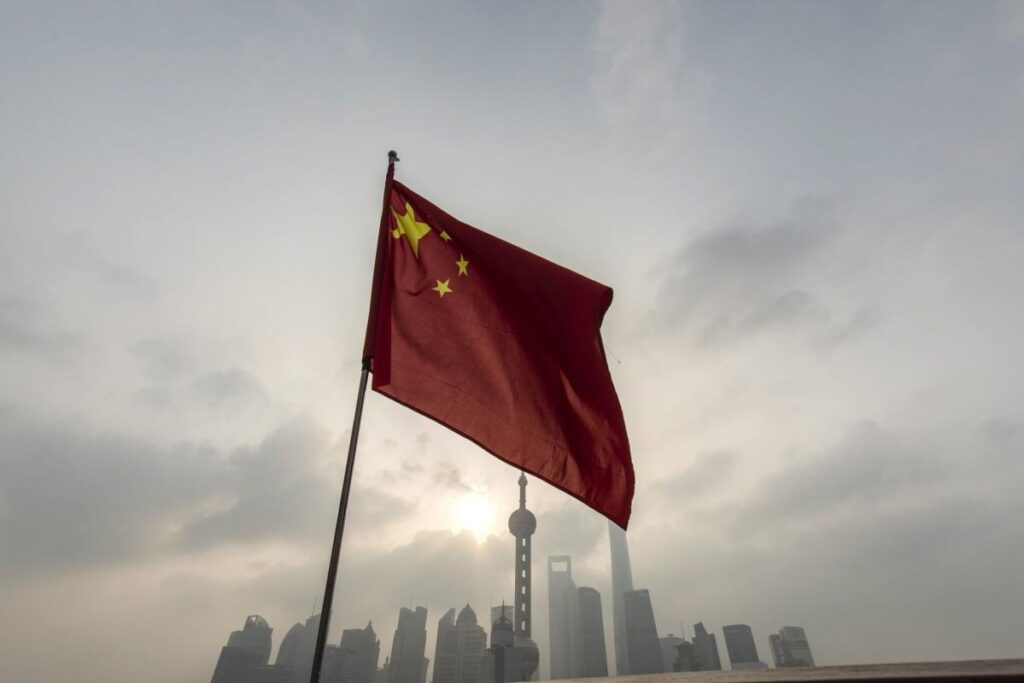

(Bloomberg) — Buying and selling desks throughout China have develop into inundated with unverified speak of a shift in Xi Jinping’s Covid Zero coverage, sparking an epic rally in shares and underscoring simply how determined traders have develop into for indicators that the nation’s $6 trillion market rout is ending.

Most Learn from Bloomberg

A number of display photographs purporting to point out the world’s second-largest economic system is transferring nearer to a reopening have been circulating on Twitter, WeChat and different social media platforms since late Monday.

Whereas none of them have been confirmed — and all outward indicators from Chinese language officialdom are that the Covid Zero coverage stays intact — traders have propelled the Grasp Seng China Enterprises Index to an 8.4% two-day acquire in Hong Kong, paring its slide since February 2021 to 56%. Buying and selling volumes have soared, and the Chinese language yuan has strengthened from a 15-year low towards the greenback.

“It’s all rumour, and there’s no method to both show the rumors true or false within the quick time period,” stated Du Kejun, associate at Beijing Gelei Asset Administration Heart Restricted Partnership. “On the finish of the day, it’s simply that persons are keen to purchase the selloff.”

Even by the requirements of a market infamous for rumor-fueled swings, this week’s frenzied strikes stand out — significantly towards a backdrop of continued lockdowns and virus flareups throughout China.

Learn: China Locks Down Space Round Foxconn’s ‘IPhone Metropolis’ Plant (1)

The market beneficial properties have been stoked by hope that Xi will relent on Covid Zero to rescue the ailing economic system after he solidified his grip on energy ultimately month’s Get together Congress. However probably the most highly effective Chinese language chief since Mao Zedong has given no public indication of a shift, and consultants have cautioned that the nation has made too little progress on vaccination to reopen with out a surge in deaths.

For traders anxious about lacking out on a rally when it does lastly come, the stakes are probably huge. When Chinese language shares surged from their lows within the wake of the 2008 world monetary disaster, the majority of the beneficial properties occurred through the span of some months, adopted by years of uneven buying and selling.

“It simply reveals that there’s a lot of pent up demand for Chinese language equities, which have been overwhelmed to demise within the final six months,” stated Manish Bhargava, fund supervisor at Straits Funding Holdings in Singapore. The market “might stage an enormous rally if Beijing does announce a gradual reopening,” he stated.

The Grasp Seng China Enterprises Index gained as a lot as 3.2% on Wednesday earlier than buying and selling in Hong Kong was halted because of an approaching tropical storm. Reopening shares together with vaccine makers, airways and on line casino shares led the advance, with CanSino Biologics Inc. rising 63% in Hong Kong.

Wild Swings

The market frenzy was first triggered by social media posts {that a} committee was being shaped to evaluate methods to exit Covid Zero. One other unconfirmed doc made the rounds on Wednesday, purporting to point out that China is predicted to carry a gathering on Friday to announce a slew of adjustments together with shortening necessary quarantine.

“It appears to me that persons are kind of selecting to consider what’s on the market,” stated Hao Hong, a associate at Develop Funding Group, who has circulated a few of the hypothesis on Twitter. “The market has been so oversold. Folks need to cowl their shorts, and those that don’t have positions would concern to overlook out the rally. And that’s why persons are taking part.”

Beijing’s stringent Covid restrictions have been the most important concern for traders, making the market delicate to the slightest indicators of a change within the coverage. Covid curbs and lockdowns have made China inventory measures a few of the world’s worst performers this yr.

Even with rising market hypothesis, China has proven little indicators of loosening its Covid restrictions. Authorities locked down an space the place Foxconn’s iPhone plant is situated on Wednesday afternoon. On Tuesday, Chinese language Overseas Ministry spokesman Zhao Lijian stated he’s “not conscious” of a committee to evaluate Covid Zero exit eventualities.

“Folks might have misunderstood once they see the headline that it’s about utterly opening up, however in our view it’s fairly unlikely for China to utterly abandon Zero Covid,” stated Zerlina Zeng, senior credit score analyst at CreditSights. “It’s politically delicate to dispose of it as a result of through the social gathering congress, the rhetoric round Zero Covid has been so robust.”

–With help from Ishika Mookerjee, Yuling Yang, Charlotte Yang, Wenjin Lv, Mengchen Lu and Lorretta Chen.

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.