(Bloomberg) — A worth battle amongst electrical car makers in China is taking a toll on even essentially the most resilient gamers, as evidenced by BYD Co.’s staggering $18 billion drop prior to now month.

Most Learn from Bloomberg

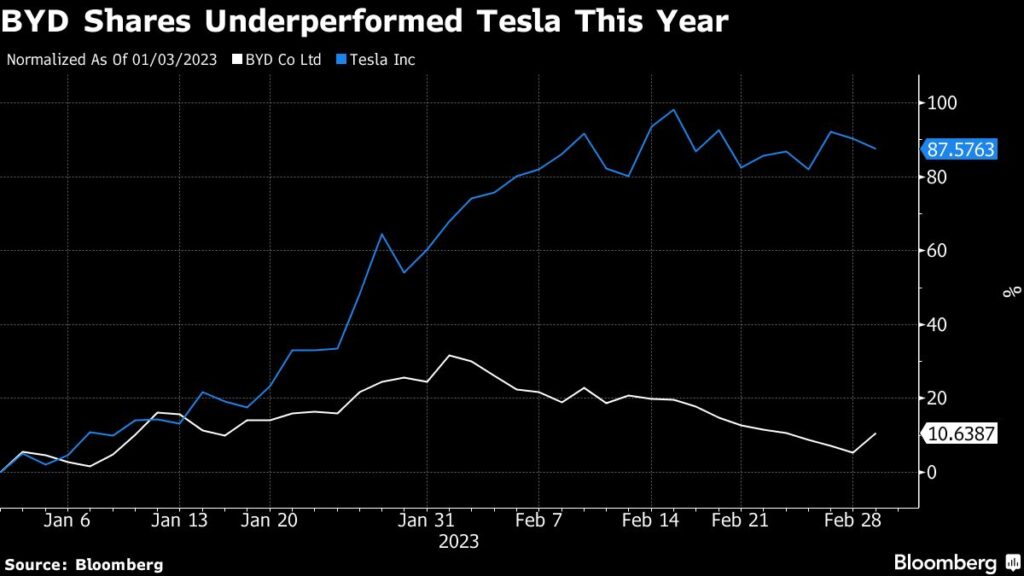

The US-listed shares of the producer that’s backed by Warren Buffett have declined 14% since Feb. 1, underperforming rival Tesla Inc. which superior 9% in the course of the interval. Compared, a gauge of worldwide EV makers fell 9%.

Merchants are rising cautious about BYD’s prospects after the electrical car maker’s sellers slashed costs of some fashions to spice up gross sales. The change in sentiment underscores the wave of warning that’s sweeping the business following strikes by Nio Inc. and XPeng Inc. to comply with Tesla’s lead in reducing costs as demand slows.

“A gradual business shift is underway as extreme worth cuts can result in consumers holding again, awaiting even decrease costs, whereas additionally having an excessively unfavorable affect on margin for all gamers,” mentioned Robert Mumford, an funding supervisor at GAM Hong Kong Ltd. “Decrease enter costs thus far should not prone to offset a unfavorable hit to margins.”

Buyers are actually sifting by means of the pile of shares to find out the probably winners and losers from the value battle, Mumford added.

On this respect, some say Shenzhen-based BYD might maintain up comparatively properly because it has higher pricing energy and controls most of its provide chain by producing its personal chips and batteries.

“Some gamers might must bear money burn for market share positive factors and improved scale impact, which can result in intensified competitors and market consolidation,” Citigroup Inc. analysts Jeff Chung and Beatrice Lam wrote in a notice. “Over the long run, we imagine market consolidation will additional strengthen BYD’s market share.”

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.