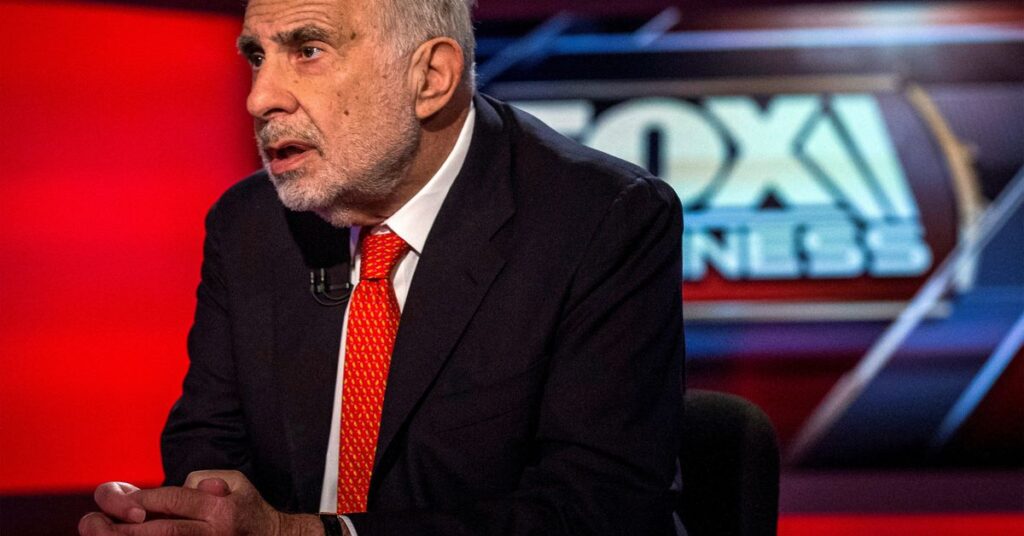

Could 3 (Reuters) – Carl Icahn’s empire took one other hit on Wednesday when his holding firm’s shares plunged additional within the aftermath of a essential report from brief vendor Hindenburg Analysis, bringing the valuation drop because the brief vendor attacked it to greater than $6 billion.

Hindenburg on Tuesday accused Icahn Enterprises LP (IEP) (IEP.O) of over-valuing its holdings and counting on a “Ponzi-like” construction to pay dividends. Icahn known as the report “self-serving” and he stood by IEP’s statements about its funds. He didn’t reply to a request for touch upon Wednesday.

IEP shares hit an intraday low of $31.78 – their lowest in additional than a decade. The corporate is now value $11.5 billion, 35% lower than its worth on Monday earlier than Hindenburg revealed its report.

Icahn owns about 85% of IEP and has pledged over 60% of his stake as collateral for private loans. The Hindenburg report has wiped $7.5 billion off Icahn’s fortune, leaving him with a web value of $10.8 billion, in response to Forbes.

IEP is scheduled to report its first-quarter earnings on Friday, limiting its capability to remark intimately on its funds upfront.

“Activist brief assaults a number of days earlier than an issuer experiences earnings are frequent as a result of regulatory quiet intervals can restrict the issuer’s capability to reply and catch them off-guard,” mentioned Josh Black, editor-in-chief of Insightia, which offers information on shareholder activism and company governance.

Jefferies Monetary Group Inc (JEF.N), the one main Wall Avenue brokerage that covers IEP, declined to touch upon Wednesday on whether or not it had plans to revise its “purchase” ranking. Its analyst Daniel Fannon has constantly supplied this constructive ranking on IEP since 2013. Fannon didn’t reply to requests for remark.

The assault has landed Icahn in uncharted waters. Identified for his face-offs with trade heavyweights corresponding to AIG (AIG.N) and McDonald’s Corp (MCD.N), the billionaire has by no means seen his agency turn into a goal of activist investing.

Hindenburg has taken on a number of high-profile targets in latest months, together with India’s conglomerate Adani Group and Jack Dorsey-led digital funds platform Block Inc (SQ.N).

William Ackman, a hedge fund veteran who famously feuded with Icahn over their opposing takes on dietary supplements firm Herbalife, known as the Hindenburg report a “must-read”.

“There’s a karmic high quality to this brief report that reinforces the notion of a circle of life and loss of life,” he tweeted on Tuesday.

Reporting by Niket Nishant in Bengaluru; Modifying by Saumyadeb Chakrabarty

: .