(Bloomberg) — Chinese language shares roared again from a rout and the yuan strengthened as hypothesis mounted that policymakers are making preparations to regularly exit the stringent Covid Zero coverage that’s been the most important bugbear for traders.

Most Learn from Bloomberg

A gauge of Chinese language shares listed in Hong Kong surged nearly 7% intraday, rebounding from its lowest shut since late 2005. Nonetheless, it pared features after Chinese language Overseas Ministry spokesman Zhao Lijian stated he’s “not conscious” of a authorities committee to evaluate methods to exit Covid Zero.

Shares jumped earlier as unverified social media posts circulated on-line {that a} committee was being fashioned to evaluate eventualities on tips on how to exit Covid Zero. The market had seen a heavy bout of promoting following the Communist Celebration congress, the place President Xi Jinping’s energy seize led to expectations that strict lockdowns and different market-unfriendly insurance policies will possible persist.

“I believe the market’s response reveals how a lot anticipation there was for the reopening out there,” stated Hao Hong, companion at Develop Funding Group.

The influence of the hypothesis was felt past China markets. US inventory index futures additionally prolonged features whereas a broader gauge of Asian equities climbed greater than 2%. Iron ore futures in Singapore rose, heading for the most important enhance in three weeks, whereas copper costs rebounded after three days of consecutive declines. Oil additionally gained amid a broader market rally.

The Cling Seng Tech Index jumped as a lot as 9.3% earlier than paring features to beneath 8%. The CSI 300 Index of onshore shares ended 3.6% larger, probably the most since march.

‘Not Shocked’

To make sure, markets have rallied on such reopening hypothesis up to now, solely to be left upset as China continued to pursue Covid Zero.

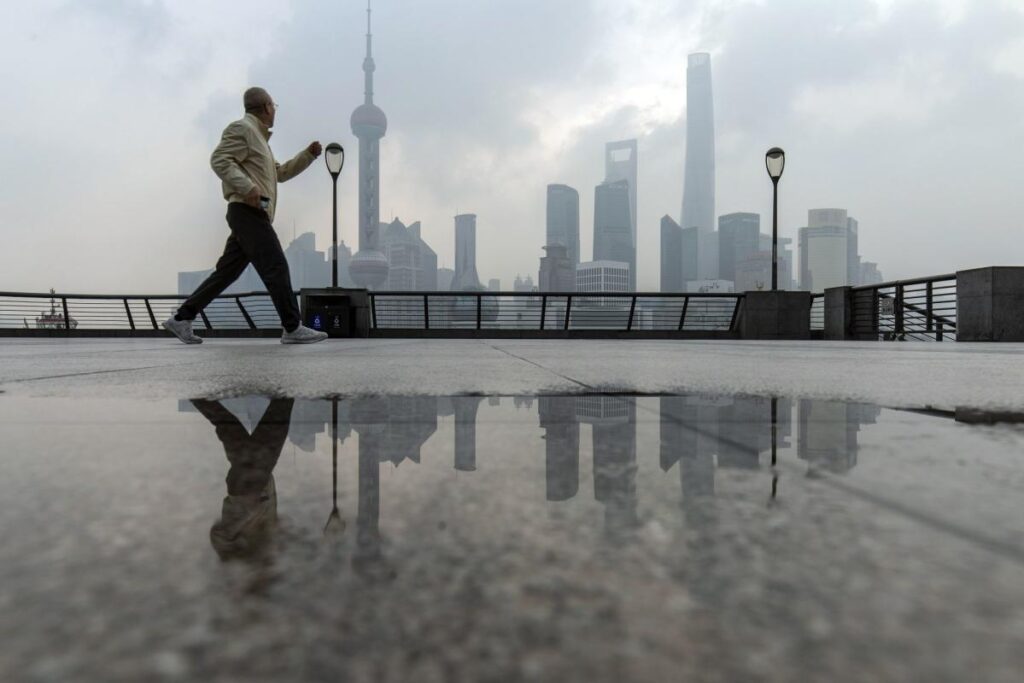

Authorities have ramped up lockdowns quietly for the reason that not too long ago concluded celebration congress, because the extremely transmissible omicron pressure continues to breach virus defenses. Financial powerhouses together with Shanghai, Zhengzhou and Guangzhou all have various ranges of restrictions in place, which have upended manufacturing and disrupted every day lives.

Nonetheless, there are debates on tips on how to positive tune the zero-tolerance strategy as social and financial prices rise and the general public and traders develop weary. Chinese language officers are mulling a minimize to journey quarantine to 2 days in a lodge and 5 days at dwelling, down from seven days in a lodge and three days at dwelling, Bloomberg Information has reported.

Dip consumers although have suffered repeated setbacks within the face of the relentless equities rout.

“I’m not shocked by the rumor circulating on-line a few conditional reopening,” stated Liu Xiaodong, a fund supervisor at Shanghai Energy Asset Administration Co. “The state council might be ready for the deliberation by the group of consultants to find out the following step. The market can also be keen to purchase that an inflection level is close to for Covid Zero.”

READ: China Ramps Up Lockdowns, Covid Restrictions Throughout Nation (1)

The onshore yuan rose as a lot as 0.7% earlier than paring features to 0.2%. It fell to a 15-year low earlier within the session. The yield on 10-year authorities bonds rose two foundation factors to 2.66%, ending 4 straight days of declines.

The newest rally comes as world monetary trade heavyweights collect in Hong Kong for a summit the place China’s Covid insurance policies are certain to be a subject of dialogue.

“Efforts to resuscitate consumption and appeal to international investments can’t be completed with out some type of re-opening,” stated Fiona Lim, senior international change strategist at Malayan Banking Bhd in Singapore. “Any affirmation by authorities to ease up on Covid-Zero would most likely strengthen yuan considerably.”

–With help from Jeanny Yu, Chester Yung, Wenjin Lv, Linda Lew, Jessica Zhou and April Ma.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.