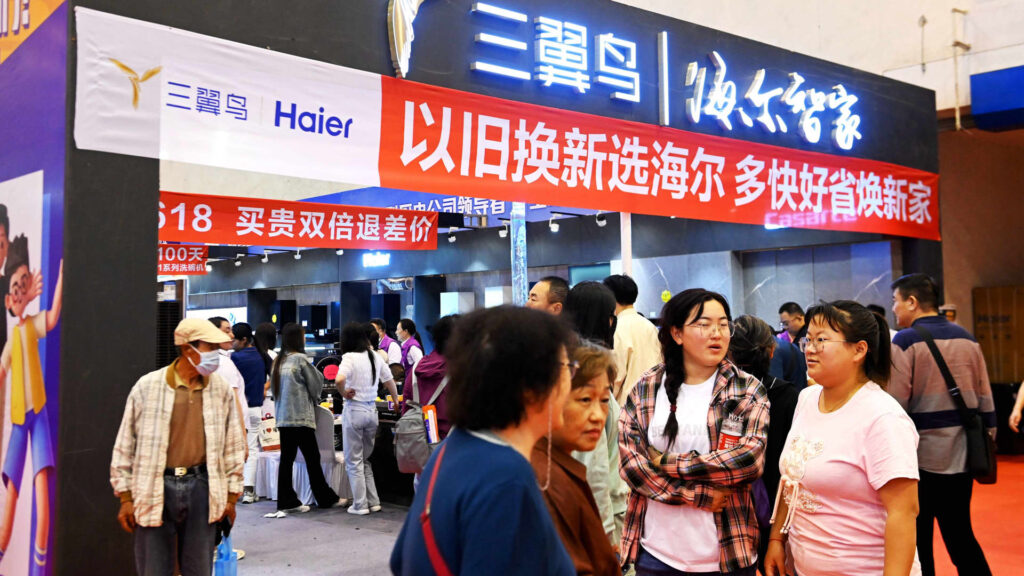

A banner performs up China’s trade-in coverage at a house items expo in Qingdao, Shandong province, China, on June 1, 2024.

Nurphoto | Nurphoto | Getty Pictures

BEIJING — China’s plan to spice up consumption by encouraging trade-ins has but to point out important outcomes, a number of companies informed CNBC.

China in July introduced allocation of 300 billion yuan ($41.5 billion) in ultra-long particular authorities bonds to broaden its current trade-in and tools improve coverage, in its bid to spice up consumption.

Half that quantity is aimed toward subsidizing trade-ins of vehicles, house home equipment and different bigger-ticket shopper items, whereas the remaining is for supporting upgrades of huge tools corresponding to elevators. Native governments can use the ultra-long authorities bonds to subsidize sure purchases by shoppers and companies.

Whereas the focused transfer to spice up consumption stunned analysts, the measures nonetheless require China’s cautious shopper to spend some cash up entrance and have a used product to commerce in.

“We aren’t conscious of corporations which have seen this translate, for the reason that promulgation of the measures, into concrete incentives on the bottom in China,” Jens Eskelund, president of the EU Chamber of Commerce in China, informed reporters earlier this week.

“Our encouragement can be that now we deal with execution [for] seen, measurable outcomes,” he mentioned.

The chamber’s evaluation discovered that the central authorities coverage’s complete budgeted quantity is about 210 yuan ($29.50) per capita. Provided that “solely a portion of [it] will attain family shoppers, it’s unlikely that this scheme alone will considerably enhance home consumption,” group mentioned in a report printed Wednesday.

Analysts usually are not overly optimistic concerning the extent to which the trade-in program may help retail gross sales.

UBS Funding Financial institution Chief China Economist Tao Wang mentioned in July that the brand new trade-in program may help the equal of about 0.3% of retail gross sales in 2023.

China’s retail gross sales for August are due Saturday morning. Retail gross sales in June rose by 2%, the slowest for the reason that Covid-19 pandemic, whereas July gross sales progress noticed a modest enchancment at 2.7%.

New power automobile gross sales, nonetheless, surged by practically 37% in July regardless of a drop in general passenger automobile gross sales, in line with business knowledge.

The trade-in coverage greater than doubled current subsidies for brand new power and conventional fuel-powered automobile purchases to twenty,000 yuan and 15,000 yuan per automobile, respectively.

Ready for elevator modernization

In March and April, China had already began to roll out coverage broadly supporting tools upgrades and shopper product trade-ins. Across the measures introduced in late July, officers famous 800,000 elevators in China had been used for greater than 15 years, and 170,000 of these had been in service for greater than 20 years.

Two main overseas elevator corporations informed CNBC in August that they had but to see particular new orders below the brand new program for tools upgrades.

“We’re nonetheless on the very early stage on this entire program proper now,” mentioned Sally Loh, president of China operations for U.S. elevator firm Otis. Companies know concerning the general financial quantity, she mentioned, however “as to how a lot is being allotted to elevators, this hasn’t actually been clarified.”

“We do see that positively there’s plenty of curiosity by the native authorities to verify this type of funding from the central authorities is being successfully deployed to the residential buildings that almost all want this substitute,” she mentioned, noting the introduced funding “actually helps to resolve a few of the financing points that we noticed had been a giant concern for our prospects.”

Otis’ new tools gross sales fell by double digits in China throughout the second quarter, in line with an earnings launch. It didn’t get away income by area.

Finnish elevator Kone mentioned its Larger China income fell by greater than 15% within the first six months of 2024 yr on yr to 1.28 billion euros ($1.41 billion), dragged down by the property stoop. That was nonetheless greater than 20% of Kone’s complete income within the first half.

“Positively we’re excited concerning the alternative. We have been enthusiastic about it for a very long time,” mentioned Ilkka Hara, CFO of Kone. “That is extra of a catalyst that can allow many to make the selection.”

“I positively see alternative sooner or later,” he mentioned. “How rapidly it materializes, that is arduous to say.”

Hara identified that new elevators can save extra power versus older fashions, and mentioned Kone plans to develop its elevator service enterprise along with unit gross sales.

Secondhand market outlook

Central authorities insurance policies can take time to get carried out regionally. A number of main cities and provinces have solely in the previous couple of weeks introduced particulars on how the trade-in program would work for residents.

For ATRenew, which operates shops for processing secondhand items, the ultra-long authorities bonds program to help trade-ins doesn’t have a short-term influence, mentioned Rex Chen, the corporate’s CFO.

However he informed CNBC the coverage helps the longer-term growth of the secondhand items market, and he hopes there will likely be extra authorities help for constructing trade-in kiosks in neighborhood communities.

ATRenew focuses on pricing and resale of chosen secondhand merchandise — the corporate claims it turned Apple’s in mainland China trade-in associate final yr.

In particular classes and areas — corresponding to cell phones and laptops in components of Guangdong province — trade-in quantity did rise this summer time, Chen mentioned.

Commerce-in orders coming from e-commerce platform JD.com have risen by greater than 50% yr on yr for the reason that new coverage was launched, in line with ATRenew, which didn’t specify the time-frame.

— CNBC’s Sonia Heng contributed to this report.

Correction: This story has been up to date to replicate that ATRenew is Apple’s trade-in associate in mainland China.