There isn’t any denying Nvidia has been the centerpiece of the unreal intelligence (AI) revolution to date. Its expertise is used within the overwhelming majority of the world’s AI platforms just because it affords probably the most computing energy. And Nvidia shares have carried out accordingly because the motion acquired moving into earnest early final yr.

As is the case with another trade, nevertheless, time is driving adjustments on the AI entrance. Nvidia is not the market’s prime alternative. This title is shifting towards Taiwan Semiconductor Manufacturing Firm (NYSE: TSM), which is arguably higher positioned to capitalize on the following chapter of AI’s development story.

Taiwan Semiconductor is behind the scenes… all of them

Nvidia is not doomed. However it could be naïve to not acknowledge that the majority of AI’s simple cash has already been made. Competitors is heating up. Intel and Superior Micro Units are stepping up their video games. Worth wars are underway.

There’s an usually missed however essential element concerning the AI {hardware} enterprise you need to perceive, nevertheless. That’s, chipmakers just like the aforementioned Nvidia and AMD normally do not manufacture their very own chips. They sometimes outsource such work to third-party “contract” producers which are able to fabricating this silicon to its designers’ specs.

Taiwan Semiconductor is one among these contract producers. Certainly, it is the most important title within the enterprise. It is estimated to fabricate on the order of two-thirds of the world’s semiconductors and related circuitry, and an excellent higher share when simply trying on the planet’s high-performance chip market.

This may assist drive the purpose residence: Superior Micro Units in addition to Nvidia are each confirmed prospects of Taiwan Semiconductor. Intel continues to spend money on the development of its personal foundries, though it is solid a developmental partnership with Taiwan Semiconductor to take action.

Join the dots. Taiwan Semiconductor may very well be the technological coronary heart and soul of the worldwide AI revolution.

And it is not restricted to information facilities. As time marches on, AI computing work is making its method towards finish customers, and finish customers’ cell phones particularly. Apple‘s latest processor — the A17 discovered within the iPhone 15 Professional and Professional Max — is able to dealing with generative AI duties on the gadget itself relatively than within the cloud, the place most generative AI work is presently accomplished.

It isn’t simply Apple wading into on-device synthetic intelligence waters, both. Qualcomm‘s latest high-performance Snapdragon 8 (Gen 3) cellular processors can deal with the identical type of load on cellular units.

Apple in addition to Qualcomm each additionally make the most of Taiwan Semiconductor’s chip-manufacturing providers.

Nonetheless loads of alternative forward

Taiwan Semiconductor Manufacturing does not make each chip utilized by the aforementioned outfits, for the report, nor does it manufacture each AI chip the world’s presently utilizing or will use sooner or later. It is seemingly shedding market share as different gamers ramp up their capability to crank this silicon out, actually. Intel particularly is exhibiting the potential to turn out to be a critical competitor to Taiwan Semiconductor.

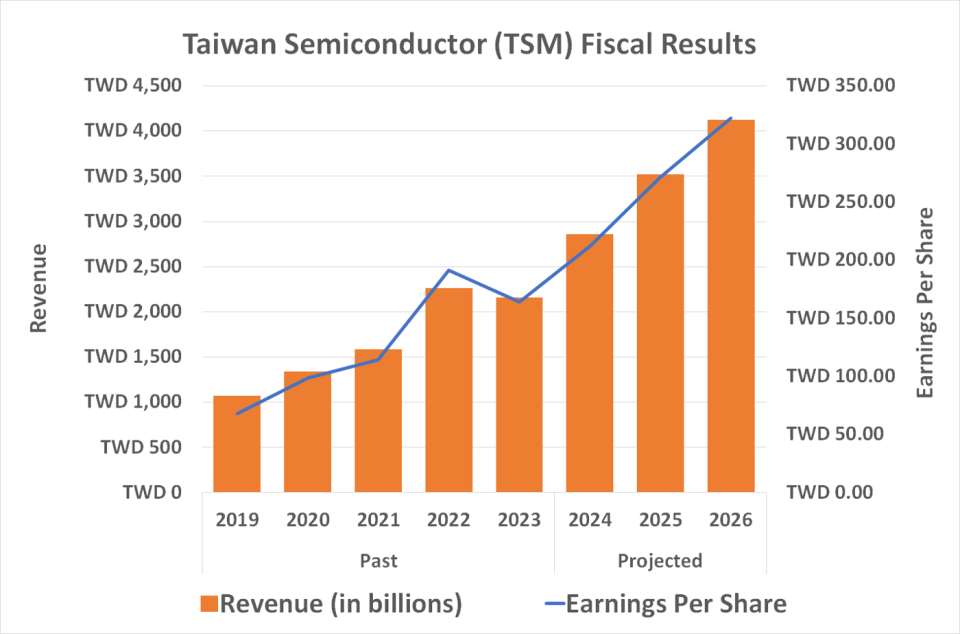

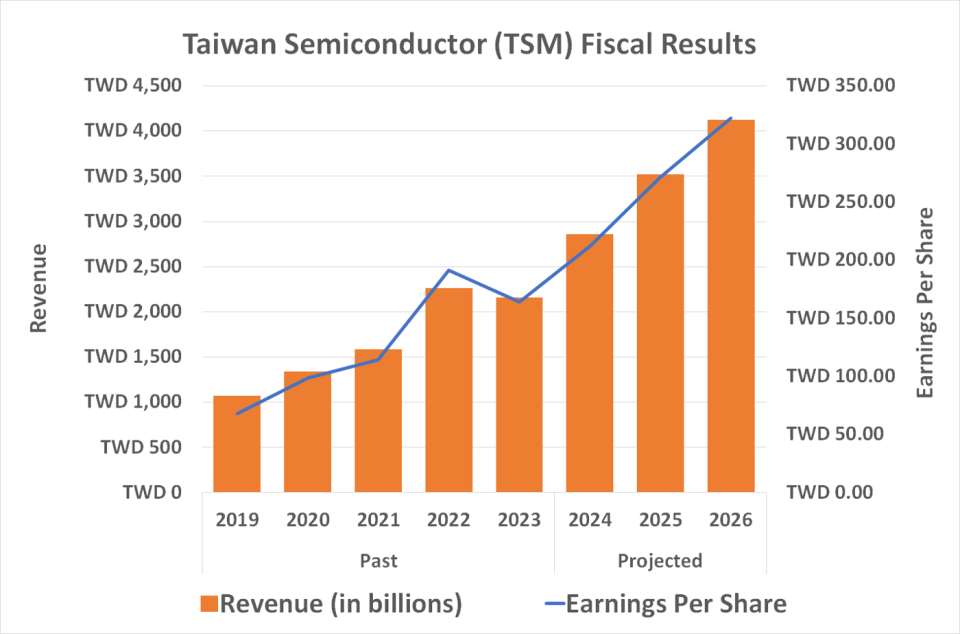

There’s nonetheless extra upside right here than not, nevertheless, regardless of the prospect of shrinking market share. Market analysis outfit Skyquest suggests the unreal intelligence {hardware} market is about to develop at an annualized tempo of 15.5% via 2031, whereas the cellular AI market is prone to develop at a compound yearly fee of practically 27% for a similar timeframe. On this vein, the analyst neighborhood believes Taiwan Semiconductor’s prime line is about to just about double between final yr and 2026, because the AI chipmaking trade gels.

So why is that this inventory down greater than 20% simply since its July peak (with many different synthetic intelligence names down equally)? That is acquired extra to do with the market surroundings than anything. Buyers lastly started realizing final month that a couple of too many shares had reached too-frothy valuations. The disappointing jobs report for July launched on Friday of final week did not assist both, main the group to presume lingering financial weak spot is on the horizon.

And possibly it’s.

Do not lose perspective, although. Even in a troublesome financial surroundings most chip manufacturers are nonetheless going to wish new silicon. And most of them are nonetheless in no place to make a lot (if any) of it themselves. They’re going to nonetheless want Taiwan Semiconductor to make it for them. Certainly, financial weak spot may even stifle capital expenditures on new foundries, making a confirmed, cost-effective foundry like Taiwan Semiconductor Manufacturing all of the extra essential to the AI enterprise’s greatest gamers.

Do you have to make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $641,864!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of August 6, 2024

James Brumley has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

Neglect Nvidia: Purchase This Magnificent Synthetic Intelligence (AI) Inventory As an alternative was initially revealed by The Motley Idiot