Firms that profit from the proliferation of synthetic intelligence (AI) have soared massive time over the previous yr or so, however their spectacular good points imply that they don’t seem to be low-cost anymore.

Nvidia (NASDAQ: NVDA) is a first-rate instance of how an AI-fueled surge has elevated the valuations of semiconductor corporations which are capitalizing on the adoption of this expertise. The graphics-card specialist was buying and selling at just below 13 instances gross sales on the finish of 2022, however its 233% good points previously yr imply that it’s now buying and selling at a way more costly 33 instances gross sales.

That studying is considerably greater than Nvidia’s five-year common gross sales a number of of 20. Nonetheless, the corporate with whose assist Nvidia has dominated the AI chip market to this point hasn’t acquired a lot love from the market. Shares of Nvidia’s foundry associate Taiwan Semiconductor Manufacturing (NYSE: TSM), popularly referred to as TSMC, are up simply 25% previously yr.

The nice half is that TSMC inventory stays less expensive than Nvidia. It’s buying and selling at 8.6 instances gross sales and has a trailing earnings a number of of twenty-two, which is way decrease than Nvidia’s price-to-sales ratio of 33 and earnings a number of of 78.

Nonetheless, TSMC inventory may not stay low-cost for lengthy, particularly after its newest quarterly outcomes that time towards an enormous turnaround within the firm’s fortunes in 2024.

Let’s take a look at the explanations TSMC inventory may comply with in Nvidia’s footsteps and begin hovering.

AI is ready to drive strong progress for TSMC

TSMC launched its fourth-quarter 2023 outcomes on Jan. 18. The corporate’s full-year income fell nearly 9% yr over yr to $69.3 billion, whereas earnings have been all the way down to $5.18 per share from $6.57 in 2022.

The year-over-year decline in TSMC’s prime and backside traces will be attributed to the weak spot within the smartphone, knowledge heart, and Web of Issues (IoT) markets final yr.

However that’s set to vary in 2024. TSMC has guided for first-quarter income of $18.4 billion on the midpoint of its vary, which might be a ten% enhance over the prior-year interval.

TSMC’s first-quarter 2023 income was down nearly 5% from the year-ago quarter. And administration forecasts 2024 income to extend within the low- to mid-20% vary, suggesting {that a} strong turnaround is forward.

This potential soar in TSMC’s 2024 income will be credited to the rising demand for its superior 5-nanometer (nm) and 3nm chips. The corporate factors out that 3nm chips accounted for 15% of its income within the fourth quarter, up from zero within the year-ago interval. The 5nm chips, that are utilized by the likes of Nvidia to fabricate common AI chips similar to its H100 processor, accounted for 35% of its income as in comparison with 32% in the identical interval final yr.

The demand for these superior chip nodes ought to proceed growing in 2024 and past, because of prospects similar to Nvidia which are going to considerably enhance the manufacturing of AI chips. Provide chain rumors point out that Nvidia may triple the output of its H100 processors this yr.

In the meantime, the corporate’s next-generation AI chips, code-named Blackwell, are reportedly going to be manufactured utilizing TSMC’s 3nm course of in 2024 in order that they’ll ship much more computing energy.

Because it seems, Nvidia just isn’t the one one in line to buy TSMC’s 3nm chips. Together with Apple, which already makes use of the 3nm platform in its newest iPhone era, the likes of AMD, MediaTek, and Qualcomm, are additionally anticipated to purchase the 3nm chips. That is why TSMC is predicted to extend the capability utilization of the 3nm course of to 80% in 2024.

Administration predicted in December 2022 that its 3nm expertise may assist chipmakers create chips value an estimated $1.5 trillion inside 5 years since going into quantity manufacturing. So buyers can count on TSMC to continue to grow shortly in 2024 and past.

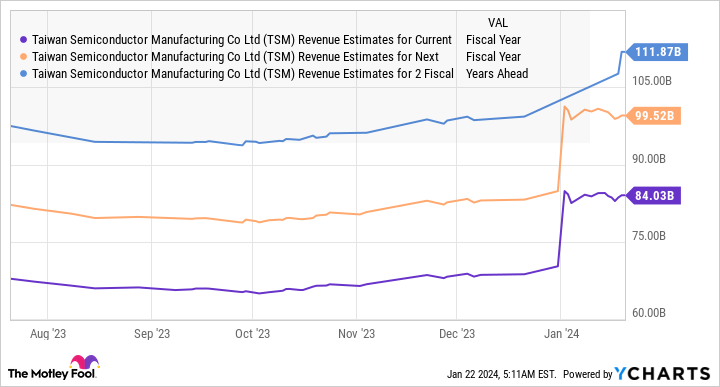

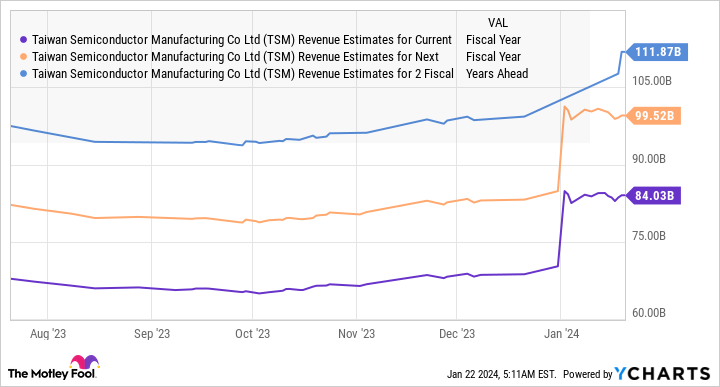

In consequence, analysts have considerably elevated their progress expectations from TSMC.

Count on the inventory to ship spectacular upside

The chart above means that TSMC may generate $112 billion in income in 2026. As talked about above, it trades at 8 instances gross sales, which is in keeping with its five-year common gross sales a number of. An analogous a number of after a few years, together with $100 billion in annual income, would point out a market cap of $896 billion, a soar of 51% from present ranges.

However there’s a good likelihood that it may commerce at a a lot greater gross sales a number of contemplating that AI shares similar to Nvidia are likely to command premium valuations. Assuming TSMC may command even half of Nvidia’s price-to-sales ratio of 33, its market cap may soar to a powerful $1.85 trillion in a few years if it may well obtain $100 billion in income. That means a possible upside of 212% from present ranges.

So, the underside line is that TSMC’s inventory may soar as AI drives stronger demand for its superior chips, which is why buyers ought to contemplate shopping for it earlier than it turns into costly.

Must you make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Taiwan Semiconductor Manufacturing wasn’t considered one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

See the ten shares

*Inventory Advisor returns as of January 16, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a disclosure coverage.

Purchase This Extremely Low-cost Synthetic Intelligence (AI) Inventory Earlier than It Begins Hovering Like Nvidia was initially printed by The Motley Idiot