It’s turn into mainstream to foretell a recession this yr. The Federal Reserve is on a gradual path of rate of interest will increase – the newest was a 25-basis level hike introduced in the present day – to struggle inflation, and the central financial institution has already indicated it is going to keep this course till inflation is effectively and actually down. By definition, that may contain rising the price of capital to choke off the cash provide, and sure spark a recession within the cut price.

However not everyone seems to be leaping onto that prepare. Watching the state of affairs from funding banking large Credit score Suisse, chief US fairness strategist Jonathan Golub takes the contrarian stance. Predicting a lackluster yr for shares, moderately than an outright collapse, Golub mentioned, “If I am appropriate in the best way that we do keep away from this recession within the near-term, the market will proceed to offer you somewhat little bit of aid. So the decision is for multiples stand up somewhat bit, earnings to fall somewhat bit, after which you find yourself with a wholly uninspiring 3-4% return for equities between now and the top of the yr.”

What buyers want to recollect right here is that Golub’s ‘uninspiring return’ represents a mean – and there shall be loads of shares beating that common and bringing severe progress to the desk. His colleagues among the many Credit score Suisse inventory analysts are highlighting this truth, by publishing suggestions for shares that, of their view, will deliver good points of 30% and go up from there. In any market situation, progress like that may earn a re-examination from buyers.

For our half, we may give these Credit score Suisse picks that re-examination. Utilizing the information instruments at TipRanks, we’ve pulled up the main points on two of them; right here they’re, together with the analyst commentary.

Exelixis, Inc. (EXEL)

The primary firm we’re taking a look at is Exelixis, a biotech agency that has reached the brass ring – it has a line of accredited drugs in the marketplace, producing regular revenues, and has a latest historical past of constructive quarterly earnings. Exelixis’ lineup of medicines is targeted on most cancers remedy, and the corporate payments itself as a ‘resilient chief’ within the oncology area.

The flagship product is cabozantinib, a drugs used within the remedy of thyroid and renal cancers. Exelixis markets the drug beneath two model names, Cabometyx and Cometriq, and these, together with the cobimetinib formulation Cotellic – marketed in partnership with Genentech – type the present core of the corporate’s enterprise.

It’s a profitable core, too. In response to the latest launch of its preliminary 4Q22 and full yr 2022 monetary outcomes, Exelixis noticed whole revenues of $1.6 billion final yr, in comparison with a complete high line of $1.4 billion in 2021. Trying forward, the corporate is guiding towards a high line between $1.575 billion and $1.675 billion for 2023. The newest backside line numbers come from 3Q22, when Exelixis reported a GAAP web earnings determine of 23 cents per share, beating the consensus estimate of 20 cents a share. Exelixis will report its full information for 4Q22 on February 7.

Going ahead in 2023, Exelixis’ primary precedence shall be conducting the medical trial program to develop the product line. Developing this yr, the corporate may have a knowledge readout for a Section 3 medical trial of cabozantinib within the remedy of metastatic non-small cell lung most cancers. This examine is being run as a mix remedy with atezolizumab and has enrolled 366 sufferers. Additionally in a Section 3 trial is zanzalintinib, a brand new drug candidate (earlier referred to as XL092) for the remedy of superior non-clear-cell renal carcinoma. The examine has 291 sufferers and is due for growth.

The pipeline doesn’t come low-cost, however along with its income stream, Exelixis has deep pockets. The corporate completed 3Q22 with $2.1 billion in money and liquid belongings readily available, a rise from the $1.9 billion obtainable on the finish of 2021.

Becoming a member of the bulls, Credit score Suisse analyst Geoffrey Weiner takes an upbeat stance on this firm and its inventory.

“Based mostly on our conversations with key opinion leaders (KOLs) and evaluation of the renal cell carcinoma (RCC) panorama, we undertaking product gross sales may develop to ~$2B in 2025, even with out potential label expansions,” Weiner famous.

“EXEL has adequate money movement to bridge the hole between cabo and worth creation from its pipeline, which incorporates a number of clinical-stage candidates and an underappreciated/rising antibody drug conjugate (ADC) pipeline… We predict the prospects for the home-grown asset zanzalintinib/XL092 (next-generation cabo-like TKI) and XB002 (TF-ADC) are missed, as is EXEL’s transfer to construct out an ADC pipeline. We imagine there are a number of medical catalysts to drive pipeline curiosity over the following one to 2 years,” the analyst added

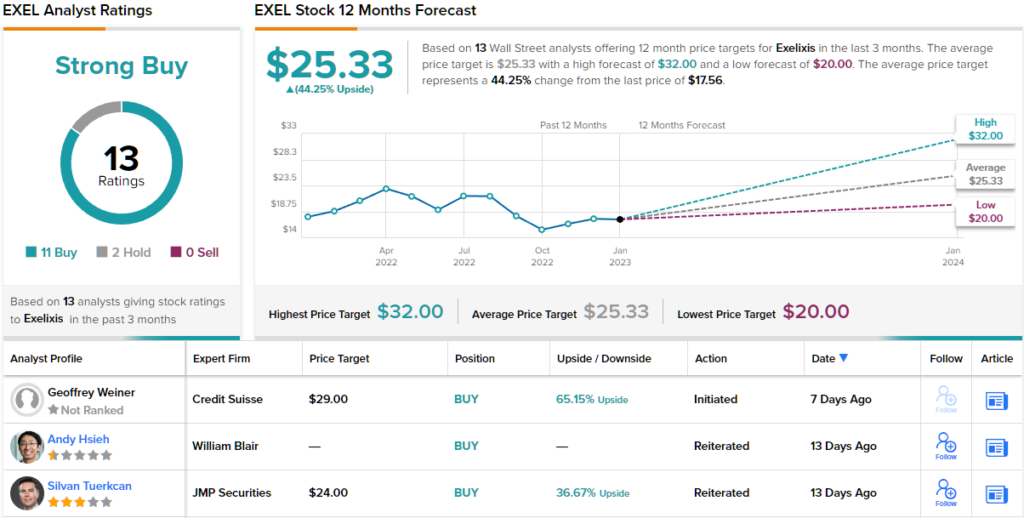

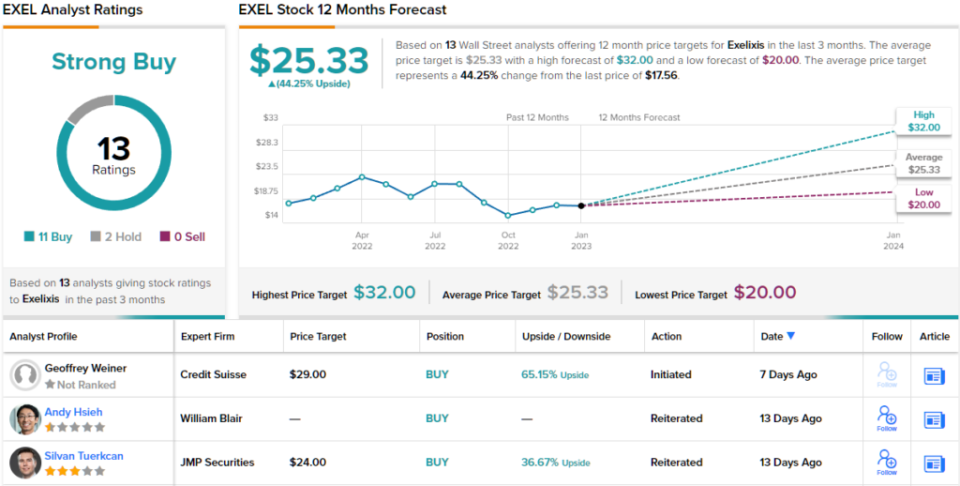

Gazing into the close to future, Weiner sees match to charge EXEL shares an Outperform (i.e. Purchase), with a value goal of $29 indicating potential for a sturdy 65% share appreciation over the approaching yr.

Total, EXEL shares preserve a Sturdy Purchase analyst consensus ranking, primarily based on 13 latest critiques. These critiques break down 11 to 2 in favor of Buys over Holds, and the corporate’s $25.33 common value goal implies a 44% upside potential from the present share value of $17.55. (See EXEL inventory forecast)

Boyd Gaming Company (BYD)

The following Credit score Suisse choose we’re taking a look at is Boyd Gaming, one of many main on line casino operators within the gaming business. Spreading out of its Las Vegas dwelling, Boyd now has 28 gaming services and properties throughout 10 states, and as well as, the corporate has a 5% fairness stake in FanDuel Group, a number one sports activities betting operator. Boyd’s experience has additionally introduced the corporate a administration settlement with a tribal on line casino in northern California.

This array of properties has supplied Boyd a robust income stream and earnings. The corporate will report its full-year 2022 outcomes tomorrow after market shut, however trying again to 3Q22, we see that Boyd had $877.3 million on the high line. This was up 4% year-over-year, and with a 9-month whole income of $2.63 billion, the corporate is effectively on monitor to beat final yr’s full-year determine. On the backside line, Boyd’s Q3 adjusted earnings of $1.48 per share have been up greater than 13% y/y.

Boyd has gotten a lift from robust client spending popping out of the pandemic interval. It stays to be seen if this can maintain up going ahead; a discount within the charge of inflation shall be supportive of the buyer discretionary spending phase usually.

Of curiosity to buyers, Boyd this yr reinstated its quarterly dividend fee. The corporate had suspended dividends beginning in 2020, however restarted the funds in 1Q22. The present dividend is 15 cents per frequent share, greater than double the final 2019 fee. At this charge, the fee annualizes to 60 cents and provides a small yield of 1%.

5-star analyst Benjamin Chaiken, in his write-up of Boyd for Credit score Suisse, lays out a number of the reason why this inventory ought to do effectively going ahead: “(1) Development within the Downtown Las Vegas market and BYD’s funding within the Freemont property. We predict the Downtown market may inflect larger as company demand on the Strip returns… (2) BYD is spending $100m to maneuver its Treasure Chest on line casino from a riverboat to a newly developed land-based asset adjoining to the prevailing property. We predict new facilities, higher entry, and a extra cohesive on line casino flooring may drive a 20-30% ROI. (3) BYD bought Pala Interactive in November ’22, so annualizing the acquisition needs to be a small tailwind in ’23… (4) BYD has a Tribal administration contract for the Sky River On line casino, which we estimate will drive $36m of mgmt. charges in ’23…”

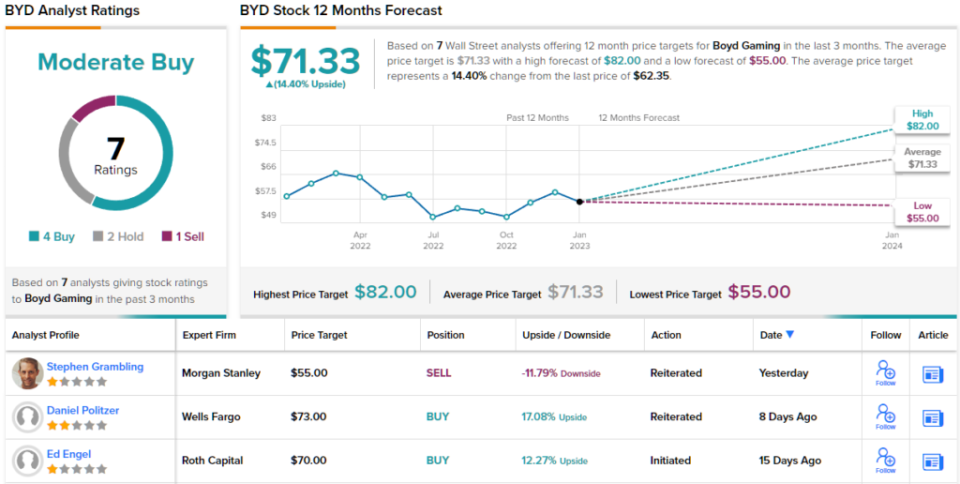

Based mostly on these 4 causes, Chaiken charges BYD shares an Outperform (i.e. Purchase) ranking, together with an $82 value goal that implies a 12-month potential upside of 31.5%. (To observe Chaiken’s monitor document, click on right here)

Total, this inventory will get a Average Purchase from the Avenue’s analyst consensus, primarily based on 7 analyst critiques that embrace 4 Buys, 2 Holds and a single Promote. The inventory is promoting for $62.35 and its $71.33 common value goal suggests an upside potential of ~14% on the one-year horizon. (See BYD inventory forecast on TipRanks)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your personal evaluation earlier than making any funding.