Monetary companies is an trade determined for some innovation. In an age when absolutely anything could be achieved on-line, the thought of going to a brick-and-mortar financial institution to finish a fundamental transaction will not be interesting.

Fintech companies that function on the intersection of expertise and finance, equivalent to Stripe, Chime, Plaid, and others, have introduced some much-needed disruption to legacy monetary companies. However traders can solely entry these firms by way of particular funding automobiles as they’re nonetheless non-public.

Nevertheless, one rising publicly traded fintech is SoFi Applied sciences (NASDAQ: SOFI). SoFi went public a number of years in the past following a merger with a particular goal acquisition firm (SPAC) led by billionaire investor Chamath Palihapitiya.

With shares buying and selling at a modest $7, traders is likely to be questioning if SoFi is a profitable alternative within the budding fintech realm. Let’s dig into why it is a distinctive funding prospect and see if the corporate has potential to generate returns robust sufficient to assist make you a millionaire.

SoFi’s enterprise mannequin is fascinating

SoFi is making a one-stop store for members on its platform, with entry to a bunch of on-line companies together with pupil loans, mortgages, and inventory market investing. This number of merchandise beneath one roof has allowed SoFi to cross-sell to its person base.

This method is called a flywheel enterprise mannequin. In idea, by cross-selling at a excessive charge, SoFi doesn’t must allocate as many assets to buyer acquisition over time. Subsequently, the corporate can use its capital to double down on extra product innovation, thereby making SoFi a formidable competitor for conventional monetary companies firms.

However the long-term potential may very well be huge

SoFi’s enterprise mannequin would possibly look enticing on the floor, however traders want to know that this has been pricey to create. During the last a number of years, the corporate has accomplished quite a few acquisitions to assist construct out its platform. These transactions, mixed with efforts to amass a big member base, have resulted in staggering working losses. Till now, that’s.

Throughout the fourth quarter, ended Dec. 31, SoFi stunned traders by posting its first-ever revenue on the premise of typically accepted accounting rules.

What’s even higher is that administration instructed traders that ongoing profitability could be anticipated by way of 2026. That is encouraging as a result of it legitimatizes SoFi’s differentiated enterprise mannequin.

With constant profitability on the horizon, traders would possibly surprise if SoFi has untapped potential able to producing profitable returns.

May SoFi inventory make you a millionaire?

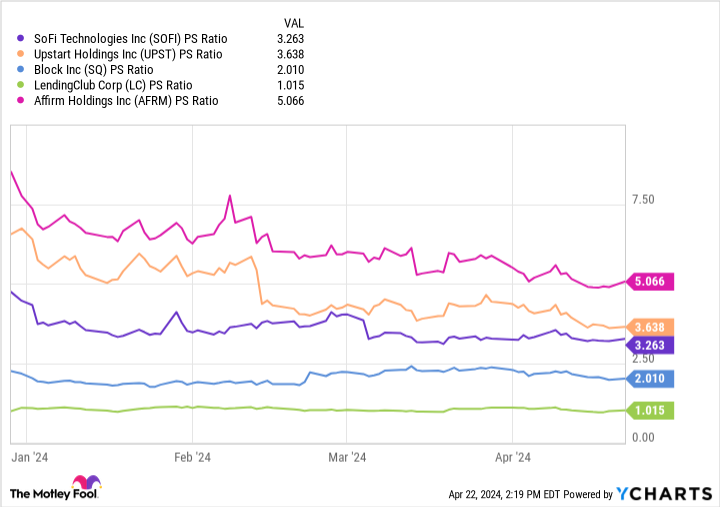

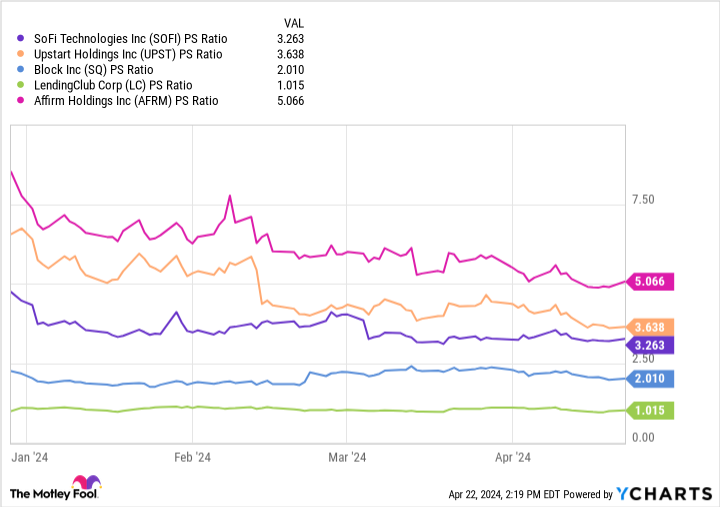

The chart under compares SoFi with friends in fintech on a price-to-sales (P/S) foundation. At a P/S of simply 3.3, it’s in the midst of this cohort.

The essential concept for traders is to double down on their winners and maintain their highest-conviction positions over the course of a few years and even a long time.

Take Warren Buffett for instance. The Oracle of Omaha has owned quite a lot of completely different shares through the years. However monetary companies have constantly remained a high sector for him, with firms like Financial institution of America, American Categorical, Visa, and Mastercard representing pillars of the Berkshire Hathaway portfolio.

Buyers with an extended horizon ought to take into account SoFi’s potential amid a rising fintech sector. The corporate’s ecosystem of companies might make it a future chief because the sector evolves, and I’m optimistic that administration will make good on its steering and that regular income will turn into extra of a staple of its enterprise.

These elements ought to play a job in SoFi’s progress over time. I feel the corporate’s greatest days may very well be forward, and it has the potential to be a millionaire maker in the long term.

Must you make investments $1,000 in SoFi Applied sciences proper now?

Before you purchase inventory in SoFi Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 greatest shares for traders to purchase now… and SoFi Applied sciences wasn’t one in every of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $537,557!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 22, 2024

American Categorical is an promoting accomplice of The Ascent, a Motley Idiot firm. Financial institution of America is an promoting accomplice of The Ascent, a Motley Idiot firm. Adam Spatacco has positions in Block and SoFi Applied sciences. The Motley Idiot has positions in and recommends Financial institution of America, Berkshire Hathaway, Block, Mastercard, Upstart, and Visa. The Motley Idiot recommends the next choices: lengthy January 2025 $370 calls on Mastercard and brief January 2025 $380 calls on Mastercard. The Motley Idiot has a disclosure coverage.

Can SoFi Inventory Assist You Retire a Millionaire? was initially revealed by The Motley Idiot