Shares of the hydrogen gas cell firm Plug Energy (NASDAQ:PLUG) have been type of on the fritz these days, experiencing a decline of about 35% in August. The August 9 earnings report, which indicated Plug’s gross sales had risen by a strong 72%, additionally revealed losses that had been 50% worse than what analysts had anticipated – an element that contributed to the decline within the firm’s inventory.

And but, one analyst isn’t fairly able to throw within the towel on Plug simply but. In a current notice, Jefferies’ Dushyant Ailani took over protection of Plug Energy for the funding banker. And whereas Ailani trimmed Jefferies’ worth goal for Plug inventory from $16 to simply $12 a share, the analyst nonetheless maintained Jefferies’ “purchase” score on Plug.

Which type of is smart. In any case, if Ailani believes the inventory is value $12 per share, it may nonetheless yield a possible revenue of 40% from present ranges, assuming the analyst is correct about Plug inventory’s worth.

However is $12 the right worth?

Nicely, let’s take into account: As Ailani studies, after 12 months of building work, Plug continues to be within the technique of getting its Georgian “inexperienced hydrogen” manufacturing course of up and working. Already, this plant is producing gaseous hydrogen on the charge of three tons per day (tpd). However Plug must be producing liquid hydrogen to make the gas supply simply transportable and usable for fueling hydrogen gas cell automobiles. Plug had hoped to be doing liquid hydrogen by the top of August, however that timeline has been pushed again a bit, to the top of the quarter — so September.

Plug hopes to ramp manufacturing quantity as effectively, to about 15 tpd by the top of subsequent month, or early October at newest. Then in part 2 of the venture, Plug hopes to double that manufacturing charge to 30 tpd by the second quarter of 2024.

So… excellent news, proper? Nicely, not precisely. For one factor, Plug isn’t presently producing a complete lot of “inexperienced hydrogen” — i.e., hydrogen break up from water molecules utilizing energy generated from renewable vitality sources. Somewhat, the corporate is presently producing its hydrogen from “gray” sources — pure gasoline. And for an additional, Plug continues to be dropping cash at current, as famous above. In reality, even after the corporate begins producing liquid hydrogen and quintuples, its manufacturing capability later this quarter, Ailani observes that gross “revenue” margins for the corporate will most likely nonetheless be destructive 8%.

Translation: For each $1 of hydrogen Plug sells, the corporate will lose $0.08 — earlier than including losses from working prices, curiosity on its close to $1 billion in debt, and so forth. On the underside line, subsequently, you possibly can most likely assume that Plug’s web revenue margin goes to be a complete lot worse than simply destructive 8%. In reality, proper now Plug’s web revenue margin is destructive 95%.

And but, this reality doesn’t appear to faze Ailani, who’s, in any case, valuing Plug not on its income (which Plug doesn’t have), however fairly on Plug’s revenues (which it does). In keeping with the analyst, a good worth to pay for Plug is about 4.5 instances the $2.4 billion in gross sales the corporate could or could not make in 2025.

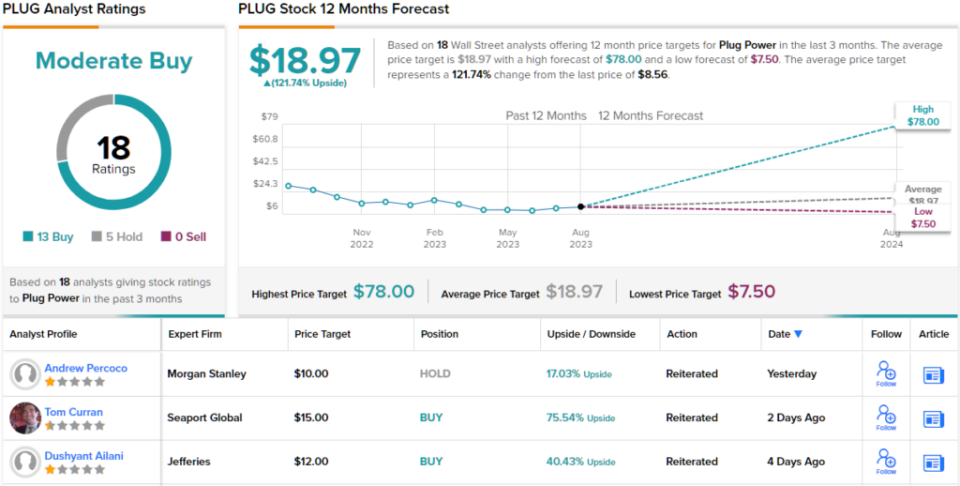

General, Wall Road has not given up on PLUG. The analysts have filed 18 analyst evaluations in current weeks, and these embrace 13 Buys in opposition to 5 Holds, for a Average Purchase consensus score. PLUG inventory is priced at $8.54 and the $18.97 common worth goal suggests ~122% upside from that degree. (See PLUG inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.