Chipotle Mexican Grill (NYSE: CMG) is doing one thing it is by no means executed earlier than in its 30-year historical past. The corporate is splitting its inventory, with the operation scheduled for this week. The choice got here after the shares soared within the triple digits over the previous few years, reaching past $2,000 final 12 months and previous $3,000 this 12 months.

The explanation for such monumental good points? This fast-casual restaurant has reported quarter after quarter of development — even excelling throughout early pandemic days because of its digital ordering system — and has constructed a model that retains prospects coming again. Now, the inventory cut up will carry the per-share value of this high-flying inventory down, making it extra accessible for a broad vary of buyers.

Let’s check out what to anticipate — and contemplate whether or not this restaurant large is a purchase.

Why launch a inventory cut up?

First, a number of factors about inventory splits usually. These operations contain issuing extra shares to present shareholders to decrease the value of every particular person share. They’re purely mechanical and do not change an organization’s market worth, the worth of your holding, or the valuation of the inventory. This implies they do not function a catalyst for inventory efficiency — buyers will not rush out to purchase a inventory simply because it is introduced a inventory cut up.

That mentioned, a inventory cut up is usually optimistic for an organization over time as a result of it makes it attainable for buyers who wish to make a small buy to take action with out counting on fractional shares. And these operations additionally recommend an organization is optimistic about its future, with the concept that the inventory, from its new stage, can as soon as once more take off.

The brand new share value is decided by the ratio of the cut up, and this brings me to the topic of the Chipotle operation. In one of many greatest inventory splits in New York Inventory Change historical past, Chipotle will provide present holders 49 shares for each one share they personal. Shareholders will obtain the shares after the June 25 market shut, and the inventory will start buying and selling on a split-adjusted foundation as of the market open on June 26.

Contemplating Chipotle’s value at this time — about $3,214 — the value following this 50-for-1 inventory cut up will likely be about $64.

Although the document day to learn from the cut up was on June 18, in the event you purchase the inventory previous to the cut up’s completion, don’t fret — the appropriate to the additional shares transfers from the vendor to you whenever you make the acquisition.

Chipotle’s earnings development

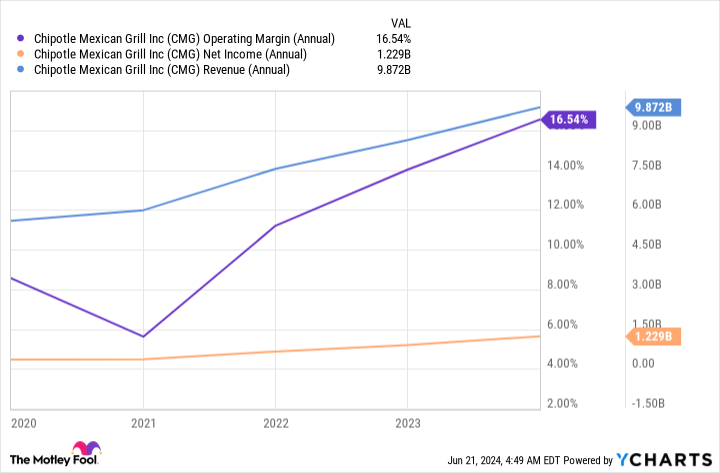

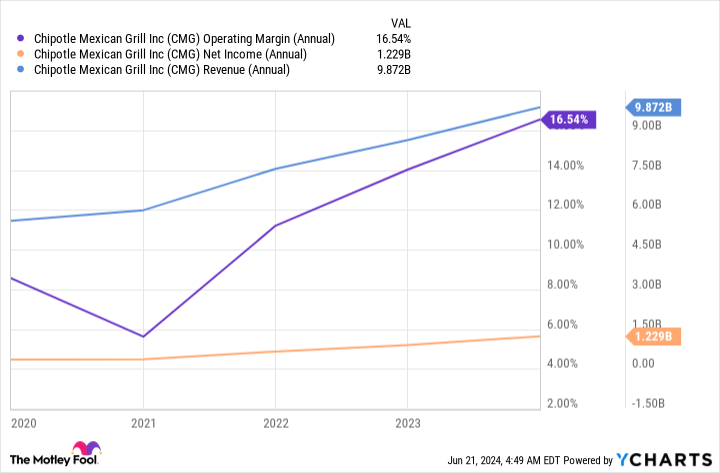

So, by midweek, Chipotle’s per-share value will make the inventory a neater purchase, however in any other case, the funding alternative will stay the identical because it was previous to the inventory cut up. Now let’s contemplate if this high restaurant inventory is a purchase. Nobody can say Chipotle hasn’t been profitable in the case of rising earnings and widening margins — over time, the corporate has executed this effectively.

CMG Working Margin (Annual) knowledge by YCharts

And it is executed all of this whereas increasing. Final 12 months, Chipotle opened 271 new eating places, and greater than 85% of them are geared up with a digital order pickup window referred to as a Chipotlane. This retains the corporate on observe to achieve its long-term objective of seven,000 eating places in North America, greater than double at this time’s quantity. Chipotle additionally goals to achieve $4 million in common unit volumes (AUV), or the typical gross sales every location generates, up from about $3 million presently.

In the meantime, Chipotle prospects preserve returning because of the restaurant’s promise of contemporary and wholesome merchandise and its centered menu. This helped the corporate report double-digit income development to $2.7 billion in the latest quarter, and good points in earnings per share and working margin.

The valuation downside

All of this sounds implausible, however the one downside with Chipotle is its valuation. The corporate trades for 57x ahead earnings estimates, effectively surpassing valuations of McDonald’s and Yum! Manufacturers. They commerce for about 20x. I’d count on Chipotle to commerce at a premium to those fast-food giants — however not by such an ideal diploma.

So, is that this inventory cut up inventory a purchase? This depends upon your funding model. Chipotle’s enterprise has confirmed its energy over time, and the corporate has room for growth in North America and even internationally. This might increase earnings effectively into the long run.

For long-term buyers favoring development, Chipotle inventory nonetheless may ship strong returns, so you might take into consideration opening a small place within the restaurant large to diversify your portfolio — the post-split value affords you the power to do that extra simply. However, contemplating the inventory’s steep valuation, worth buyers might discover tastier alternatives elsewhere.

Must you make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Chipotle Mexican Grill wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Adria Cimino has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.

Chipotle’s Inventory Break up Occurs This Week. Here is What to Count on. was initially printed by The Motley Idiot