkshire mentioned its a number of dozen companies nonetheless see from provide chains and occasions past their management, such because the COVID-19 pandemic and Russia-Ukraine battle.

Berkshire additionally mentioned rising prices from gasoline and accidents harm respective outcomes at two of its best-known companies, the BNSF railroad and Geico auto insurer.

Cathy Seifert, a CFRA Analysis analyst with a “maintain” ranking for Berkshire, mentioned the corporate could also be “at an inflection level, not not like the financial system,” the place it might want to include prices to organize for slowing demand and a potential recession.

“Backside line, this was a wholesome quarter, however one must be involved over its trajectory over the subsequent 12 months,” Seifert mentioned.

HUNKERING DOWN

The quarterly web loss equaled $1,832 per Class A share, and in contrast with a revenue of $10.34 billion, or $6,882 per share, a yr earlier.

Outcomes included $10.45 billion of losses from investments and derivatives, because the inventory costs of many giant Berkshire investments apart from Apple Inc (AAPL.O) fell.

Accounting guidelines require Berkshire to report such modifications even when it buys and sells nothing. This causes giant quarterly swings in outcomes that Buffett says are often meaningless.

Working revenue, in the meantime, rose to $7.76 billion, or about $5,294 per Class A share, from $6.47 billion, or $4,331 per share, a yr earlier.

Outcomes improved regardless of a $2.7 billion after-tax loss from Ian, a powerful Class 4 hurricane that slammed into Florida on Sept. 28. Income rose 9%, whereas bills rose 7%.

“The priority is which of the rising bills are going to grow to be extra everlasting,” mentioned Tom Russo, a associate at Gardner, Russo & Quinn in Lancaster, Pennsylvania, who invests greater than $1 billion in Berkshire.

Russo mentioned outcomes mirror “an enterprise hunkering down and conserving sources whereas it awaits giant ‘elephants,'” a time period Buffett makes use of to explain giant acquisitions.

Berkshire ended September with $109 billion of money, up from $105.4 billion in June, although it spent $11.6 billion final month to purchase the Alleghany Corp insurance coverage enterprise.

A strengthening U.S. greenback led to $858 million of third-quarter good points from Berkshire’s non-dollar-denominated debt.

In the meantime, the Fed’s aggressive elevating of short-term rates of interest fueled a 21% enhance in insurance coverage funding revenue, with revenue from U.S. Treasuries and different debt almost tripling to $397 million.

BNSF, GEICO

Revenue at BNSF fell 6% as bills jumped by one-third, together with will increase of 27% for compensation and 80% for gasoline, a few of which was handed on to clients by means of surcharges.

Geico suffered its fifth straight quarterly underwriting loss, dropping $759 million earlier than taxes, reflecting extra frequent and expensive accident claims, rising used automobile costs and automobile elements shortages. Written premiums barely modified.

Seifert mentioned Geico, run by Berkshire portfolio supervisor Todd Combs, has fared worse than many different auto insurers, and will endure additional erosion in underwriting if its “restricted income development and claims value inflation” persists.

Offsetting the declines have been revenue will increase of 6% from Berkshire Hathaway Power and 20% from manufacturing, service and retail companies together with Clayton Houses, although rising mortgage charges will doubtless minimize into future house gross sales.

Berkshire additionally mentioned rising charges could considerably decrease any discount in shareholder fairness ensuing from an upcoming accounting change for some insurance coverage contracts.

Buffett, 92, has run Berkshire since 1965.

Traders intently watch Berkshire due to his repute, and since outcomes typically mirror broader financial tendencies.

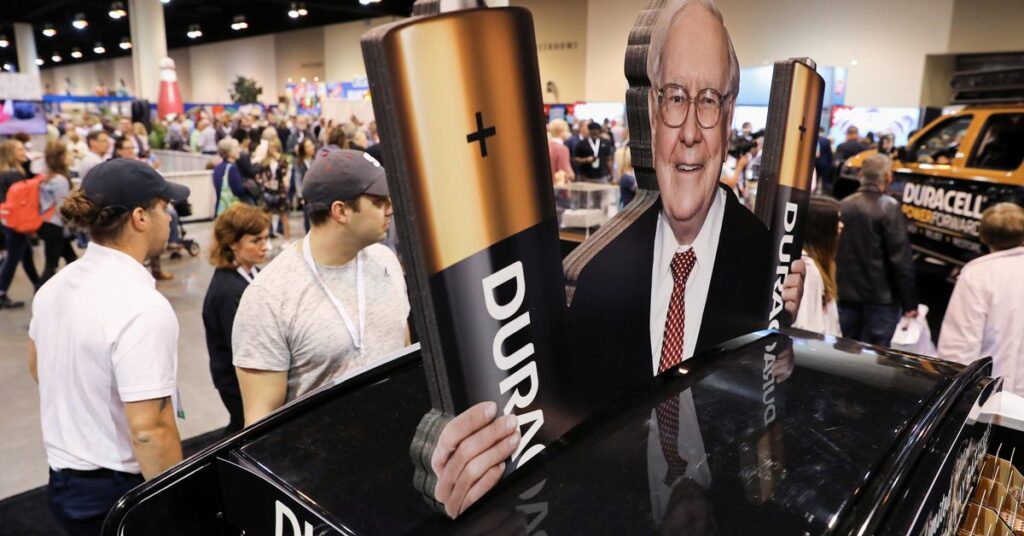

The corporate additionally owns acquainted client manufacturers akin to Dairy Queen, Duracell, Fruit of the Loom and See’s Candies.

Reporting by Jonathan Stempel in New York; Enhancing by Mark Potter, Chizu Nomiyama and Jonathan Oatis

: .