(Bloomberg) — Chevron Corp. plans to purchase again $75 billion of shares and enhance dividend payouts after a 12 months of report earnings that evoked offended denunciations from politicians all over the world as hovering power costs squeezed shoppers.

Most Learn from Bloomberg

The inventory repurchase program will kick in April 1 and can be triple the dimensions of the earlier authorization unveiled in early 2019, the corporate stated in an announcement Wednesday. This system is equal to virtually one-fourth of the corporate’s market worth and 5 occasions the present degree of annual buybacks.

Though Chevron’s plan pales compared to the $89 billion that Apple Inc. allotted to repurchases previously 12 months, it’s prone to incense critics who’ve accused the oil business of battle profiteering after Russia’s invasion of Ukraine despatched power costs surging.

President Joe Biden was amongst those that lambasted oil explorers for devoting money to shareholder-friendly initiatives like dividends and buybacks as an alternative of plowing it into extra drilling that may swell crude provides. Chevron rose as a lot as 3.9% in after-hours buying and selling.

“For a corporation that claimed not too way back that it was ‘working exhausting’ to extend oil manufacturing, handing out $75 billion to executives and rich shareholders positive is an odd solution to present it,” Abdullah Hasan, a White Home spokesman, stated in an announcement on Wednesday night time. “We proceed to name on oil firms to make use of their report earnings to extend provide, and cut back prices for the American individuals.”

The corporate additionally can pay traders a $1.51-a-share dividend on March 10, a 6.3% enhance from the earlier quarter.

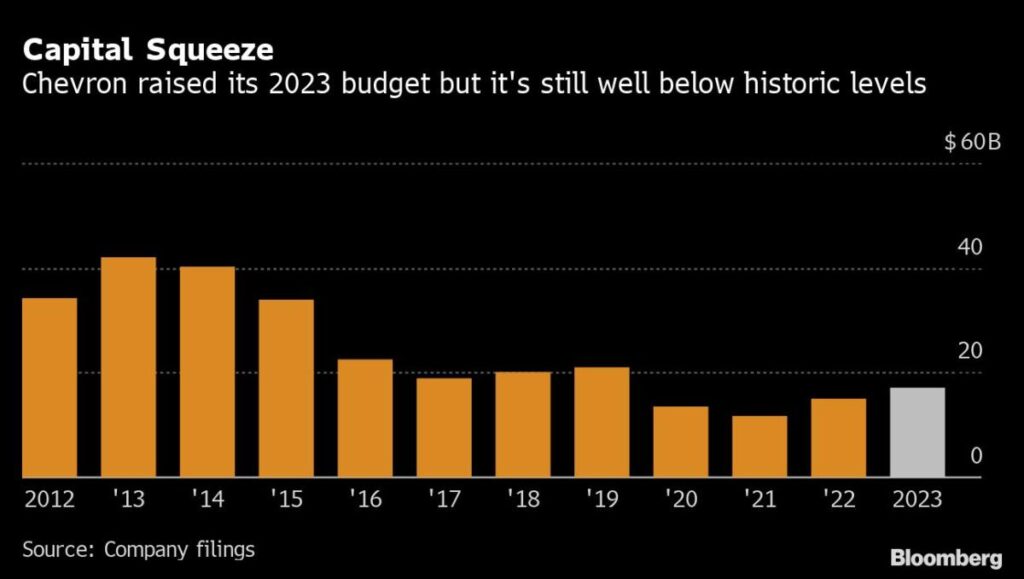

Though power costs have pulled again for the reason that early phases of Russia’s assault on Ukraine, analysts count on US oil firms’ earnings to remain robust as a result of they’ve saved capital spending in test, in contrast to in earlier increase cycles. As an alternative, the windfall has been used to pay again debt and enhance investor returns.

Chevron raised share buybacks a number of occasions final 12 months as oil costs rose, however Chief Monetary Officer Pierre Breber has pledged to keep up the repurchase price at the same time as commodity costs pull again. With net-debt ratios presently under the corporate’s goal vary, Chevron is keen to let borrowing ranges rise to maintain shopping for again shares if wanted, Breber stated final 12 months.

The corporate final 12 months introduced that capital spending for 2023 can be on the prime finish of its steering vary at $17 billion. Chevron is scheduled to report fourth-quarter outcomes on Jan. 27.

–With help from Tom Contiliano and Justin Sink.

(Updates with White Home response, in fifth paragraph.)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.