In terms of speaking about synthetic intelligence (AI), Microsoft usually dominates the dialog, and rightly so. Early on, the corporate partnered up with OpenAI, a start-up that is capturing the imaginations of buyers worldwide.

However let’s put Microsoft apart for a second. Many shares can profit from the AI pattern, however some are much less apparent than others. For one such under-the-radar AI decide, buyers ought to contemplate shopping for shares of Reserving Holdings (NASDAQ: BKNG).

Reserving inventory is at an all-time excessive as of this writing, but when administration’s AI plan works out, then the inventory might proceed notching new highs sooner or later.

How AI can assist a journey platform

Earlier than I clarify how AI can assist, it is best to start out with how the corporate makes cash. Reserving is a platform that vacationers can use to search out flights, motels, rental vehicles, and extra.

After discovering what they want, vacationers can select to guide immediately with the airline, rental automotive firm, and so forth. In these circumstances, Reserving merely earns a fee. It is a good enterprise and has made the corporate what it’s in the present day. Nevertheless, administration has better aspirations.

Reserving’s administration would like its customers guide each side of their journey on its platform immediately — it calls this a “related journey.” To even make this imaginative and prescient a risk, the corporate needed to construct out its personal funds platform.

A journey agent would assist folks guide each side of their journey. However using a human agent can be cost-prohibitive for an organization the scale of Reserving. Due to this fact, administration is hoping it could actually prepare its AI to do the work of a journey agent, pushing its imaginative and prescient for related journeys ahead.

It is greater than only a imaginative and prescient. If Reserving can hold making progress on this, shareholders ought to reap the profit.

Why that is the fitting lever to tug

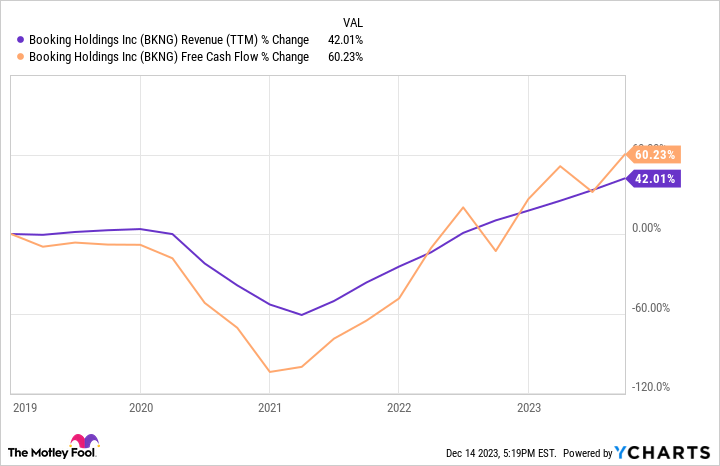

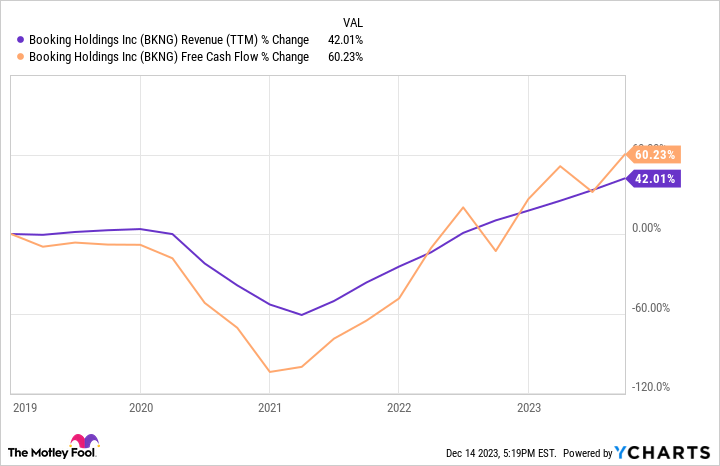

By processing prospects’ funds itself, Reserving can maintain on to vacationers’ money for just a bit longer, which is a lift to the corporate’s money movement. Because the chart beneath reveals, free-cash-flow development is outpacing income development over the past 5 years.

What’s thrilling is that there is nonetheless loads of room for the pattern to proceed enjoying out.

When Reserving processes transactions on its platform, it is known as service provider income. And when it earns a fee, it is known as company income. As of 2023, service provider income has surpassed company income for the primary time ever. Nevertheless, by means of the primary three quarters of 2023, service provider income makes up solely 51% of whole income, which means it has loads of room to proceed rising into a bigger proportion of the entire.

Furthermore, it is attainable that lots of Reserving’s customers are making their journey preparations in numerous locations. If the corporate’s AI journey agent is efficient, it might get customers to guide many (if not all) elements of their journey on Reserving, which might be a lift to income.

More and more efficient AI can assist Reserving’s prime line as customers buy extra of their journey preparations in a single place — that is administration’s imaginative and prescient of the related journey. That is solely attainable if Reserving is processing the funds, and when it does the fee processing, it is a enhance to money movement.

Over the long run, Reserving’s cash-flow development can result in market-beating returns. That is why I consider this can be a sneaky AI inventory to contemplate shopping for even now that it is buying and selling close to an all-time excessive.

Must you make investments $1,000 in Reserving Holdings proper now?

Before you purchase inventory in Reserving Holdings, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for buyers to purchase now… and Reserving Holdings wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of December 11, 2023

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Reserving Holdings and Microsoft. The Motley Idiot has a disclosure coverage.

Overlook Microsoft: Purchase This Synthetic Intelligence (AI) Inventory Poised for a Bull Run As a substitute was initially revealed by The Motley Idiot