When Amazon‘s deal to accumulate iRobot (NASDAQ: IRBT) fell via earlier this 12 months, it was as if the air was let loose of the robotic vacuum maker’s inventory. Virtually instantly, shares went over a cliff. The corporate has been struggling to achieve traction ever since. Its gross sales have been declining, the enterprise is struggling to remain out of the purple, and money burn can be a priority.

In any case of this, iRobot’s inventory is down 72% 12 months to this point. Nevertheless, the corporate lately introduced on a brand new CEO with expertise in main turnarounds. And at a reasonably sizable low cost, the inventory might look like an inexpensive purchase for contrarian buyers. Can the inventory bounce again this 12 months, and will now be time to purchase shares of iRobot?

iRobot will get a brand new CEO with “turnaround expertise”

On Could 7, iRobot introduced that Gary Cohen can be approaching as the corporate’s new chief govt officer, efficient instantly, to assist steer its turnaround. With 25 years of expertise, together with coping with turnarounds, Cohen has expertise serving to a number of companies enhance their gross sales and earnings via cost-cutting initiatives, company restructuring, and product improvements.

For iRobot, it is the kind of management that might assist put the corporate on a way more optimistic trajectory, as its monetary efficiency has been abysmal in recent times. Gross sales of $891 million in 2023 have fallen by 38% from 2020, after they topped $1.4 billion. Throughout that point, the corporate’s backside line has flipped from a revenue of $147 million right into a lack of practically $305 million this previous 12 months.

The corporate faces a tricky highway forward

At a time when shoppers are dealing with increased inflation and there is probably a recession on the horizon, it will not be simple for iRobot to get heading in the right direction. Its high-priced robots might discover it laborious to do effectively with extra competitors available in the market, and folks could also be much less prone to spend as a lot as they’ve up to now.

In iRobot’s most up-to-date quarter, which ended on March 30, its common gross promoting worth per robotic unit was $346 — down from $402 in the identical interval final 12 months. Even with a decrease promoting worth, income totaling $150 million was nonetheless down 6% 12 months over 12 months. For 2024, the corporate expects its income to return in between $815 million and $860 million, and it initiatives a internet loss per share of at the very least $2.23.

And whereas it did generate optimistic money circulate from its operations final quarter of $1.4 million, that would not have been the case if not for a $75 million termination charge which Amazon needed to pay the corporate attributable to its failed acquisition try.

Is iRobot’s inventory low cost sufficient?

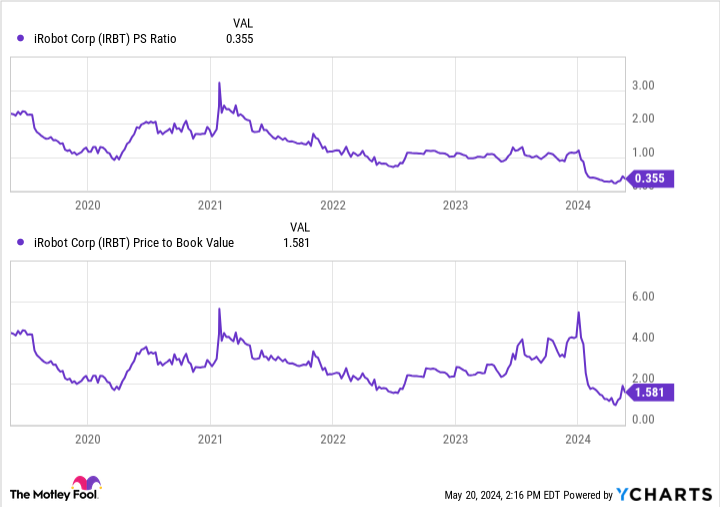

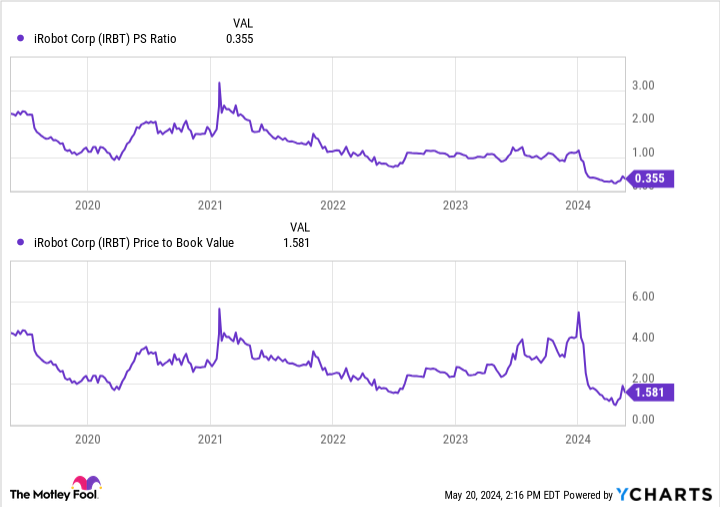

Shares of iRobot are buying and selling at simply 0.3 occasions gross sales and just one.5 occasions e book worth. These are at far decrease ranges than what the inventory has averaged up to now. It has come off its 52-week lows, but it surely’s nonetheless down 78% from its 52-week excessive of $51.49.

iRobot inventory is buying and selling at a reduction, however figuring out whether or not it is a good worth will in the end rely upon what the corporate’s financials appear to be sooner or later. And with iRobot in the midst of a turnaround, it is laborious to decipher simply how robust the enterprise will find yourself being.

Ought to buyers take an opportunity on iRobot inventory?

iRobot has became a speculative funding, and it is solely appropriate for buyers with a excessive danger tolerance. Its gross sales are crashing, the corporate is burning via money, and dilution is an actual menace for buyers in future quarters.

On the very least, I might wait a couple of quarters to see how the brand new CEO is doing and the way effectively the turnaround goes. Until there is a drastic enchancment within the firm’s fundamentals and a purpose to be extra optimistic about iRobot’s future progress, it is a inventory most buyers are possible higher off avoiding in the interim. Whereas it is attainable for the inventory to bounce again if there are indicators that the enterprise goes in the appropriate route, buyers can be taking up an enormous danger by shopping for the inventory proper now and assuming that can occur.

Do you have to make investments $1,000 in iRobot proper now?

Before you purchase inventory in iRobot, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and iRobot wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $652,342!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of Could 13, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. David Jagielski has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and iRobot. The Motley Idiot has a disclosure coverage.

Can iRobot Inventory Bounce Again After Crashing 72% This 12 months? was initially revealed by The Motley Idiot