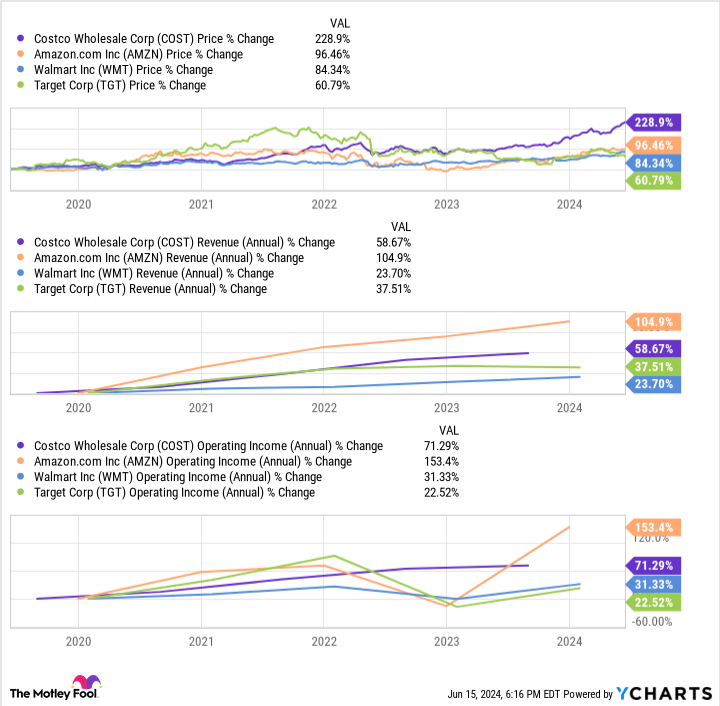

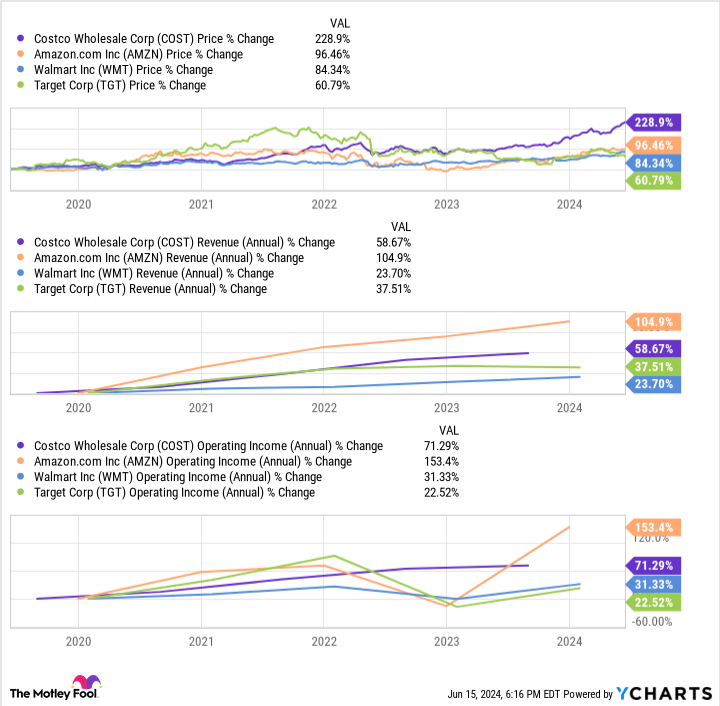

Shares in Costco (NASDAQ: COST) have risen 229% over the previous 5 years, delivering the sort of development normally reserved for tech shares. The corporate ranks fifth among the many world’s largest retailers, with a few of its greatest rivals together with Walmart and Amazon.

But Costco seems to have loads of room left to run. The retail big’s share value has skyrocketed greater than 92,000% because it went public in 1985, seemingly creating various millionaires. Nevertheless, the corporate is barely simply getting began on its growth overseas and has tapped right into a profitable subscription-based mannequin.

In consequence, it isn’t too late to make a long-term funding on this retailer and revenue from its future. So here is why Costco stays a millionaire-maker inventory price contemplating proper now.

The facility of a subscription-based mannequin

Retail generally is a difficult business, with many firms having to take care of decrease revenue margins than different sectors. Nevertheless, Costco has discovered a manner round that, with its enterprise extra reliant on memberships than product gross sales.

In the same technique to Amazon’s Prime subscription, which has likewise seen exponential success, entry right into a Costco location requires buyers to pay for an annual membership. Whereas requiring shoppers to pay to go inside a grocery retailer might’ve gone very fallacious for the corporate, the other has occurred.

Costco has attracted hundreds of thousands of shoppers through the years, charming them with entry to high quality merchandise at wholesale pricing, all for a low annual payment. The corporate’s dedication to this mannequin has seen it amass almost 75 million paid memberships, a determine that rose 8% yr over yr in its newest quarter, the primary quarter of its fiscal 2024. In the meantime, Costco boasts a 90% renewal charge worldwide.

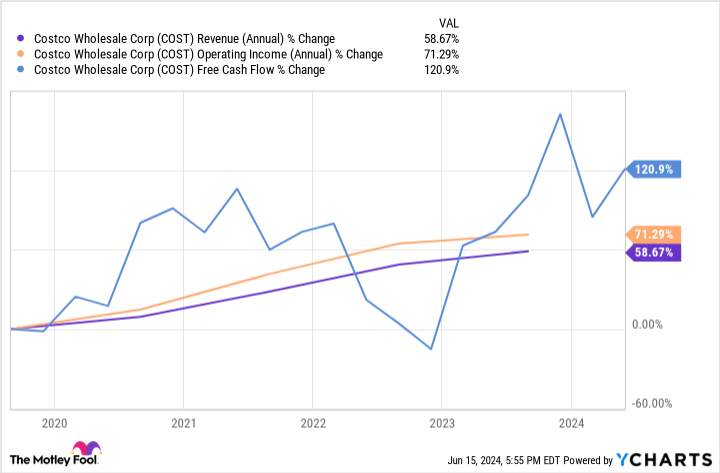

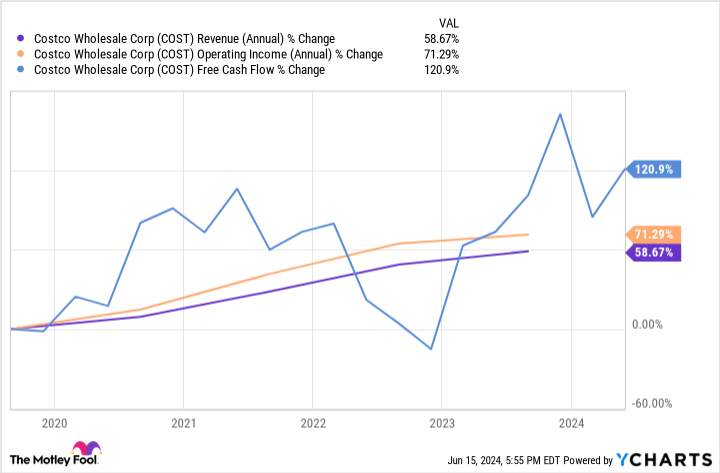

Costco’s success through the years has seen its financials skyrocket, with this chart displaying how the corporate’s annual income, working earnings, and free money stream have grown since 2019.

Costco’s fiscal 2023 earnings finest characterize the corporate’s successful membership mannequin and its optimistic impact on earnings. The retail firm achieved over $6 billion in earnings in the course of the yr, with membership charges making up 73% of that.

Costco’s inventory is price its premium price ticket

Costco nearly all the time trades at a premium, represented by its excessive ahead price-to-earnings (P/E) ratio of 53. The determine is greater than a lot of its rivals, with the identical metric for Walmart and Goal at 28 and 15. Even Amazon’s is decrease at 40.

Nevertheless, I would argue that Costco is price its price ticket for buyers prepared to carry for the long run. The info above reveals that Costco has outperformed all these firms in inventory development over the previous 5 years. Apart from, Amazon has overwhelmed its fellow retailers in annual income and working earnings development.

Furthermore, Costco is barely simply getting began with its growth overseas, which is able to most likely proceed to spice up earnings for years. The corporate operates 876 areas throughout 14 nations. Nevertheless, Costco has six or fewer shops in six of these nations, representing huge development potential. And that is earlier than contemplating the various areas the corporate has but to enter.

As an illustration, Costco opened its first location in China in 2019 and the second in 2023 after being held up by the COVID-19 pandemic. But, the corporate already has six shops within the East Asian nation and has barely scratched its floor.

It is a comparable state of affairs in France. There are solely two Costco warehouses in France, with one opening final yr, and each positioned close to Paris. Nevertheless, vital growth potential stays within the European nation and lots of different nations.

In Q3 2023, worldwide income rose 9% yr over yr, outperforming home income development by about 2%. The section will seemingly proceed outperforming home gross sales over the long-term as Costco stays on its present development trajectory.

Along with a stable development historical past and a successful enterprise mannequin, Costco is a inventory that might make you a millionaire if you happen to’re prepared to attend.

Must you make investments $1,000 in Costco Wholesale proper now?

Before you purchase inventory in Costco Wholesale, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Costco Wholesale wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $808,105!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Dani Cook dinner has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Costco Wholesale, Goal, Walmart, and Walt Disney. The Motley Idiot has a disclosure coverage.

May Costco Be a Millionaire-Maker Inventory? was initially printed by The Motley Idiot