-

Nasdaq 100 and S&P 500 declines in September current a shopping for alternative, says Ned Davis Analysis.

-

Weak seasonality information and extreme pessimism readings counsel a powerful 4th quarter rally is forward, NDR stated.

-

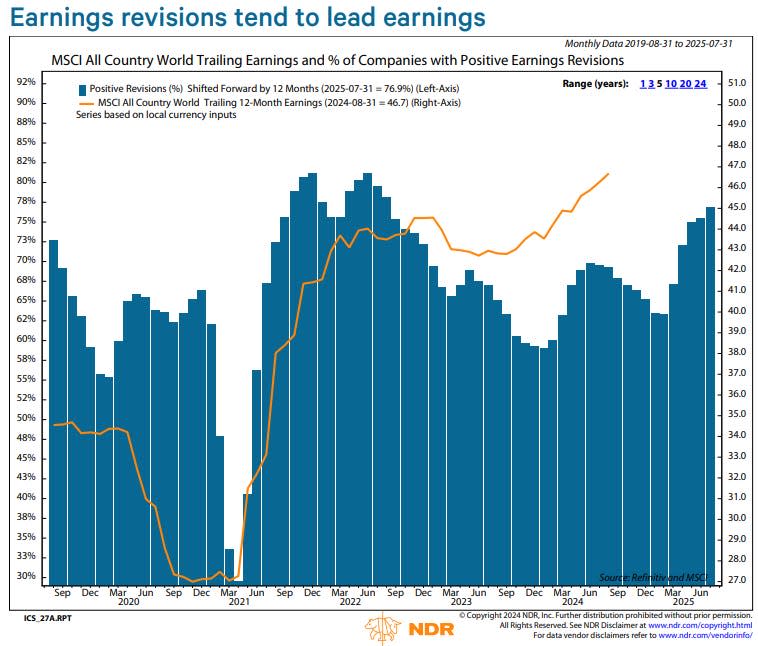

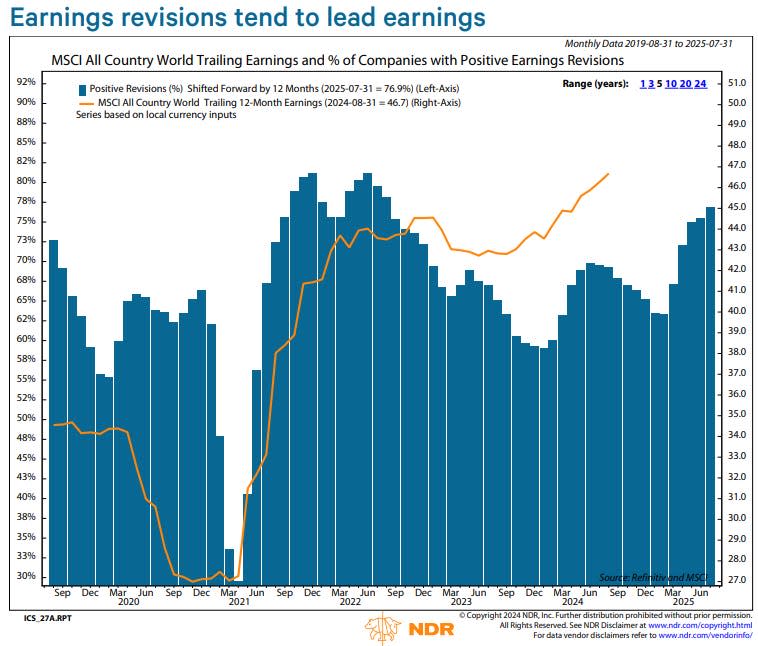

NDR sees no indicators of a pointy bear market, with optimistic earnings revisions and financial indicators.

A 6% decline within the Nasdaq 100 and 4% decline within the S&P 500 for the reason that begin of September represents a pretty shopping for alternative for traders, in response to Ned Davis Analysis.

The analysis agency stated in a notice on Friday that the weak point in shares up to now this month is greater than typical, given weak seasonality information — however it’s additionally a giant alternative given the market is heading for its finest three-month stretch of the yr.

“With the September weak point relieving the optimism and sending sentiment indicators to extreme pessimism readings, equities could be prone to launch a persistent ascent just like the primary quarter advance, supported by fourth quarter seasonal tendencies,” NDR strategist Tim Hayes stated.

He added: “Whereas a comparability of three-month declines exhibits that August – October has been the weakest, October – December has been the strongest.”

Hayes finds it encouraging that, based mostly on inside NDR readings, the inventory market, financial system, and company earnings are displaying no indicators of being weak to a pointy bear market decline akin to what occurred in 2022.

Analyst earnings revisions proceed to pattern greater, traditionally a number one indicator for company earnings.

“As with revisions, financial efficiency is a number one indicator of earnings development, presently supporting the earnings outlook. Whereas the recession chance has risen from its lows of Could and June, it hasn’t risen out of its bullish mode for equities,” Hayes defined.

Altogether, meaning the present inventory market decline is extra prone to be a backyard selection correction that finally proves to be wholesome for the sustainability of the continued bull rally that started in October 2022.

“The present choppiness will show to be simply that, not the signal of a brand new bear market. It ought to result in a shopping for alternative inside the persevering with bull market, forward of renewed rallying within the fourth quarter,” Hayes stated.

Learn the unique article on Enterprise Insider