One of many tried-and-true strategies of constructing generational wealth is investing. Whether or not it is by way of actual property, commodities, or the inventory market, investing in sturdy asset courses may also help you flip a modest sum of cash into wholesome heaps of money in the long term.

A few of the most profitable investments in fashionable historical past are due to know-how. With synthetic intelligence (AI) fueling pleasure throughout the tech sector proper now, traders are absolutely questioning if they need to get in on the motion. Extra importantly, chances are you’ll be asking your self what firms are rising as true leaders in AI.

Palantir Applied sciences (NYSE: PLTR) is an information analytics platform that sells software program to the U.S. authorities and its Western allies in addition to industrial enterprises.

Final 12 months shares in Palantir rocketed 167% on the heels of the corporate’s inroads within the AI house. This momentum has poured over into 2024, with shares up one other 25% up to now this 12 months.

Given the meteoric rise in Palantir inventory, it is pure to surprise if the corporate is the following millionaire maker.

Let’s dig into Palantir’s enterprise and analyze why it is a sturdy selection for long-term traders. After taking a detailed have a look at the themes fueling Palantir proper now, it ought to turn out to be extra clear if proudly owning the inventory may also help you turn out to be a millionaire.

How Palantir struck gold in 2023

The final couple of years have been fairly risky for the software program market. Unusually excessive inflation and a sequence of rising rates of interest from the Federal Reserve impacted companies of all sizes.

As companies slashed price range spend, companies like Palantir witnessed decelerating development. The inventory cratered to an all-time low of simply $6 in December 2022. Nonetheless, final 12 months the corporate rebounded sharply as AI euphoria permeated all through the tech sector.

Final April, Palantir launched its fourth core software program suite: the Synthetic Intelligence Platform (AIP). The issue? Palantir was overshadowed by a mess of headline-grabbing investments from huge tech stalwarts resembling Microsoft, Amazon, and Alphabet.

Palantir resorted to an unconventional lead era technique merely known as “Bootcamps.” Basically, these are immersive trainings throughout which potential clients can check Palantir’s varied software program companies. The first objective of those seminars is to assist companies type a use case rooted in AI.

This technique has labored up to now, as exemplified by Palantir’s accelerated buyer adoption. Final 12 months the corporate elevated its general buyer depend by 35%. Furthermore, income from U.S. personal sector shoppers rose 70% 12 months over 12 months throughout the fourth quarter.

Is Palantir a very good long-term funding?

There are a great deal of firms seeking to money in on the AI narrative. However like different development alternatives, there are seemingly solely going to be a finite variety of winners in the long term.

Some of the interesting elements of Palantir is the corporate’s constant profitability. Many high-growth software-as-a-service (SaaS) companies have but to achieve profitability on a usually accepted accounting ideas (GAAP) foundation, or expertise inconsistent ebbs and flows in free money move.

Palantir’s income development is complemented by an increasing margin profile, which has dropped to the underside line. The corporate’s sturdy liquidity place offers Palantir with an additional layer of economic horsepower over its friends, and is fueling the engine because it takes on huge tech.

Will Palantir make you a millionaire?

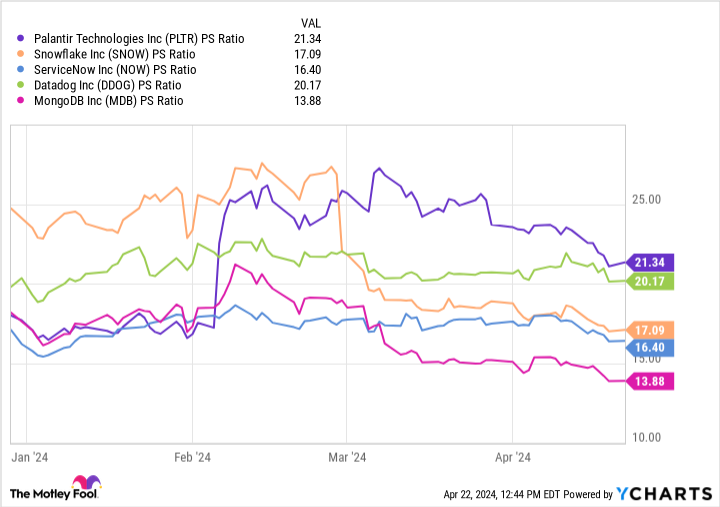

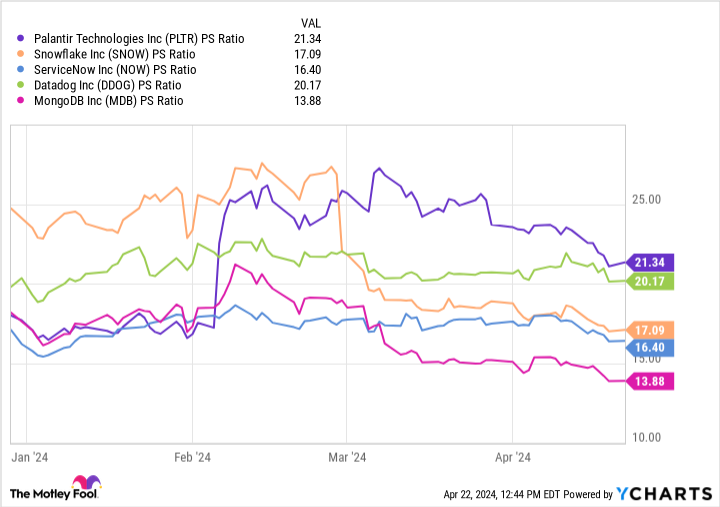

At a price-to-sales (P/S) ratio of 21.3, Palantir inventory is not low-cost in comparison with its friends. However a better have a look at the chart under ought to make clear a few vital concepts.

Specifically, Palantir’s valuation multiples expanded in February shortly after the corporate revealed a powerful fourth-quarter earnings report. Nonetheless, during the last a number of weeks, the inventory has skilled some promoting exercise — resulting in a little bit of a dip in share value.

Furthermore, regardless of its fast ascent, Palantir inventory remains to be down practically 45% from all-time highs a few years in the past.

Given how a lot Palantir inventory has run during the last 12 months, it is pure for traders to have some trepidation about shopping for in now at a premium valuation. When assessing any funding alternative, it is at all times vital to zoom out and take into consideration the larger image.

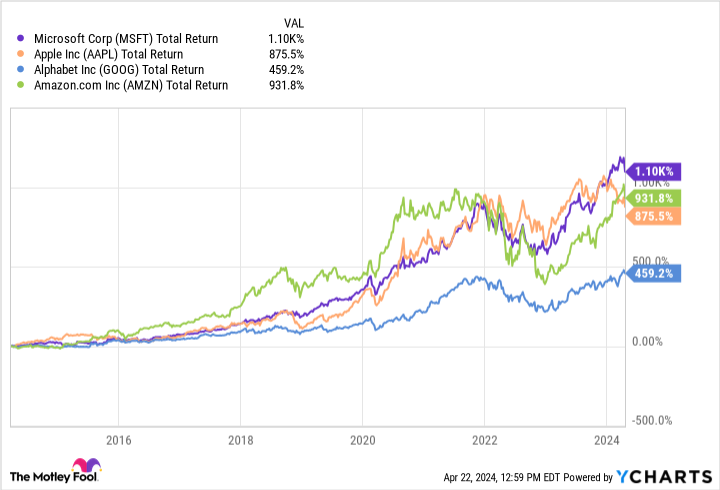

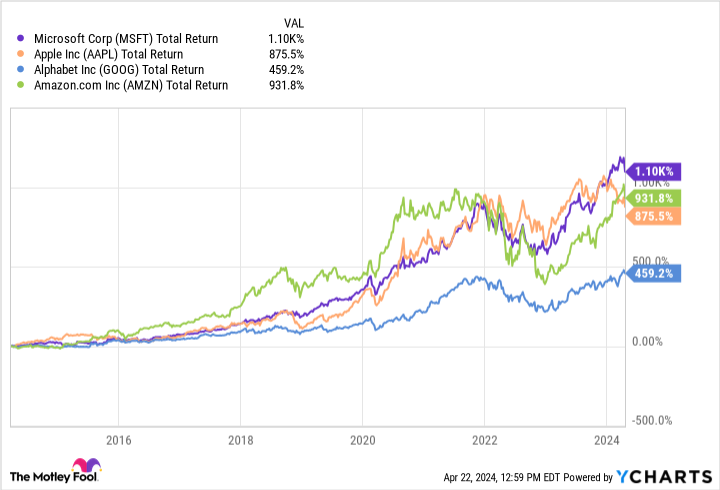

Corporations like Microsoft, Alphabet, Amazon, and Apple have all been round for a number of many years. Every of these companies have skilled their share of market turbulence and varied financial cycles. And but, the chart under makes one factor abundantly clear: Every of those shares has been profitable for traders. The catch is that with a view to maximize returns, traders have to train endurance and a have long-term mindset.

It’s much more vital to spend time available in the market versus making an attempt to time the market completely. Furthermore, persistently doubling down on winners over time and constructing high-conviction positions in your portfolio can be a confirmed technique to producing strong returns.

I am not suggesting that Palantir might be the following huge tech alternative. Fairly, my pondering is that as long as the corporate operates from a place of energy in a rising market resembling AI, holding Palantir inventory over the long term may generate huge features for disciplined traders.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Palantir Applied sciences wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $537,557!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 22, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, Apple, Microsoft, and Palantir Applied sciences. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Datadog, Microsoft, MongoDB, Palantir Applied sciences, ServiceNow, and Snowflake. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Can Palantir Inventory Assist You Retire a Millionaire? was initially revealed by The Motley Idiot