A podcaster just lately shared his expertise of assembly Charlie Munger and having dinner with the legendary investor and former vice chairman of Berkshire Hathaway (NYSE:BRK)(NYSE:BRK).

Here is essentially the most beneficial piece of recommendation and key takeaway from that encounter.

What Occurred: Munger and investing icon Warren Buffett had a long-standing friendship, which continues to affect the success of Berkshire Hathaway. With Munger’s current passing, his legacy and fervour for surrounding himself with distinctive individuals proceed to form the corporate. With out their likelihood assembly, Berkshire Hathaway might need taken a really completely different path.

Don’t Miss:

David Senra, the Founders Podcast host, reads an entrepreneur’s biography every week and breaks it down as an episode on the podcast.

For one of many current podcasts, Senra shared his ideas on the ebook “Tao of Charlie Munger: A Compilation of Quotes from Berkshire Hathaway’s Vice Chairman on Life, Enterprise, and the Pursuit of Wealth” by David Clark.

Within the podcast episode, Senra mixes quotes and ideas from the ebook with real-life solutions he obtained from a dinner he had with Munger.

Trending: How do billionaires pay much less in earnings tax than you? Tax deferring is their primary technique.

“I had dinner with Charlie Munger. I spent over 3 hours with him. I obtained to see his library. I may ask him any query I needed,” Senra tweeted.

Whereas Senra shared a number of quotes from Munger within the ebook and a few that he heard from Munger at dinner, he pointed to 1 that made the largest influence.

“A very powerful lesson I discovered from him that evening was: GO FOR GREAT.”

Senra stated the quote from Munger breaks right down to a mixture of 4 easy concepts:

-

1. Charlie appears at all the pieces via the lens of historical past. Human nature doesn’t change. The identical behaviors repeat eternally.

-

2. Issues infrequently must be anticipated. That is an inescapable a part of life.

-

3. Sensible individuals don’t whine about issues. They forestall them. “Knowledge is prevention.”

-

4. Nice companies are uncommon. Nice persons are uncommon, too. Nice individuals and nice companies produce fewer issues.

Additionally Learn: Are you wealthy? Right here’s what Individuals assume you’ll want to be thought-about rich.

Why It is Vital: Within the podcast, Senra provides {that a} massive portion of individuals’s lives is trying to find their objectives, and so they typically do not attain the place they’re meant to be till later of their life.

“Your mission in life is to get into a terrific enterprise (and keep there) and construct relationships with nice individuals. Doing that can forestall the vast majority of issues which might be underneath your management. Go for excellent,” Senra stated of Munger’s 4 steps.

The podcaster stated that most individuals have to start out multiple firm to achieve their objective, together with Munger.

“Munger was in his 40s earlier than he was doing full-time what he was placed on the Earth to do.”

Munger grew to become the Vice Chairman of Berkshire Hathaway in 1978 after which grew to become the right-hand man to Buffett. The place got here after a gathering between Buffett, Munger and two buddies that led to the 2 connecting over speaking about shares.

Trending: This Adobe-backed AI advertising startup went from a $5 to $85 million valuation working with manufacturers like L’Oréal, Hasbro, and Sweetgreen in simply three years – this is how there’s a chance to take a position at $1,000 for under $0.50/share in the present day.

Munger had coincidentally labored at Buffett & Son, a grocery retailer owned by Buffett’s grandfather, as an adolescent.

With Munger on board, Buffett modified a few of his investing rules, together with his issues about diversification. Munger was in a position to get Buffett to not restrict himself to Benjamin Graham’s teachings.

“Purchase great companies at truthful costs,” Munger informed Buffett.

The idea was to purchase companies that throw off masses of cash, after which use the money to spend money on and purchase different companies. With Munger serving to with investments, Buffett was satisfied to spend money on Coca-Cola (NYSE:KO), a call he might by no means have made with out Munger’s affect.

Going for excellent and surrounding himself with nice individuals helped Buffett and Berkshire Hathaway immensely, and is among the key items of recommendation he discovered from Munger alongside the way in which.

Learn Subsequent:

This story is a part of a brand new collection of options with regards to success, Benzinga Encourage.

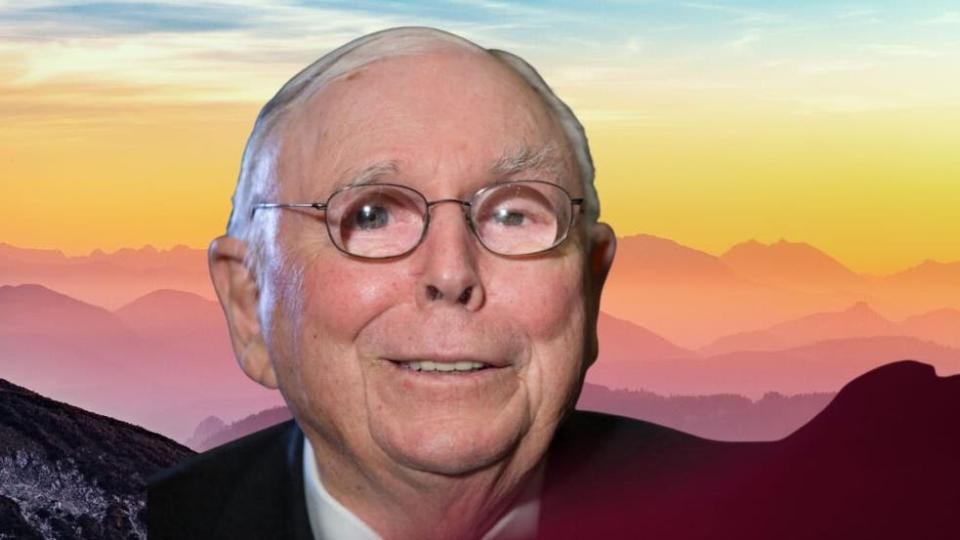

Picture created utilizing synthetic intelligence by way of Midjourney.

Up Subsequent: Remodel your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. Click on now to entry distinctive insights that may set you forward in in the present day’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text Charlie Munger’s Three-Phrase Rule That Guided Warren Buffett May Assist You Too initially appeared on Benzinga.com