Pedestrians stroll handed signage at Cigna headquarters in Bloomfield, Connecticut.

Michael Nagle | Bloomberg | Getty Photographs

Try the businesses making the largest strikes premarket:

Cigna — Cigna gained 3% in premarket buying and selling after beating top- and bottom-line estimates for its newest quarter and elevating its full-year forecast. Cigna’s outcomes obtained a lift from decrease medical prices and robust progress at its medical insurance unit.

associated investing information

Warner Bros. Discovery — The media firm fell 2.3% within the premarket after it reported a quarterly loss, and its adjusted earnings fell barely in need of expectations. Nevertheless, its streaming enterprise did flip round earlier losses and reported a quarterly revenue.

DraftKings — The sports activities betting firm’s inventory surged 11.6% within the premarket after DraftKings reported considerably increased than anticipated income for its newest quarter and growing its full-year outlook.

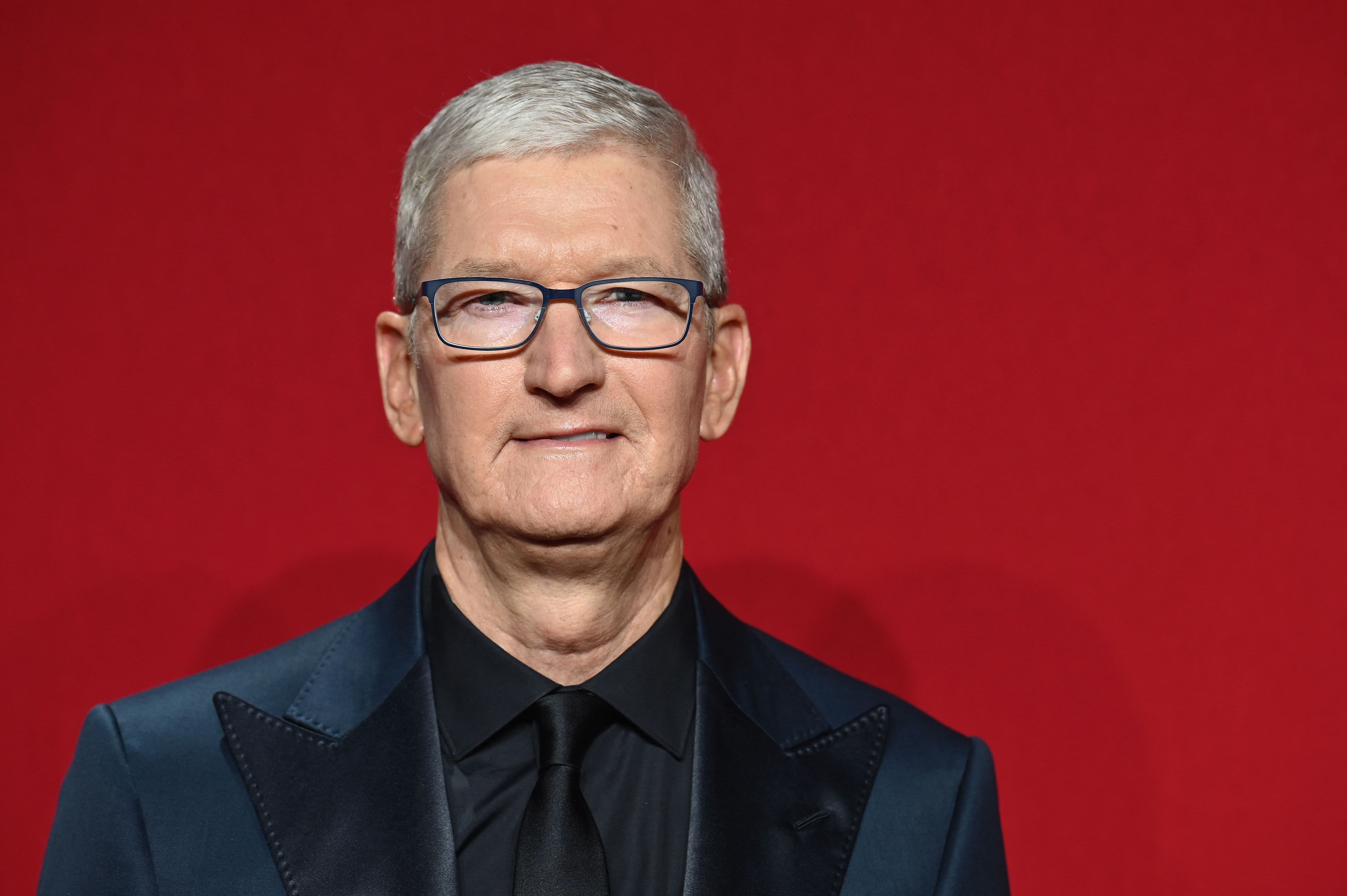

Apple — Apple rose 2.7% in premarket buying and selling after beating quarterly earnings and income estimates, with significantly upbeat outcomes for its flagship iPhone. Apple did, nonetheless, submit its second consecutive quarter of declining income for under the third time previously decade.

Bumble — Bumble posted increased than anticipated quarterly gross sales, as consumer demand for its courting app remained sturdy. The inventory jumped 9.1% in premarket motion.

Reserving Holdings — Reserving’s shares fell 3% after the journey companies firm reported quarterly revenue and gross sales that beat analyst estimates amid sturdy journey demand, however its adjusted earnings did fall in need of analyst forecasts. Reserving inventory was additionally buying and selling close to all-time highs previous to the report.

Expedia — Expedia rallied 5.6% following its quarterly outcomes, although the journey web site operator reported a bigger than anticipated loss. Expedia did see its highest-ever first quarter income, along with a 20% leap in gross bookings.

DoorDash — DoorDash posted a premarket achieve of 4% following a smaller than anticipated loss for the meals supply service, in addition to quarterly income that beat analyst forecasts. DoorDash additionally raised its full-year steerage, as demand for its companies stays sturdy.

Lyft — Lyft shares plunged 15.4% in off-hours buying and selling because the ride-hailing service issued a weaker than anticipated forecast for the present quarter. The inventory slide comes regardless of higher than anticipated quarterly outcomes.

Coinbase — Coinbase posted higher than anticipated quarterly outcomes, resulting in a 8.1% premarket rally for the cryptocurrency change’s inventory. The achieve comes regardless of a warning from the corporate of upcoming strain on its subscription and companies income.