(Bloomberg) — What do you do when China’s fast-moving markets provide buyers a style of the rebound they’ve been eager for? Purchase the nation’s beaten-down expertise shares.

Most Learn from Bloomberg

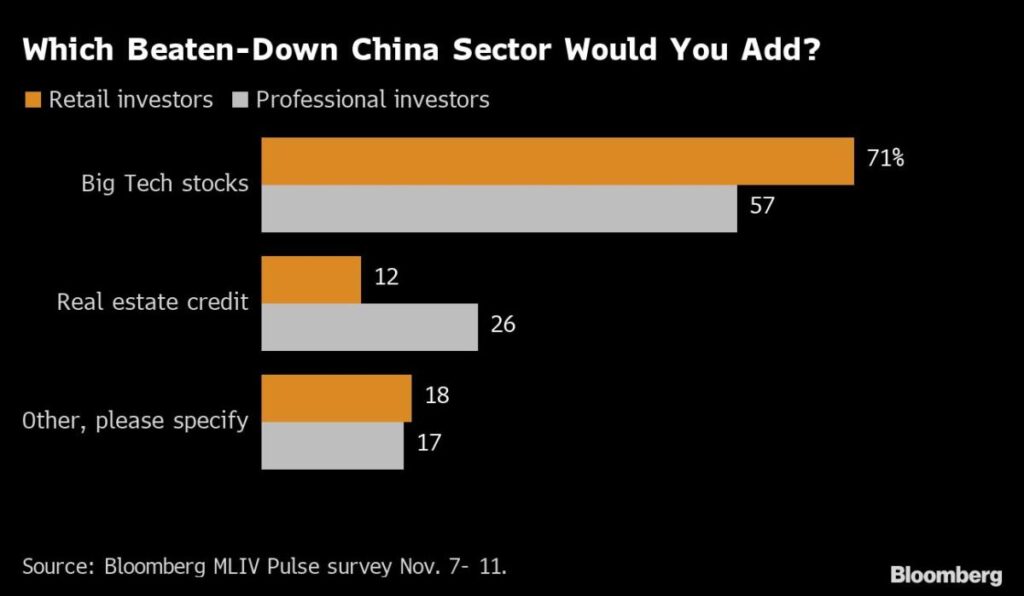

Huge Tech is the most-favored Chinese language sector by institutional and retail respondents within the newest MLIV Pulse survey, with 42% of 244 buyers additionally saying they plan to extend their publicity to the nation within the subsequent 12 months.

Chalk it as much as a concern of lacking out. The broader the hole between the share value and metrics akin to earnings and gross sales, the larger the potential for beneficial properties when excellent news lands, the logic goes. That’s taking part in out this month amid indicators that China could have began to pivot away from its Covid-Zero coverage, with widely-followed shares like Alibaba Group Holding Ltd. displaying intraday surges of 20%.

There’s loads of room for a rebound. The Cling Seng Tech Index and the Nasdaq Golden Dragon China Index of US-listed corporations are down about 70% since peaking in February 2021. That’s worse than any of the 92 benchmarks tracked by Bloomberg. In September alone, funds bought $33 billion of Chinese language tech shares, in line with a latest be aware by Morgan Stanley quants.

To be clear although, nothing basic has modified for the tech business. There’s little proof that President Xi Jinping will reverse his marketing campaign to rein within the nation’s tech giants, and efforts to stop the delisting of Chinese language shares from US exchanges are progressing slowly. Lockdowns in key cities like Guangzhou function a reminder that the dedication to get rid of Covid-19 continues to be stifling consumption and hammering the financial system.

However when Chinese language markets rally, they do it with gusto. Brief-covering and momentum-chasing have been the most important drivers of the nation’s equities over the previous three weeks, with mainland-based buyers additionally snapping up bargains in Hong Kong. That’s at the same time as huge names like Tiger World Administration throw within the towel on China and cut back their allocations.

On Monday, Chinese language shares and the yuan rose after the nation’s monetary regulators issued a 16-point directive to assist the property business — an indication authorities are severe about addressing a disaster that is been a key drag on markets and financial development.

It’s no shock that shares may be deemed low-cost. The Golden Dragon gauge trades at lower than 15 occasions its members’ projected earnings, a 34% low cost to its common of the previous 10 years. Buyers will get extra readability on the well being of company China within the coming weeks, with bellwethers like Alibaba, JD.com Inc. and Pinduoduo Inc. as a result of report outcomes.

Practically a half of market individuals who responded to the survey anticipate US-listed Chinese language shares to recoup a number of the losses by the tip of the 12 months. Fewer than a fifth of them noticed declines persevering with. Markets are underpricing a possible Covid Zero exit, in line with 48% of respondents. Some 46% stated markets are too enthusiastic a few reopening.

Beijing’s virus-containment coverage is seen as each the most important potential catalyst for beneficial properties and a high danger to Chinese language markets subsequent 12 months, underscoring how central it’s change into to the outlook. Goldman Sachs Group Inc. says reopening would set off a 20% achieve in Chinese language equities.

In a probably telling growth, China final week reduce quarantine for inbound vacationers and scrapped the so-called circuit breaker system that penalizes airways for bringing virus circumstances into the nation. The brand new Politburo Standing Committee not too long ago stated the nation wanted to stay with the Covid Zero coverage, however that officers additionally wanted to be extra focused with their restrictions.

Excessive rates of interest would be the foremost danger for worldwide monetary markets subsequent 12 months, in line with a majority of buyers, {followed} by a slowdown in China. A worldwide recession was additionally amongst issues cited by respondents.

MLIV Pulse is a weekly survey of readers of the Bloomberg Skilled Service and web site. The newest ballot was performed in Nov. 7-11.

For extra markets evaluation, see the MLIV Weblog. To subscribe and see earlier MLIV Pulse tales, click on right here.

–With help from Kasia Klimasinska.

(Updates with a TV clip underneath the fifth paragraph and Monday’s buying and selling in seventh.)

Most Learn from Bloomberg Businessweek

©2022 Bloomberg L.P.