Perceived knowledge goes that the best way to outperform the market this yr has been by leaning into the Magnificent Seven shares (AAPL, AMZN, GOOGL, META, MSFT, NVDA, TSLA).

These market leaders – all tech giants – are seen as being liable for the market’s rally, however maintain that thought, says Ark Make investments CEO Cathie Wooden.

These names don’t take up a lot room in Wooden’s flagship Ark Innovation ETF, but the fund, with its deal with daring, revolutionary shares, nonetheless managed to beat the principle indexes’ performances all through the primary half of the yr. And that’s indicative of a notable pattern, says Wooden.

“We don’t personal many of the Magnificent Seven. We personal Tesla in measurement, however the others, both by no means or partial positions, are in our flagship technique,” she not too long ago stated. “And thru the second quarter, we outperformed even the NASDAQ 100, which is dominated by these shares… I do suppose our outperformance within the first half – and it was vital outperformance – means that perhaps beneath the market is broadening out, and that’s very wholesome.”

In the meantime, Wooden has been loading up on the names she sees as primed to maintain on outperforming, and as can be anticipated, amongst them are some cutting-edge equites. We determined to get the lowdown on a pair of her current picks and ran them by way of the TipRanks database to additionally gauge common Avenue sentiment towards them. Right here’s what we discovered.

Intellia Therapeutics (NTLA)

Wooden’s investing type closely favors pioneers, and our first inventory has that in spades. Intellia Therapeutics is a biotech firm on the forefront of the event of CRISPR/Cas9 gene enhancing know-how for therapeutic functions. Intellia is a pacesetter within the subject, harnessing the facility of CRISPR to develop revolutionary remedies for a variety of genetic illnesses. The corporate’s mission is to create life-changing therapies by exactly enhancing the DNA inside a affected person’s cells, providing the potential to treatment or considerably mitigate genetic problems at their root trigger.

This can be a firm boasting some critical credentials: one in all Intellia’s co-founders, Jennifer Doudna, alongside Emmanuelle Charpentier, was awarded the 2020 Nobel Prize in Chemistry for the groundbreaking CRISPR endeavors.

All of the above wouldn’t imply a lot for Intellia with out an energetic pipeline, and right here, along with a number of therapies within the pre-clinical stage, the corporate has a number of medicine which have superior to the clinic.

Amongst these are NTLA-2001, being labored on as an in vivo, systemically delivered, investigational CRISPR-based remedy for protein dysfunction transthyretin (ATTR) amyloidosis. The corporate intends to submit an Investigational New Drug (IND) utility to the FDA for a pivotal examine of NTLA-2001 in ATTR-CM (cardiomyopathy) this month. And topic to regulatory suggestions, Intellia hopes to kick off a world examine earlier than the tip of the yr. Earlier than the tip of the yr, the corporate additionally plans on releasing extra medical knowledge from the ATTR-CM arm of the Part 1 examine.

The corporate can also be finding out NTLA-2002 as a therapy for hereditary angioedema (HAE), a uncommon genetic situation outlined by inflammatory assaults. Intellia plans to finish enrollment within the Part 2 portion of the Part 1/2 examine within the second half of the yr, and will the regulators approve, provoke a world pivotal Part 3 examine by Q3 2024.

All of this has evidently gotten Wooden in a shopping for temper. Over the previous month, by way of the ARKK fund, she bought 193,896 shares. Her total holdings now stand at 6,940,818 shares, at present price ~$261.6 million.

Primarily based on the pipeline’s prior efficiency and upcoming catalysts, Barclays analyst Gena Wang can also be assured Intellia represents a wonderful alternative for buyers.

“Given preliminary IND clearance in HAE, broadly relevant preclinical knowledge in fetal improvement, and older affected person inhabitants in ATTR-CM, we count on excessive chance of IND clearance (possible in Nov) for NTLA-2001 Ph3 in ATTR-CM,” the analyst stated. “We proceed to consider NTLA’s in vivo gene enhancing platform was nicely validated by a number of medical packages, with vital upside potential from a number of near-term medical catalysts.”

Accordingly, Wang has an Obese (i.e., Purchase) ranking on NTLA shares, backed by a $90 value goal. There’s loads of upside – 139% to be precise – ought to the goal be met over the following 12 months. (To observe Wang’s observe file, click on right here)

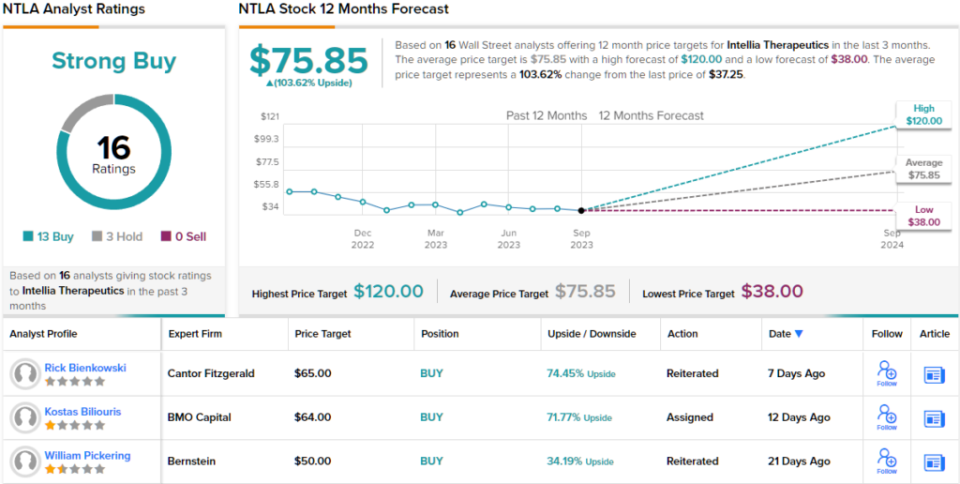

Most on the Avenue agree with Wang’s stance. The inventory’s Robust Purchase consensus ranking is predicated on 13 Buys vs. 3 Holds. At $75.85, the common value goal signifies the analysts count on the inventory to greater than double in worth within the yr forward. (See NTLA inventory forecast)

Pacific Biosciences (PACB)

We’ll keep within the biotech area for the following Wooden-backed identify, though Pacific Biosciences operates in a special phase. The life science instruments firm develops and brings to market gene sequencing methods.

Pacific Biosciences operates with two main sequencing methods: one is Single-Molecule Actual-Time Sequencing (SMRT), which capitalizes on the traits of zero-mode waveguides, and the opposite is Sequencing by Binding (SBB) chemistry. The SBB technique employs pure nucleotides and a seamless incorporation course of for attaching and elongating DNA strands.

Not like biotech firms targeted on medical improvement, the corporate’s merchandise usher in an everyday income stream. In Q2, boosted by the brand new Revio long-read sequencing methods (business shipments started in March), the corporate generated file quarterly income of $47.57 million, in what amounted to a 34% year-over-year enhance. The determine additionally beat the Avenue’s forecast by $7.66 million. The sturdy efficiency prolonged to the bottom-line too. Whereas working at a loss, adj. EPS of -$0.26 fared higher than the -$0.31 anticipated by the analysts.

On the Q2 earnings name, the corporate additionally disclosed that it had agreed to accumulate Apton Biosystems, a developer of sequencing and single-molecule detection methods, in a deal that might rise as much as $110 million.

Towards this backdrop, Wooden has been loading up. By way of the ARKK fund, she purchased 298,214 shares in August, bringing her complete holdings to fifteen,108,533 shares. These at present command a market worth of greater than $172.3 million.

TD Cowen analyst Dan Brennan sees loads to love about this next-gen DNA sequencing specialist.

“Expectations are excessive for PACB, with a focused 40-50% multi-year income CAGR and an thrilling, extremely differentiated Revio launch. Our buyer diligence has been strong, and we really feel sturdy 2Q outcomes assist our optimistic thesis,” Brennan stated. “The Apton acquisition will generate investor curiosity, with mgmt indicating having access to such a platform is in line with their LT planning (and creates a leverageable asset in a really giant market with a reasonably superior platform) – all true, although we argue given pleasure over the fabric Revio alternative, Apton focus/spending must be managed appropriately and never in any means dilute the main focus/execution with Revio.”

These feedback underpin Brennan’s Outperform (i.e., Purchase) ranking on PACB, whereas his $19 value goal provides one-year upside of ~70%. (To observe Brennan’s observe file, click on right here)

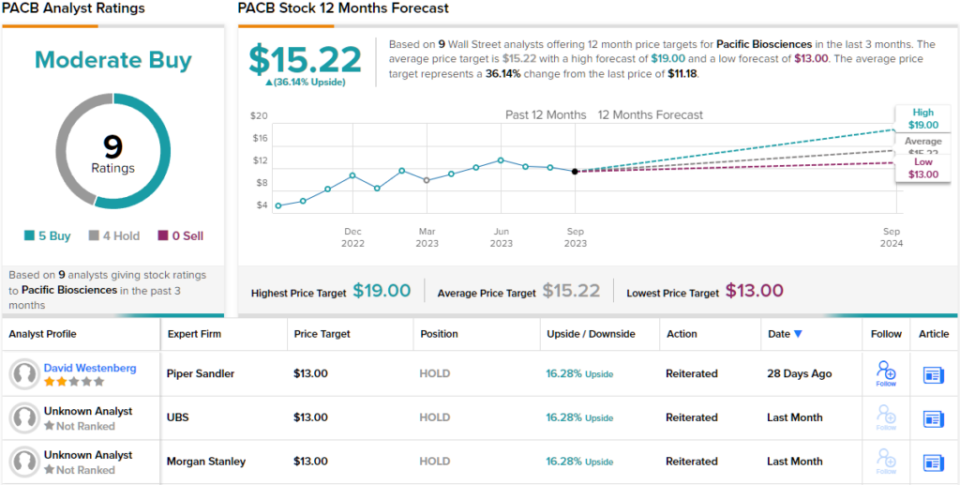

Turning to the remainder of the analyst neighborhood, opinions are break up nearly evenly. 5 Buys and 4 Holds add as much as a Reasonable Purchase consensus ranking. At $15.22, the common value goal implies 36% upside potential. (See PACB inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your personal evaluation earlier than making any funding.