Retail shopping for on credit score is rising sharply if the bank card spends are any indication. With the economic system popping out of the issues created by the Covid pandemic, bank card spends within the April-August interval shot up by 70.36 per cent when in comparison with the earlier yr.

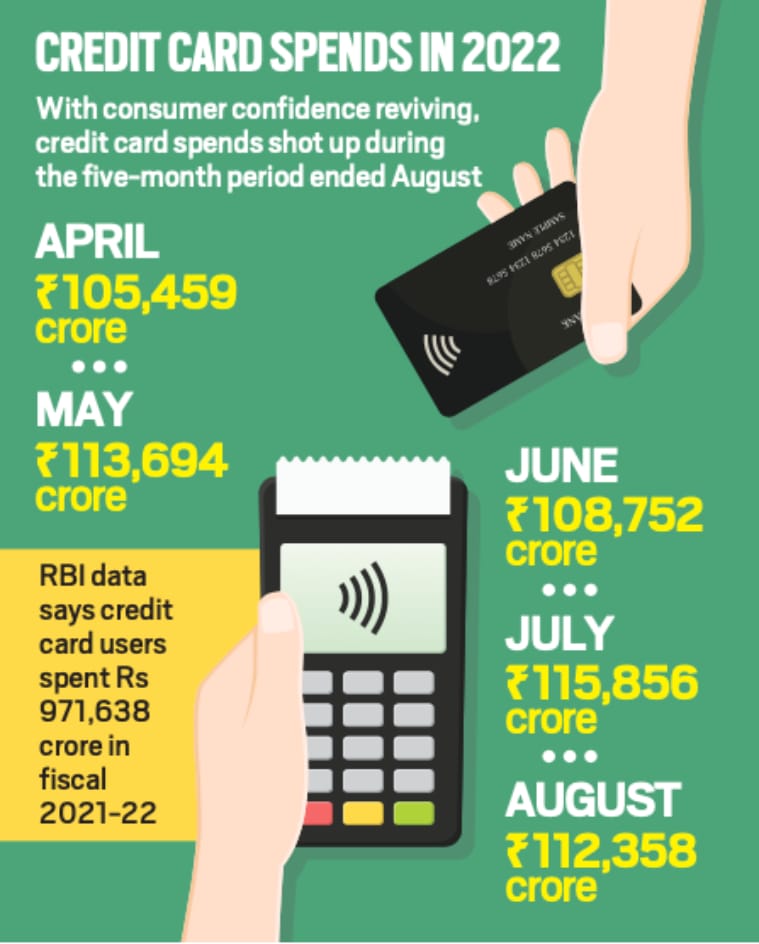

With client confidence reviving, bank card spends shot as much as Rs 556,119 crore throughout the five-month interval ended August 2022 as in opposition to Rs 326,427 crore in the identical interval of final yr. Clients – with a card base of seven.8 crore — are actually spending over Rs one lakh crore each month utilizing their bank cards. Card customers spent Rs 112,358 crore within the month of August 2022 as in opposition to Rs 77,733 crore in August final yr whereas in July it was Rs 115,856 crore (Rs 74,885 crore final yr). It’s set for an additional rise within the ongoing festive season.

In line with RBI information, bank card customers spent Rs 971,638 crore in fiscal 2021-22 as in opposition to Rs 630,414 crore a yr in the past. Of this, as a lot as Rs 380,643 crore was spent via POS (level of sale) machines of retailers in 2021-22.

Buyer spending via bank cards has already overtaken debit card utilization. In 2021-22, debit card utilization was Rs 730,213 crore, almost Rs 240,000 crore decrease than bank card spends. “The rise in bank card utilization is important because the rate of interest charged by bank card issuers is round 38-42 per cent each year. When you carry ahead the stability to the following billing cycle, the excellent will shoot up and the cardboard holder will get right into a lure if it’s carried ahead repeatedly,” mentioned a banking supply.

Bank card excellent as of August 2022 was Rs 167,443 crore as in opposition to Rs 131,536 crore a yr in the past, in keeping with RBI information.

Client confidence has been on a restoration path since July 2021 after the influence of the Covid-19 pandemic waned. Although the RBI’s present state of affairs index (CSI) remained in damaging terrain, it improved within the newest RBI survey spherical on the again of higher sentiments on common financial state of affairs and spending. Most households reported increased present spending, which was primarily pushed by important spending. Almost three-fourths of the respondents count on additional rise in total spending over the following one yr and one other 20 per cent count on it to stay across the prevailing ranges, says the RBI’s newest client confidence survey.

“Supported by progressive authorities insurance policies and lively implementation by ecosystem gamers, momentum has returned to India’s credit score market. Retail credit score portfolio balances proceed to point out sturdy restoration throughout merchandise, with dwelling mortgage balances rising by 15 per cent, auto loans by 13 per cent, client sturdy loans by 61 per cent, bank card by 32 per cent, and private mortgage balances by 29 per cent, year-over-year to June 2022,” mentioned Rajesh Kumar, Managing Director and CEO of TransUnion CIBIL.

“The Indian credit score atmosphere has proven indicators of sturdy restoration, with enchancment in credit score exercise in addition to constructive lender sentiment,” Kumar mentioned. “Credit score efficiency has persistently improved year-over-year, with usually decrease delinquency ranges. The time is ripe for lenders to determine many credit-eligible customers throughout India’s geography and attain them to supply straightforward and fast entry to credit score whereas delivering a constructive expertise.”

In line with TransUnion, the share of youthful Indian customers opening new credit score merchandise has grown steadily over the past two years. In June 2022, one third of originations (33 per cent) have been amongst customers aged 18 to 30, having elevated from 22 per cent in 2020. Concurrently, 32 per cent of originations have been from below-prime debtors as in comparison with 28 per cent in Q2 2019, indicating higher lender urge for food to broaden credit score entry to a wider spectrum of customers.

In June 2022, 23 per cent of originations have been amongst customers in metro areas, in comparison with 25 per cent in 2019 beforehand, with the proportion of originations in non-metro areas having elevated by two 4 share factors over the past three years.

In the meantime, from October 1, the RBI’s card-on-file (CoF) tokenisation norms have kicked in, which goal at improved security and safety of card transactions. For any purchases executed on-line or via cell apps, retailers, fee aggregators and fee gateways won’t be able to save lots of essential buyer credit score and debit card particulars resembling three-digit CVV and expiry date.