Cathie Wooden is known for her singular investing fashion. Favoring excessive progress and disruptors, she usually seems to be throwing warning to the wind and prepared to tread the place different Wall Avenue titans might concern to go.

Nonetheless, outré Wooden’s technique may appear to some, there’s one danger she’s not prepared to take. Addressing the current comeback of meme shares, the Ark Make investments CEO lately issued a warning to traders eager to get in on the motion, sensibly warning that it’s going to finish badly for a lot of piling into speculative names equivalent to GameStop and AMC.

“Purchaser beware, there have been lots of people within the first meme inventory craze who acquired damage badly,” Wooden commented.

That mentioned, it’s not as if Wooden has instantly turned to worth investing for inspiration. Nonetheless following her playbook of publicity to innovators, we’ve determined to get the lowdown on two of the much less lauded names that make up a part of her Ark Make investments portfolio.

Right here it seems that the Avenue is in sync with the Wooden view; based on the TipRanks database, each these shares are rated as Sturdy Buys by the analyst consensus. Let’s see why.

Prime Drugs (PRME)

The primary Wooden-backed inventory we’ll take a look at matches Wooden’s innovation-focused investing fashion completely. Prime Drugs is a biotech firm working on the forefront of gene modifying. Based in 2019, the corporate’s progressive method facilities on its Prime Enhancing platform, a breakthrough know-how that enables for exact and versatile modifying of the human genome.

In contrast to conventional CRISPR strategies, which usually create double-strand breaks in DNA, Prime Enhancing makes use of a extra refined technique involving a ‘search-and-replace’ method to make particular alterations. This technique considerably reduces the danger of unintended mutations, enhancing the protection and effectiveness of genetic therapies.

Prime Drugs’s tech holds promise for treating a wide selection of genetic problems, probably offering cures for circumstances that at the moment have restricted or no remedy choices. The corporate’s improvement efforts span key strategic areas, together with hematology, liver, eye, neuromuscular, and lung, though a lot of the pipeline continues to be within the pre-clinical stage. One drug, nevertheless, is now advancing to the clinic.

In April, the FDA gave the go-ahead for the corporate’s IND (investigational new drug) utility for PM359, its Prime Editor indicated to deal with power granulomatous illness (CGD). That is the first-ever Prime Editor product candidate to get this far and Prime plans on initiating a Part 1/2 trial of the drug with an preliminary knowledge readout from the examine slated for 2025.

In the meantime, Wooden considerably bolstered Ark Make investments’s stake in PRME throughout Q1, buying 2.85 million shares. The agency’s complete holdings now stand at almost 5.99 million shares, at the moment price $45.13 million.

That can in all probability be thought-about a very good transfer by Chardan analyst Geulah Livshits, who additionally likes the look of what’s on provide right here.

“The platform nature of its tech means the corporate ought to be capable to transfer extra shortly for subsequent packages utilizing the identical manufacturing and supply tech,” defined the 5-star analyst. “Moreover, the present regulatory setting is very supportive of transformative therapies for uncommon ailments, with FDA officers repeatedly indicating a want to speed up the event of such therapies together with through higher engagement, use of surrogate endpoints and versatile trial designs. We consider this these components can allow Prime to realize sustained progress by advancing packages throughout and past its present pipeline.”

“With Prime on monitor to provoke IND-enabling actions for 1+ packages in its in vivo liver franchise and to appoint a DC in for RHO adRP in 2024, we consider the corporate is positioned for worth inflection because it transitions from creating a group of (fascinating) science initiatives to advancing a product pipeline,” Livshits went on to say.

Backside-line, Livshits charges PRME shares a Purchase, whereas her $17 value goal suggests the inventory has room for outsized progress of 140% over the approaching 12 months. (To observe Livshits’ monitor file, click on right here)

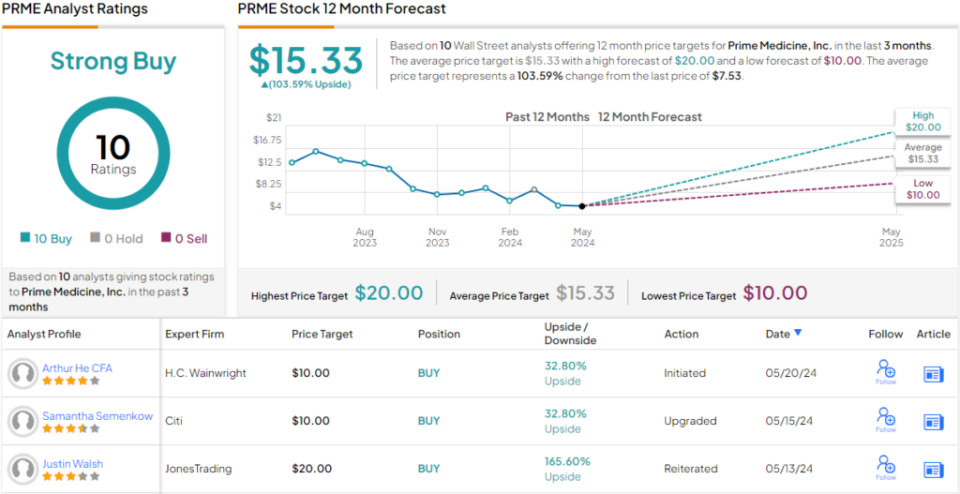

Livshits’ bullish tackle PRME is not any anomaly. All of the 9 different current analyst evaluations are optimistic, naturally making the consensus view right here a Sturdy Purchase. With a median goal of $15.33, traders might probably see returns of ~104% inside the subsequent 12 months. (See PRME inventory forecast)

AbSci (ABSI)

We’ll keep within the biotech area for Wooden’s subsequent decide. AbSci is an organization that makes use of the present market’s hottest pattern – it makes use of generative AI for drug improvement.

Describing itself as an AI drug creation firm, AbSci’s platform can produce high-affinity antibodies focusing on particular epitopes completely by laptop simulations. Reflecting their motto, “the information to coach, the AI to create, and the moist lab to validate,” AbSci can generate antibody drug candidates a lot sooner than conventional lab strategies. By streamlining what are historically laborious steps, AbSci goals to decrease prices and cut back the time-to-market for brand spanking new biologic medicine, thereby addressing crucial wants in healthcare.

This mentioned, the pipeline continues to be in its early levels. Amongst medicine being developed, the corporate is engaged on ABS-101, probably a best-in-class anti-TL1A antibody for which it initiated IND-enabling research in February. The corporate anticipates Part 1 scientific research for ABS-101 will kick off early subsequent 12 months with an interim knowledge readout slated for the second half of 2025. Moreover, proof-of-concept outcomes for novel immune-oncology drug candidate ABS-301 are anticipated round mid-2024.

As for Wooden’s involvement, her agency, Ark Make investments, initiated a brand new place in ABSI inventory throughout Q1, buying almost 3.28 million shares valued at $14.87 million.

The corporate additionally has a fan in Scotiabank’s George Farmer, who thinks traders ought to clock a chance whereas nonetheless in its infancy.

“We suggest shopping for ABSI shares to seize the worth potential of the corporate’s novel AI based mostly drug improvement technique and the early-stage biologics pipeline on which it’s based mostly,” Farmer famous. “Why? Preclinical outcomes to this point assist the aggressive benefit that lead asset ABS-101, an AI-optimized anti-TL1A therapeutic, might have over current brokers in scientific improvement for addressing the large inflammatory bowel illness (IBD) remedy market.”

To this finish, Farmer charges ABSI as an Outperform (i.e., Purchase), alongside a $13 value goal. The implication for traders? Upside of a good-looking 182% from present ranges. (To observe Farmer’s monitor file, click on right here)

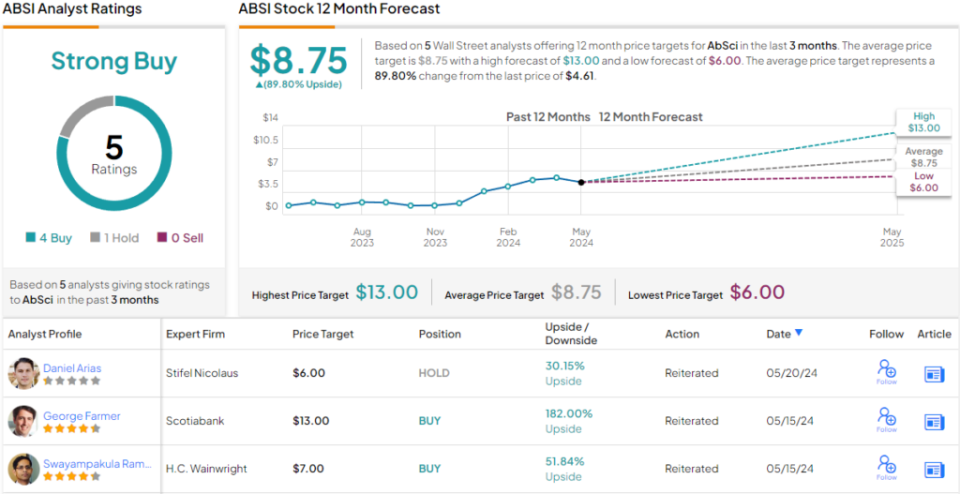

Most of Farmer’s colleagues agree together with his evaluation. Primarily based on a mixture of 4 Buys towards 1 Maintain, the inventory claims a Sturdy Purchase consensus ranking. The forecast requires one-year returns of ~90%, contemplating the common value goal stands at $8.75. (See ABSI inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Finest Shares to Purchase, a instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is vitally necessary to do your individual evaluation earlier than making any funding.