The sky just isn’t clearing up for Carvana.

Quite the opposite, large clouds proceed to collect over the corporate which was one of many large winners of the covid-19 pandemic, with a large development.

Since saying its quarterly outcomes on Nov. 3, Carvana (CVNA) – Get Free Report shares have misplaced 44% of their worth and are at the moment buying and selling at $8.06 versus $14.35 on that day. This interprets right into a decline in market capitalization of roughly $1.1 billion in two weeks. Carvana at the moment has a market worth of $1.43 billion.

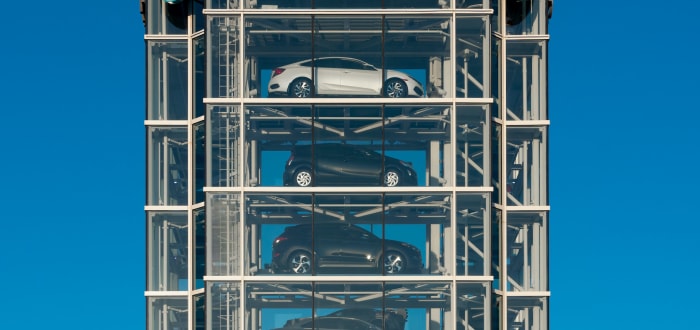

The corporate, based in 2012 and primarily based in Arizona, took benefit of favorable situations to market its new manner of shopping for a automobile. The group’s automobile merchandising machines caught nicely with the pandemic, a interval throughout which shoppers wished to keep away from contact as a lot as attainable, to restrict their publicity to the virus.

The federal authorities had additionally flooded shoppers with cash through stimulus applications. Rates of interest had been nearly zero, which meant that financing the acquisition of a automobile price virtually nothing.

Added to this, the availability chains of automobile producers had been disrupted, which made the manufacturing of recent autos tough. Confronted with these challenges, shoppers turned to the second-hand market because the ready instances for brand spanking new autos had been lengthy. Used automobile costs subsequently jumped, making it an excellent deal for Carvana.

Mainly, all of the winds had been blowing in the precise course for the corporate.

New Automotive or Used Automotive?

However popping out of the pandemic, Carvana’s fortunes appear to have turned fully. The used automobile market stays scorching. However all the opposite elements have reversed. There isn’t any extra stimulus cash. The central financial institution is aggressively elevating rates of interest and inflation is at its highest in 40 years. The financial system can be near a recession greater than ever, and the waves of job cuts comply with each other. Used automobile costs stay excessive however financing the transaction has turn into very costly for shoppers. Provide chains have improved considerably, facilitating the manufacturing of recent autos.

This was felt within the newest quarterly outcomes from Carvana: Within the third quarter, Carvana’s income fell 2.7% year-on-year to $3.4 billion, whereas web loss jumped to $283 million from simply $32 million within the third quarter of 2021, the corporate stated in a letter to shareholders.

Used automobile gross sales within the U.S. fell nearly 13% year-on-year, within the third quarter of 2022.

“In case you’re taking a look at newer used vehicles — fashions within the 1 to 3-year-old vary, you might discover that costs are nonetheless comparatively near what they bought for brand spanking new,” Shopper Stories stated. “If it’s important to borrow cash to purchase the automobile, it could be higher to discover a new automobile that may qualify you for a decrease rate of interest, to say nothing of the good thing about a contemporary manufacturing unit guarantee. Many producers subsidize financing and will supply rates of interest which might be a lot decrease than regular to certified consumers.”

All this complicates the affairs of Carvana, which had to enter $3.3 billion of debt to finance the acquisition of auctioneer Adesa’s bodily public sale enterprise this 12 months.

Elimination of 1,500 Further Jobs

The group is subsequently below monumental monetary strain.

“Vital nearer-term operational and monetary dangers for Carvana have emerged and are more likely to cloud the CVNA funding story for the foreseeable future,” Oppenheimer analyst Brian Nagel stated in a notice on Nov. 15, downgrading the inventory.

He added that “we don’t envision buyers bidding CVNA meaningfully greater till prospects for a manageable and sustained capital base turn into clearer.”

Nagel appears to verify that Carvana has a liquidity drawback which the group should deal with pretty rapidly if it needs to cease the collapse. The corporate has between $6 billion and $7 billion in debt web of the money on the steadiness sheet, in accordance with FactSet.

However Carvana just isn’t worthwhile: its adjusted EBITDA margin loss elevated by 6.2% within the third quarter. EBITDA refers to earnings earlier than curiosity, taxes, depreciation and amortization, which helps buyers to gauge the monetary well being of an organization.

The corporate is struggling to attempt to change issues and delay as a lot as attainable elevating fairness capital or including extra debt. Carvana, for instance, is decided to drastically scale back prices. After chopping 2,500 jobs in Might, the corporate has simply introduced an extra wave of layoffs which impacts 8% of its workforce, or 1,500 staff.

“It’s truthful to ask why that is occurring once more, and but I’m not certain I can reply it as clearly as you deserve,” Chief Government Officer Ernie Garcia instructed staff in an e-mail on Nov. 18. “I believe there are at the least a few elements. The primary is that the financial surroundings continues to face robust headwinds and the close to future is unsure. That is very true for fast-growing corporations and for companies that promote costly, typically financed merchandise the place the acquisition determination will be simply delayed like vehicles.”

As well as, “we didn’t precisely predict how this may all play out and the influence it will have on our enterprise. Because of this, we discover ourselves right here.”

The brand new cuts will have an effect on “many company and know-how groups in addition to some operations groups the place we’re eliminating roles, places or shifts to match our dimension with the present surroundings,” Garcia wrote.

Reached by TheStreet, Carvana did not remark.

Authorized Points

The brand new job cuts come after scores company S&P International Rankings warned it was more likely to downgrade Carvana within the close to time period, altering the outlook from steady to damaging.

“GPU [gross profit per unit] is anticipated to stay weak attributable to greater used automobile depreciation charges and decrease returns from promoting loans and different merchandise,” stated the ranking company. “Carvana generates over 50% of its GPU from promoting loans and different merchandise. With rising rates of interest, it’s harder for Carvana to compete with the massive banks that may preserve mortgage charges low, which is able to scale back the variety of loans allotted to Carvana.”

Garcia dominated out the choice of elevating capital on Nov. 3.

“Our targets are going to be on driving down bills and attempting to get optimistic EBITDA as rapidly as we are able to,” he instructed analysts. “We have got a bunch of dedicated liquidity. We have got a bunch of actual property. And I believe that we really feel like that places us in an excellent place to experience out this storm. And we’re making nice strikes inside the corporate.”

However other than these monetary difficulties, Carvana additionally faces authorized challenges. The corporate is dealing with lawsuits from clients in a number of states involving alleged points over titles and registration and over buying autos.

Michigan Secretary of State Jocelyn Benson additionally suspended the retailer’s license, with Carvana suing in return.

Carvana has stated the lawsuits are with out advantage and referred to as the choice in Michigan “arbitrary.”