Cybersecurity shares are within the information after a flawed replace from CrowdStrike nearly bricked 8.5 million computer systems worldwide final week. Whereas it is unclear how a lot the breach will influence CrowdStrike over the long run, it may very well be a long-awaited alternative for its smaller rival, SentinelOne (NYSE: S), to shine.

The rising cybersecurity star is one among Wall Road’s fastest-growing corporations and quickly heading towards profitability. In the meantime, the inventory’s enticing valuation and small dimension make it a multibagger candidate that might carry portfolios and create life-changing funding returns over the approaching years.

Listed below are three major explanation why SentinelOne is one of the best cybersecurity inventory to purchase right this moment, and why it packs millionaire-making potential for traders wanting years down the street.

1. Standout expertise with development alternatives

To be clear, I am not arguing that CrowdStrike’s blunders are the only cause why SentinelOne might succeed. SentinelOne’s cybersecurity platform stands out by itself. The corporate’s Singularity platform gives autonomous safety safety utilizing synthetic intelligence (AI) to search out threats earlier than they trigger points.

SentinelOne’s safety expertise is cutting-edge; it boasts prime efficiency in third-party benchmark exams just like the “MITRE ATT&CK” Analysis and glowing evaluations by expertise professionals on Gartner‘s web site.

SentinelOne tells a very good story however stays an underdog in a extremely aggressive cybersecurity area. Bigger friends like CrowdStrike supply their very own nice expertise, and others like Microsoft have identify energy and sticky, widespread relationships with enterprises all over the place.

I believe CrowdStrike will ultimately work via its IT outage, but it surely’s a blemish on its fame and will give SentinelOne an additional push to assist it win enterprise. That might be welcome for SentinelOne, which is already rising at a formidable price:

Sustaining sturdy development as income exceeds $1 billion will decide the inventory’s funding potential. The corporate has launched new merchandise to increase its footprint, together with merchandise for knowledge lake, cloud, identification safety, and Purple. Purple is a generative AI function that makes it simpler for IT employees to make use of SentinelOne’s platform.

These new merchandise have been a formidable 40% of bookings in Q1 of SentinelOne’s fiscal yr 2025. The profitable launch of recent merchandise is one other key to sustaining excessive income development.

Can SentinelOne develop income by not less than 20% yearly for the subsequent decade and past? Time will inform, however the substances are there.

2. A small firm with numerous development potential

Let’s study the market proof supporting SentinelOne’s long-term development alternatives. Archrival CrowdStrike believes the market alternative for AI-native cybersecurity is value $100 billion and can develop to $225 billion by 2028. Keep in mind that SentinelOne is not even doing $1 billion in annual gross sales but. This underlines simply how ample the chance forward actually may very well be and the way early it’s.

CrowdStrike provides extra merchandise right this moment, so not all of that market is at present open to SentinelOne. Nonetheless, SentinelOne’s profitable product launches ought to give traders confidence that administration will proceed working to unlock new development alternatives via product innovation over the approaching years.

What additionally instills confidence is that SentinelOne can win even the most important shoppers regardless of its smaller dimension. It at present serves three Fortune 10 corporations and lots of within the world 2000.

General, SentinelOne has proven a capability to compete with bigger competitors, possible because of its high-end expertise. This bodes nicely for long-term development so long as SentinelOne stays a expertise chief.

3. The value is true

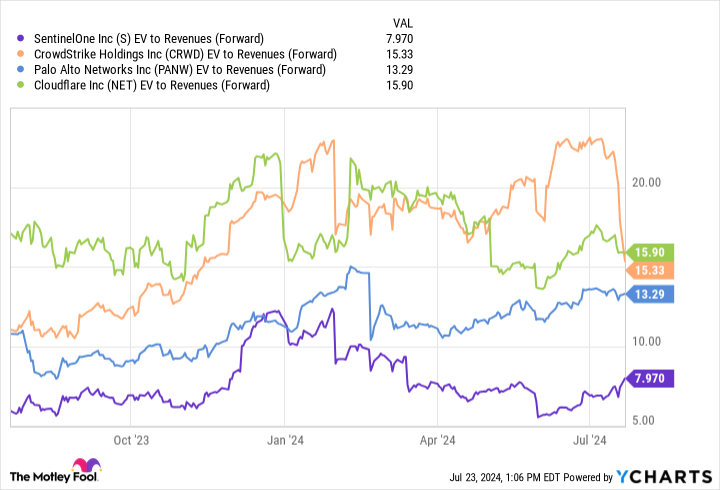

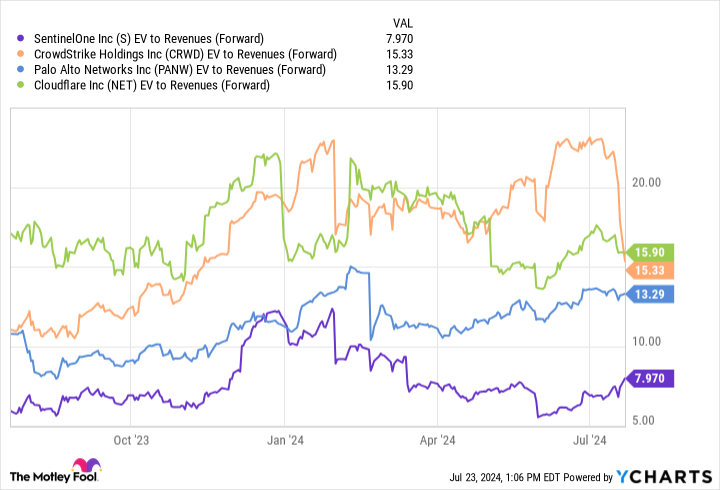

The issue with most profitable expertise shares right this moment is that they’re already huge and/or costly. A inventory wants room to run to turn into a multibagger that may create millionaire traders. SentinelOne checks two obligatory containers in that it is each small and cheap right this moment.

SentinelOne trades at a roughly 50% low cost to the opposite sizzling safety names on Wall Road. The corporate’s lack of earnings has a lot to do with this, but it surely’s altering that narrative after producing optimistic free money move final quarter.

So is SentinelOne a millionaire-maker inventory?

An affordable, small, quickly rising enterprise offers traders three tailwinds to drive long-term returns. After all, SentinelOne should proceed performing nicely as a enterprise to win the market’s confidence.

In the end, SentinelOne is a $7 billion cybersecurity inventory with a top-notch product, sturdy development momentum, and quickly bettering financials. CrowdStrike was almost a $100 billion inventory earlier than its current blunders, which provides an concept of SentinelOne’s eventual funding potential if it may well proceed following in its rival’s footsteps over the subsequent decade and past. A lot must occur between at times, however SentinelOne can completely make it easier to turn into a millionaire should you’re affected person sufficient and issues go proper.

Do you have to make investments $1,000 in SentinelOne proper now?

Before you purchase inventory in SentinelOne, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and SentinelOne wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $692,784!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of July 22, 2024

Justin Pope has positions in SentinelOne. The Motley Idiot has positions in and recommends Cloudflare, CrowdStrike, Microsoft, and Palo Alto Networks. The Motley Idiot recommends Gartner and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

May SentinelOne Inventory Assist You Turn out to be a Millionaire? was initially revealed by The Motley Idiot