(Bloomberg) — Grim milestones preserve piling up for Chinese language shares listed in Hong Kong.

Most Learn from Bloomberg

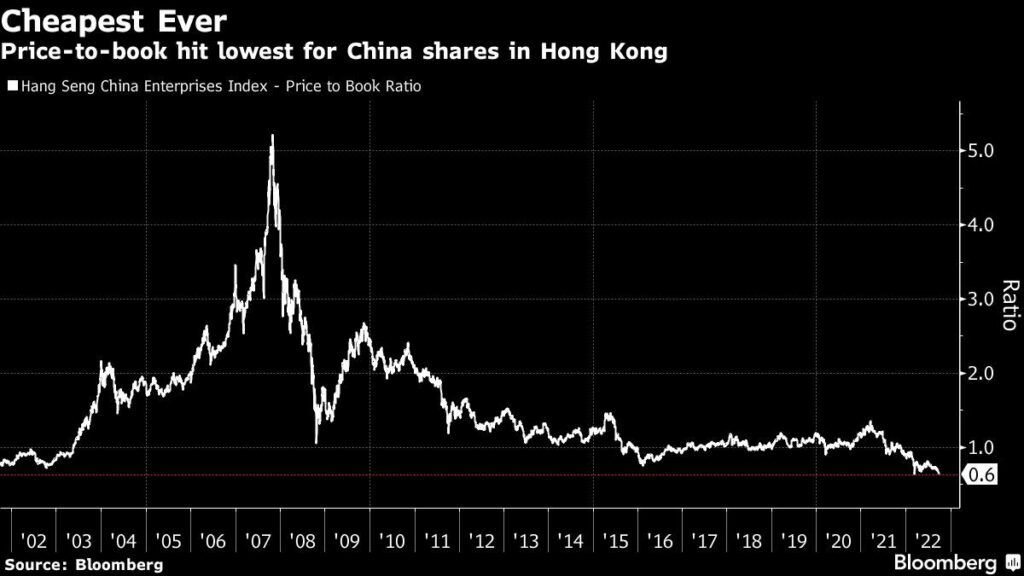

As September attracts to an finish, the Hold Seng China Enterprises Index has misplaced 14% to rank because the worst performer amongst main fairness benchmarks globally this month. Hovering across the lowest because the international monetary disaster, it’s now buying and selling at 0.6 occasions ebook worth, the most cost effective ever.

All however three shares are down the 12 months on the 50-member gauge, with property builders and tech corporations on the backside. China’s largest builder Nation Backyard Holdings Co. has misplaced virtually three quarters of its worth and video streaming agency Bilibili Inc. is down about two thirds.

Whereas the swoon is a part of a world rout as central banks all over the world step up charge hikes to tame inflation, Chinese language shares have been hit notably onerous because the Covid-Zero coverage took a toll on the nation’s economic system and as Sino-American tensions worsened over Taiwan and Russia.

Additionally, in contrast to the mainland, Hong Kong’s open capital market means international traders can pull their cash out anytime they need, making it inclined to greater swings amid macro headwinds.

READ: Issues Preserve Getting Worse for Hong Kong’s Embattled Inventory Market

Some traders are pinning their hopes on China’s twice-a-decade Communist Occasion Congress in mid-October, an occasion that has sometimes boosted the inventory market up to now. The nation has already been ramping up its help of the housing market forward of the occasion, though analysts say it’s not sufficient to show across the embattled business.

“For China, it’s nonetheless extra about whether or not Covid restrictions will ease up after the twentieth occasion congress and whether or not the economic system will see a restoration,” stated Kevin Li, fund supervisor at GF Asset Administration.

China’s manufacturing unit exercise continued to battle in September because the financial restoration was challenged by lockdowns. Demand from abroad for Chinese language items can be moderating: a gauge of recent export orders within the official PMI fell to 47, the bottom in 4 months.

Because the mainland goes on a weeklong Golden Week vacation, Hong Kong-listed shares will lose a giant group of patrons who’ve been loading up shares within the monetary hub on all however three days this month.

Till China relaxes its Covid-Zero coverage and reopens, “it’s troublesome to see what different issue might meaningfully support investor sentiment, particularly in Asia,” stated Christina Woon, funding director for Asia equities at abrdn plc.

READ: China Merchants See Property Increase, Covid Zero Resolve at Congress

(Updates with closing costs)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.