(Bloomberg) — Ken Griffin’s Citadel churned out a document $16 billion in revenue for purchasers final 12 months, outperforming the remainder of the business and one among historical past’s most profitable monetary performs.

Most Learn from Bloomberg

The highest 20 hedge fund corporations collectively generated $22.4 billion in revenue after charges, in line with estimates by LCH Investments, a fund of hedge funds. Citadel’s achieve was the biggest annual return for a hedge fund supervisor, surpassing the $15 billion that John Paulson generated in 2007 on his wager towards subprime mortgages. This was described because the “biggest commerce ever” in a subsequent e book of the identical title by Gregory Zuckerman.

However it’s a distinct story outdoors the business giants, with hedge funds total dropping $208 billion final 12 months as many managers discovered themselves on the incorrect aspect of world market turmoil. LCH estimated a return of three.4% on the high 20 managers — whereas the remainder of funds it studied suffered losses of 8.2%.

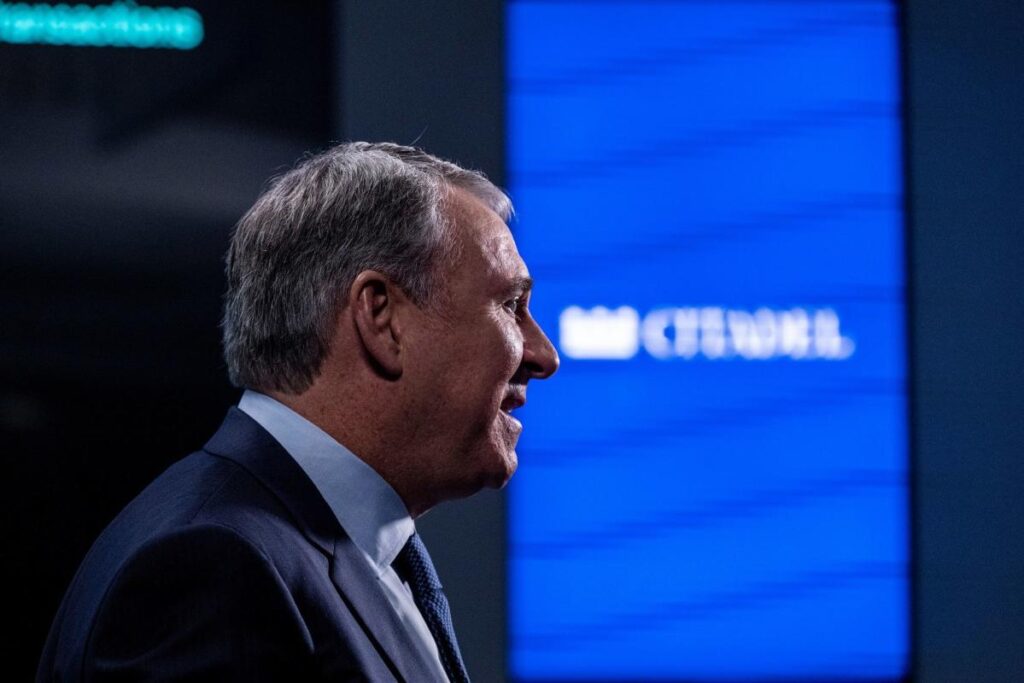

“The biggest features have been as soon as once more made by the big multistrategy hedge funds like Citadel, DE Shaw and Millennium,” LCH Chairman Rick Sopher stated in a press release. “The sturdy features they’ve generated in recent times replicate their rising dominance in methods which don’t rely on rising asset costs, and their substantial dimension.”

LCH’s annual rating is only one manner to have a look at the efficiency of hedge funds, the place managers are sometimes measured by their total features since inception. The rating, which was first printed in 2010, might exclude newer or smaller hedge funds that outperformed on a share foundation.

The findings additionally replicate the rising clout of multistrategy hedge fund corporations, that are on the cusp of taking up equity-focused funds to grow to be the dominant technique within the business. Their rising belongings and better charges are serving to them win an costly battle to rent and retain high merchants.

LCH estimated that the business has produced features in extra of $1.4 trillion for purchasers since inception. The highest 20 managers, which oversaw virtually 19% of the business belongings, produced $692 billion of that revenue, or 49% of the overall.

Supply: LCH Investments

Positive aspects are in billions of {dollars}. *denotes features frozen when all outdoors capital returned

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.