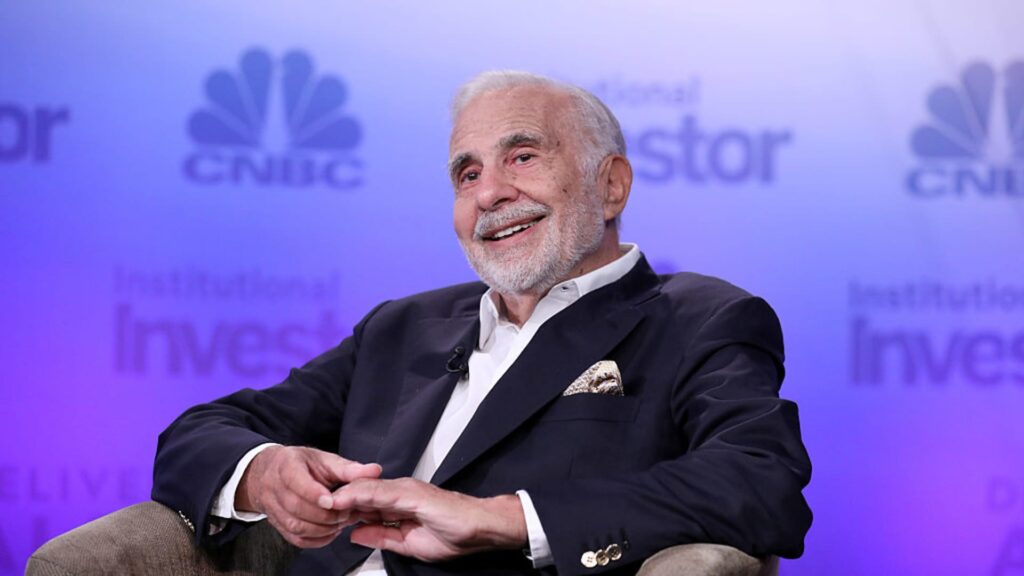

Famed investor Carl Icahn stated Thursday’s reduction rally did not change his unfavourable view in the marketplace, and he believes a recession continues to be on the horizon.

“We preserve our portfolio hedged,” Icahn stated on CNBC’s “Closing Bell Additional time” Thursday. “I’m nonetheless very, fairly bearish on what will occur. A rally like that is in fact very dramatic to say the least… however I nonetheless assume we’re in a bear market.”

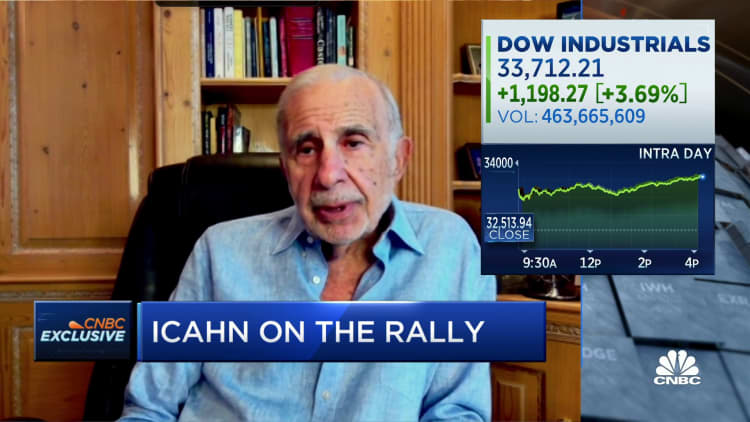

Shares staged an enormous comeback after October’s studying of client costs fueled bets that inflation has peaked. The Dow Jones Industrial Common jumped 1,200 factors for its greatest one-day achieve since Might 2020. The S&P 500 jumped 5.5% in its greatest rally since April 2020.

Huge bear-market rallies happen usually due to the big brief curiosity constructed up within the downturn, Icahn stated. Whereas the inflation report confirmed some indicators of easing, the founder and chairman of Icahn Enterprises believes value pressures are sticker than most assume due to wage will increase.

“Inflation is just not going away, not within the close to time period,” Icahn stated. “We’re going to have extra wage inflation. Lots of people do not need to work.”

The mixture of upper rates of interest and an inverted yield curve led Icahn to consider {that a} recession is inevitable, he stated.

The buyer value index elevated 0.4% for the month and seven.7% from a yr in the past, in comparison with respective estimates from Dow Jones have been for rises of 0.6% and seven.9%. The Federal Reserve has been deploying a sequence of aggressive rate of interest hikes in an effort to carry down inflation working round its highest ranges for the reason that early Nineteen Eighties.

“I believe the Fed did what they needed to do,” Icahn stated. “I believe they got here late to the sport to boost rates of interest. However I do not assume the inflation is over….I lived by means of the 70s. It took years and years and years to get it over with. You may’t wave a magic wand to get inflation over with.”