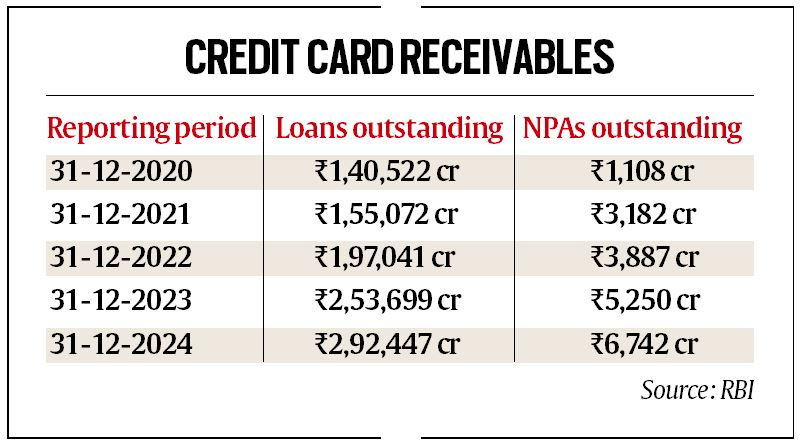

Bank card utilization has gone up considerably within the final three years, pushed by elevated shopper spending and the rising recognition of digital funds. Nevertheless, non-performing property (NPAs), or the quantity defaulted by clients, within the bank card section have additionally risen by 28.42 per cent to Rs 6,742 crore through the 12-month interval ended December 2024, in accordance with the most recent Reserve Financial institution of India information.

The RBI information reveals that gross NPAs rose from Rs 5,250 crore in December 2023 to the present degree, an increase of practically Rs 1,500 crore, amid a slowdown within the financial system. This works out to 2.3 per cent of the gross mortgage excellent of Rs 2.92 lakh crore within the bank card section of business banks in December 2024 as in opposition to 2.06 per cent of Rs 2.53 lakh crore bank card excellent within the earlier 12 months.

Bank card NPAs have shot up by over 500 per cent from Rs 1,108 crore as of December 2020, in accordance with the reply to the RTI request filed by The Indian Specific. This has occurred at a time when banks managed to convey down general gross NPAs from Rs 5 lakh crore (2.5 per cent of advances) in December 2023 to Rs 4.55 lakh crore (2.41 per cent) by December 2024.

Whereas Indian banks have succeeded in decreasing NPAs, or loans defaulted by debtors, over the previous two years, a better look reveals a major rise in NPAs throughout the private mortgage and bank card segments. This spike coincides with a rise in borrower indebtedness, casting a shadow over the sector’s progress.

Bank card excellent is unsecured in nature and carry excessive rates of interest. A mortgage account turns into an NPA when the curiosity or principal instalment is greater than 90 days overdue. When a buyer delays compensation of his bank card invoice past the billing cycle, the financial institution fees a excessive rate of interest of 42-46 per cent curiosity every year on the excellent dues and his credit score rating additionally plummets.

Card excellent is the quantity due from clients after the interest-free interval provided by banks.

What has lured clients to the bank card section are incentives like rewards on greater spending, mortgage presents and lounge advantages. “Prospects ought to realise that in the event that they hold card dues past the interest-free interval, they find yourself paying an rate of interest of as much as 42 per cent in some instances. It would put them in a debt lure,” stated a financial institution official.

Story continues beneath this advert

In November 2023, the RBI had elevated threat weight on the publicity of banks in the direction of shopper credit score, bank card receivables and non-banking finance corporations (NBFCs) by 25 per cent as much as 150 per cent. The transfer was aimed to deal with build-up of any dangers in these segments. “Whilst inquiry volumes stay sturdy, the influence of improve in threat weights on sure segments of shopper credit score pulled down the speed of progress in general shopper credit score, particularly private loans and bank cards,” the RBI’s FSR report stated.

Bank card use is rising quickly within the nation, if the client spends by means of this route are any indication. The worth of bank card transactions tripled within the final three years to Rs 18.31 lakh crore through the 12 months ended March 2024 from Rs 6.30 lakh crore in March 2021 with the financial system rising from the pandemic and shopper confidence growing over the previous a number of quarters. Bank card transactions have been Rs 1.84 lakh crore within the month of January 2025, up sharply from Rs 64,737 crore in January 2021. The variety of bank cards issued by banks additionally rose quickly to 10.88 crore as of January 2025 from 9.95 crore in January 2024 and 6.10 crore in January 2021, RBI information reveals.

© The Indian Specific Pvt Ltd