March 22 (Reuters) – Citigroup Inc (C.N) CEO Jane Fraser on Wednesday expressed confidence in U.S. banks after a sequence of closures rattled buyers and fueled turmoil in international monetary markets.

“The banking system is fairly sound,” and huge and regional banks are well-capitalized, Fraser instructed the Financial Membership of Washington D.C. on Wednesday.

“This isn’t a credit score disaster. It is a state of affairs the place it is a couple of banks which have some issues, and it is higher to be sure that we nip that within the bud,” she stated.

Prior to now two weeks, two U.S. banks collapsed, Credit score Suisse Group AG (CSGN.S) was taken over by Swiss rival UBS Group AG (UBSG.S) and America’s greatest lenders agreed to deposit $30 billion in beleaguered First Republic Financial institution (FRC.N). Fraser’s public feedback had been among the many first by a big financial institution CEO because the tumult started.

Citi, the fourth-largest U.S. lender, was considered one of 11 main banks that threw a lifeline to First Republic final week in an effort to assist it purchase time for restructuring.

Whereas Citi isn’t enthusiastic about shopping for First Republic, Fraser stated, it contributed $5 billion to the lender as a mark of confidence – and expects to be paid again.

The transfer to shore up First Republic was an unprecedented present of unity amongst banking behemoths which can be usually fierce rivals, she stated.

“We normally try to kill one another in numerous offers that we’re attempting to do,” Fraser stated. “However on this occasion, that is one the place we’re in a robust place, we wish to cease what might have been an issue.”

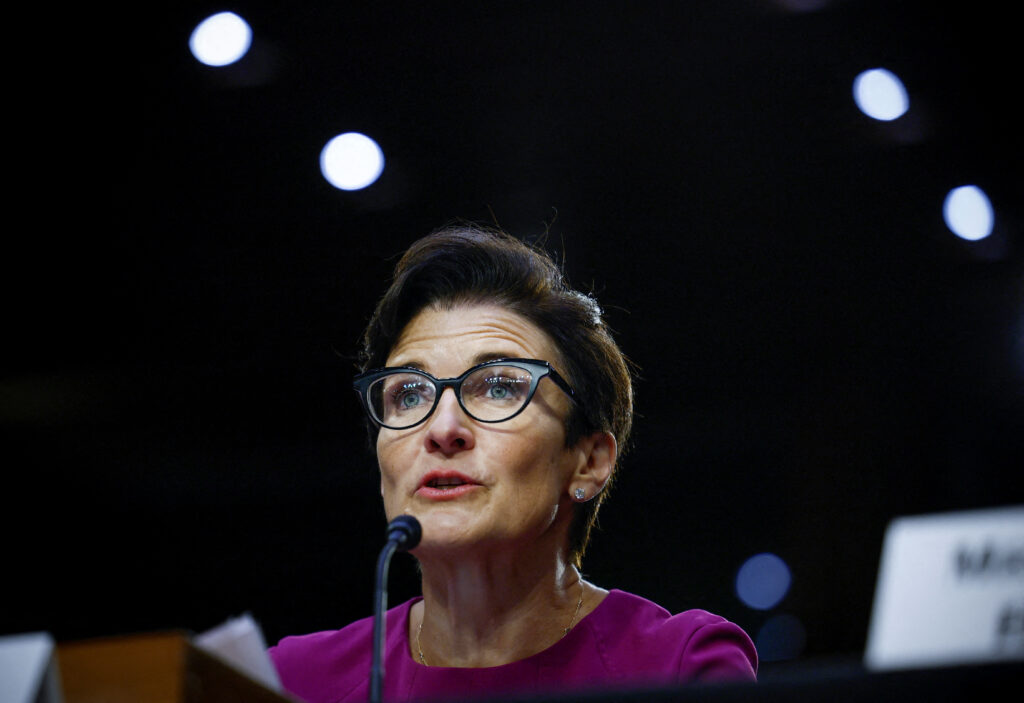

[1/2] Citigroup CEO Jane Fraser testifies earlier than a Senate Banking, Housing, and City Affairs listening to on “Annual Oversight of the Nation’s Largest Banks”, on Capitol Hill in Washington, U.S., September 22, 2022. REUTERS/Evelyn Hockstein

The rescue efforts did not cease a 15% plunge in First Republic’s shares on Wednesday.

Elsewhere, the takeover of one other ailing lender, Credit score Suisse, by rival UBS on Sunday was not stunning, Fraser stated.

“I do not assume anybody was falling off their chair that Credit score Suisse in the end ended up the place it did, it was actually a query of time,” Fraser stated. “It has been a troubled establishment for a very long time,” she stated, citing administration instability and varied crises.

Scottish-born Fraser additionally spoke about her life and profession in a wide-ranging interview with Carlyle Group Inc (CG.O) Co-Founder David Rubenstein. A journey buff with two college-age youngsters, she is the primary girl to steer a significant Wall Avenue financial institution.

As an solely little one born to an accountant father, Fraser labored as a golf caddy in her youth earlier than attending Cambridge College and Harvard Enterprise College. Fraser began her profession at Goldman Sachs Group Inc, then turned a associate at McKinsey & Co and held a number of govt roles at Citi earlier than taking the helm two years in the past.

Fraser praised the short motion taken by U.S. regulators to cease the financial institution runs that toppled Silicon Valley Financial institution and Signature Financial institution earlier this month from spreading extra broadly.

The Treasury, the Federal Reserve and the Federal Deposit Insurance coverage Company invoked “systemic threat exceptions” that allowed them to ensure billions of {dollars} of uninsured buyer cash.

“It is essential to guard depositors,” Fraser stated. “The banking system in all places around the globe is determined by confidence, and that confidence must be within the security and safety of deposits,” she stated.

Reporting by Lananh Nguyen and Saeed Azhar; Modifying by Sonali Paul and Stephen Coates

: .