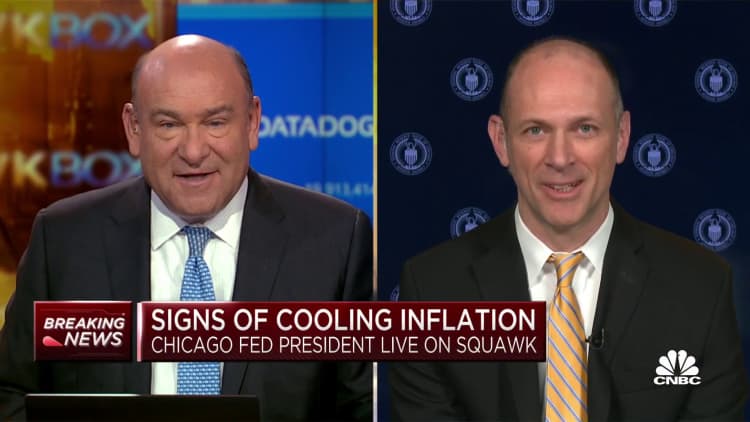

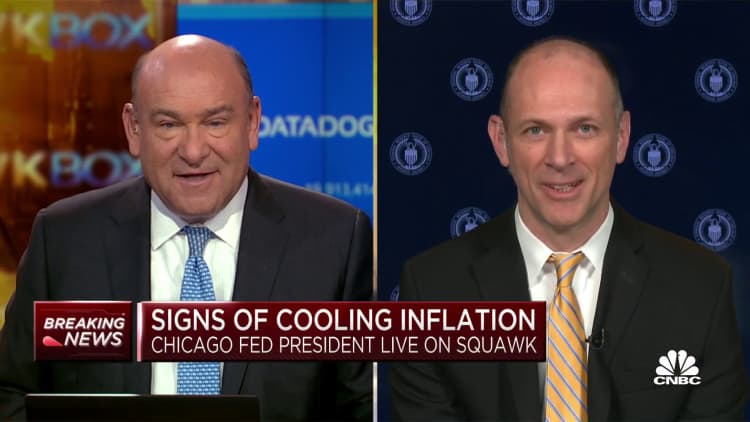

Austan Goolsbee

Kate Rooney | CNBC

The most recent batch of financial knowledge reveals constructive developments on the inflation entrance, however the Federal Reserve’s job is just not over but, Chicago Federal Reserve President Austan Goolsbee stated.

Goolsbee, who succeeded Charles Evans within the president position earlier this 12 months, is a member of the Federal Open Market Committee, which units the federal funds fee.

“While you see the producer costs coming in as large destructive numbers and also you see these negatives on retail gross sales, you do not need to overreact to short-run information, but it surely appears like that is shifting in the precise course,” he stated on CNBC’s “Squawk Field” Friday to Steve Liesman.

Information on superior retail gross sales launched Friday morning confirmed shopper spending slowed in March amid considerations associated to the financial institution disaster and potential for a recession. The info confirmed a 1% decline in March, which is a bigger fall than the 0.5% anticipated by economists polled by Dow Jones. March marked the most important month-over-month fall since November.

Excluding autos, retail gross sales fell 0.8% within the month,. That is additionally a bigger drop than the 0.4% analysts anticipated.

On Thursday, the March producer worth index, a measure of costs paid by corporations, declined 0.5% from the prior month, regardless of economists anticipating costs to remain the identical. Excluding meals and vitality, the index shed 0.1% from the prior month, whereas economists estimated a 0.2% month-to-month enhance.

Traders noticed that knowledge as constructing on the March shopper worth index report launched Wednesday. The CPI confirmed shopper costs have been up 5% from the identical month a 12 months in the past, the smallest year-over-year enhance seen in almost two years.

Nonetheless, he famous there’s “clear stickiness” in some areas of pricing. And with present financial circumstances, Goolsbee stated the U.S. may expertise a recession.

“There is not any means you’ll be able to take a look at present circumstances world wide and within the U.S. and never suppose that some delicate recession is unquestionably on the desk as a risk,” Goolsbee stated.

The info this week has bolstered hopes of these predicting the Fed may change course on its rate of interest hike marketing campaign. The central financial institution has raised rates of interest in a bid to chill inflationary pressures, however Goolsbee warned in opposition to following “lagging” indicators like wages.

“The one factor that I feel we’re spending an excessive amount of time is wage development as an indicator of costs,” Goolsbee stated. “There’s analysis out by two Chicago Fed researchers reflecting an extended custom of analysis that reveals wages don’t function a number one indicator for worth inflation. They are a lagging indicator.”

“So when individuals are what’s taking place to wages now, that is extra reflective of what occurred to costs six months in the past,” he added. “I feel we need to hold our eye on the value collection, not on the wage collection.”

Goolsbee stated that the stress within the monetary sector following the business disaster prompted by the closure of Silicon Valley Financial institution final month can assist do the work that financial coverage sometimes does. The potential for a credit score crunch also needs to be watched, he stated.