Any investing publicity to the “Magnificent Seven” shares has made your 2023 investing 12 months a giant success. This group of mega-cap tech shares, together with Nvidia (NASDAQ: NVDA), Amazon (NASDAQ: AMZN), Tesla (NASDAQ: TSLA), Apple (NASDAQ: AAPL), Microsoft (NASDAQ: MSFT), Meta Platforms (NASDAQ: META), and Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), has outperformed the broader market regardless of the Nasdaq Composite surging over 45% final 12 months.

If it isn’t damaged, do not repair it… proper? Properly, not precisely. A have a look at the numbers indicators that a few of these genuinely magnificent shares might quickly run out of steam. Listed below are the 4 shares on this group price shopping for in 2024, and the three to go away behind in 2023.

1. Nvidia: Purchase

Nvidia’s chips, which focus on demanding, high-compute purposes, have turn out to be a focus of the bogus intelligence (AI) breakthrough. The corporate has rapidly established dominance, controlling as a lot as 90% of the marketplace for AI chips. That is pushed the enterprise to new heights, accelerating income development to 200% 12 months over 12 months in its most up-to-date quarter to $18 billion.

AI demand would not appear to be going anyplace, which ought to create loads of development for Nvidia shifting ahead. Analysts imagine the corporate’s earnings will develop by 42% yearly over the approaching years, arguably justifying Nvidia’s valuation at 40 occasions 2023 income. That is a PEG ratio of simply 1, signaling the inventory remains to be enticing regardless of its huge 250% climb in 2023.

2. Apple: Keep away from

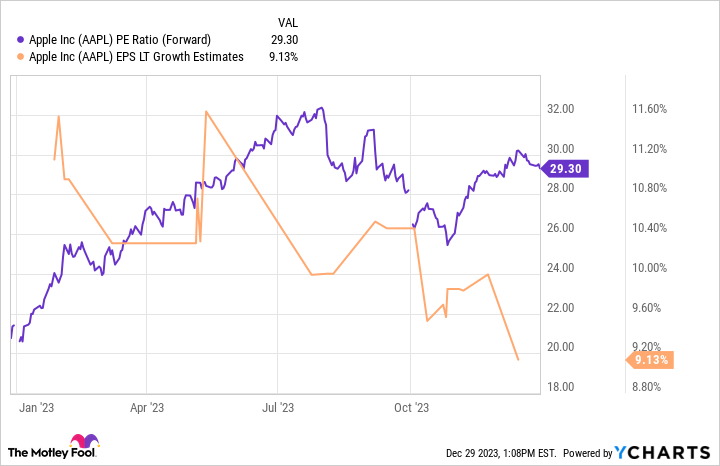

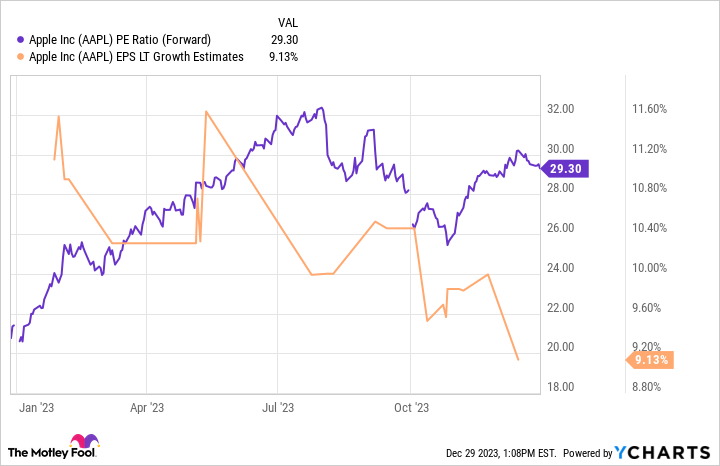

Not each “Magnificent Seven” firm has grown sufficient to maintain up with its inventory. Apple’s income has fallen over the previous 12 months, and web revenue is up simply 1%. Apple’s enterprise might be cyclical, gyrating between intervals of development relying on key iPhone releases. That is effective, however it will probably complicate issues when share costs and working outcomes go in numerous instructions.

Analysts have lowered their development expectations for Apple shifting ahead. At greater than 29 occasions 2023 earnings, that PEG ratio over 3 makes shopping for Apple right here a tricky capsule to swallow. Buyers ought to anticipate the worth to make sense once more.

3. Meta Platforms: Purchase

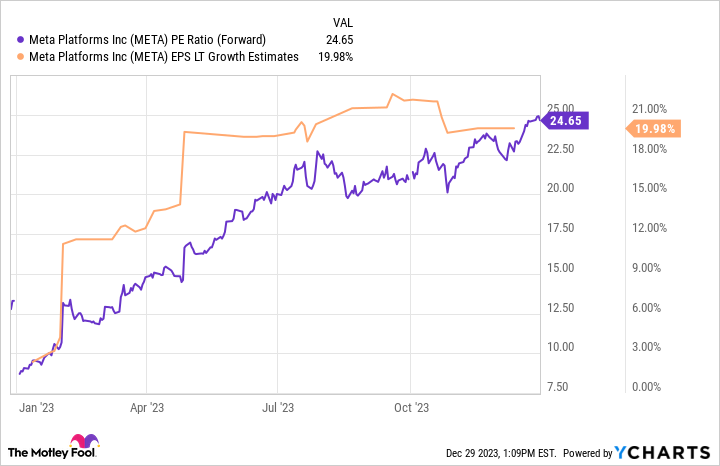

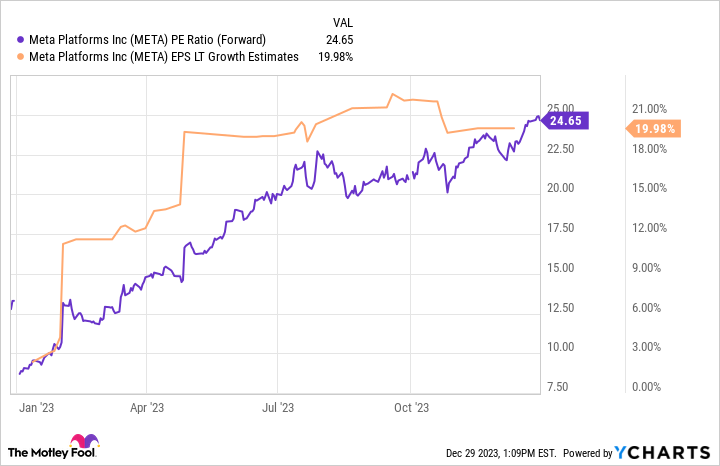

Wall Avenue was down on Meta in 2022 when the corporate was combating a slowing promoting enterprise, dangerous privateness adjustments to iPhones, and costly metaverse tasks that weren’t exhibiting any return on funding. Shares fell to $89 earlier than CEO Mark Zuckerberg righted the ship by reducing prices, working by way of the iPhone challenges, and getting income development and income again on monitor.

Astonishingly, the inventory remains to be enticing at simply 25 occasions 2023 earnings, with anticipated annual development of 20% on common shifting ahead. It seems that Meta remains to be an incredible enterprise, and Wall Avenue forgot that in a giant method. The rally in 2023 undid the pessimism, however there’s nonetheless room for the expansion Meta can obtain in 2024 and past.

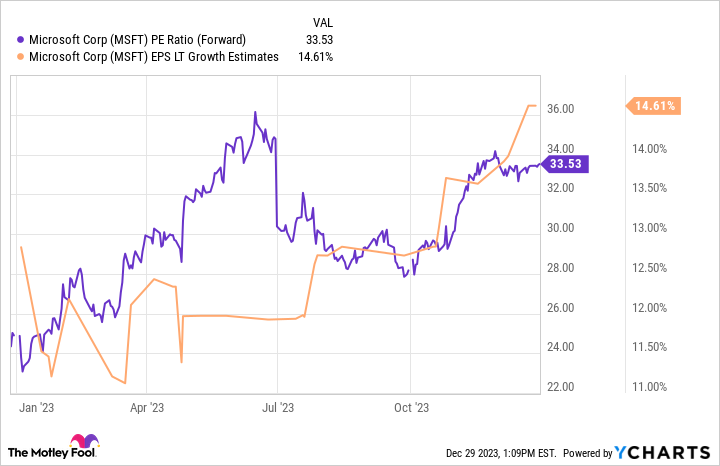

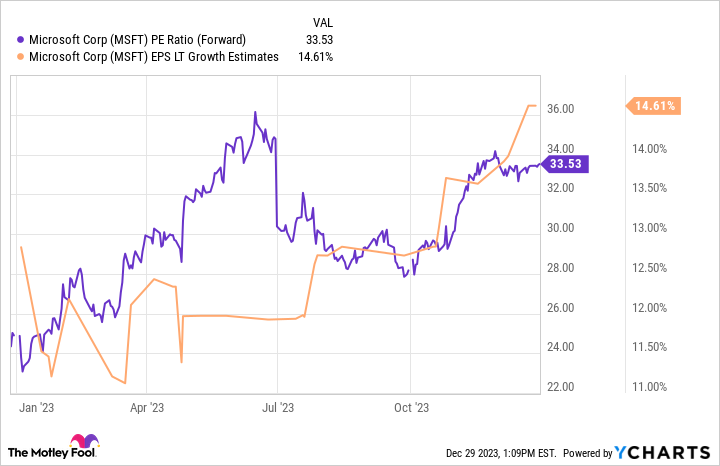

4. Microsoft: Keep away from

ChatGPT was a viral sensation in 2023, and Microsoft swiftly jumped in, tying itself to its creator, OpenAI, with a multibillion-dollar funding and prolonged partnership. Between enterprise software program, cloud computing, gaming, and extra, Microsoft is without doubt one of the world’s largest and most diversified know-how corporations. Its cloud positioning amid the AI alternative has seemingly boosted analyst expectations for its earnings development within the coming years.

Mid-teens development is nothing to dismiss, nevertheless it’s changing into tougher to name Microsoft a development inventory at its whopping $2.8 trillion market cap. At a ahead P/E over 33, the inventory’s ensuing PEG ratio over 2 is not as interesting as another “Magnificent Seven” shares.

It isn’t abhorrently costly, however after its 57% single-year gallop, there are higher offers on the market. It is OK for buyers to be choosy.

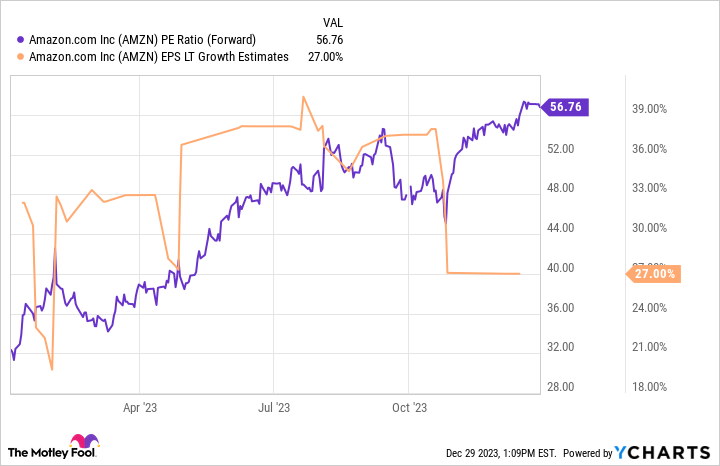

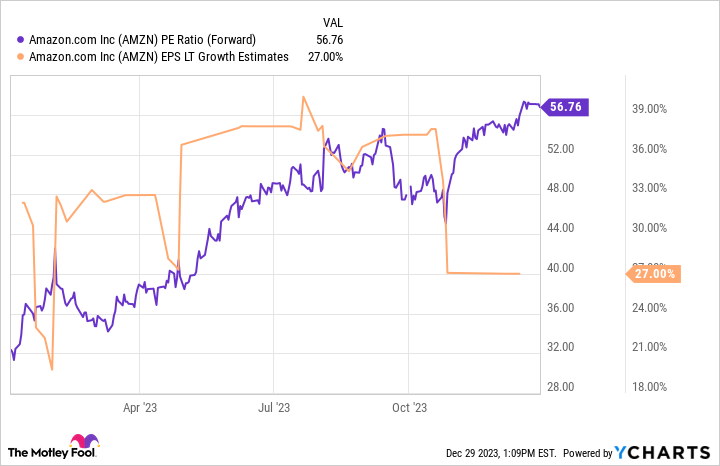

5. Amazon: Purchase

Apparently, e-commerce and cloud chief Amazon trades at an identical PEG ratio to Microsoft of simply over 2. So, why ought to buyers take into account shopping for Amazon over equally valued Microsoft? Amazon is legendary for investing its income into the enterprise, which might understate its true revenue potential. The inventory trades at 57 occasions its bottom-line earnings however simply 22 occasions its working income, that are earnings from day-to-day enterprise.

Over the previous decade, that is over 20% beneath Amazon’s common price-to-cash-from-operations ratio. Amazon has tons occurring, together with investing in creating its AI know-how, a vital ingredient to its future. That is not concerning e-commerce, which nonetheless has room to develop over the approaching a long time (e-commerce is simply 15% of U.S. retail).

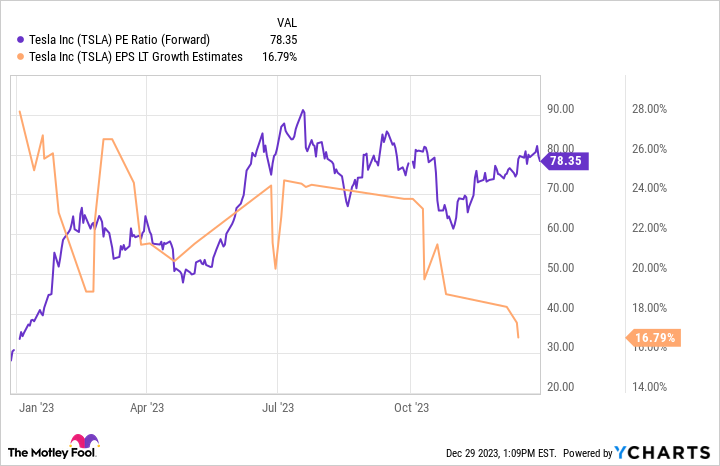

6. Tesla: Keep away from

Electrical car and power firm Tesla is one other instance of share value and fundamentals heading in reverse instructions. Tesla started reducing costs in 2023 to spice up unit gross sales. The thought is that extra items made and offered will let Tesla decrease its costs, a cycle that can value rivals out of the market. It is a daring transfer that has introduced short-term penalties to Tesla’s working outcomes. Gross revenue margin is down 22% over the previous 12 months.

Hopefully, unit gross sales will develop sufficient for Tesla to appreciate the associated fee financial savings it is striving for quickly. Analysts have aggressively lowered their expectations for Tesla’s future earnings development because of the value cuts. If analysts are right, Tesla’s inventory has turn out to be way more expensive at a PEG ratio over 4. After the inventory ran 130% final 12 months, buyers is likely to be higher off ready to purchase till the numbers show Tesla proper in its price-cutting technique.

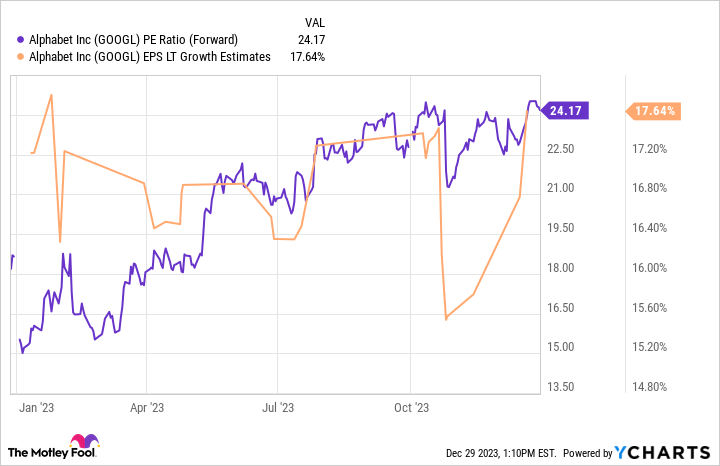

7. Alphabet: Purchase

Alphabet’s dominance with Google and YouTube overshadows its behind-the-scenes AI potential. The corporate is leaning on AI to assist prospects maximize their promoting spend on its platforms (how Alphabet makes most of its cash). Its huge pile of consumer information and pole place among the many world’s most trafficked web sites makes Alphabet a boring however efficient money-printing machine.

The corporate spends a lot of that money circulate shopping for again tons of inventory, decreasing the variety of excellent shares by 10% previously 5 years. That recipe of development and buybacks has analysts anticipating earnings to compound at over 17% yearly. The inventory’s 57% run in 2023 has raised its valuation, nevertheless it stays a strong deal for long-term buyers at a PEG ratio of 1.4.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 18, 2023

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Justin Pope has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Idiot has a disclosure coverage.

Investing Preview 2024: Purchase These 4 “Magnificent Seven” Shares. Keep away from the Others. was initially revealed by The Motley Idiot