The S&P 500 index is a widely known benchmark composed of roughly 500 shares which are U.S. firms, large, and worthwhile. Cloud-based cybersecurity firm CrowdStrike (NASDAQ: CRWD) might be included beginning on June 24. And this firm has completely earned the consideration of inclusion.

CrowdStrike went public in 2019. And throughout the firm’s fiscal 2019 (which resulted in January of that yr), it generated income of simply $250 million. Quick ahead to fiscal 2024 (which resulted in January of this yr), and it generated income of over $3 billion. Briefly, CrowdStrike has grown by a unprecedented quantity in simply 5 years as a public firm.

The standard of CrowdStrike’s development can also be noteworthy. There are firms which have grown by a comparable quantity, however few have additionally concurrently unlocked large profitability. Free money circulation has skyrocketed. And in its fiscal first quarter of 2025, CrowdStrike achieved an enormous free-cash-flow margin of 35% — that is unbelievable.

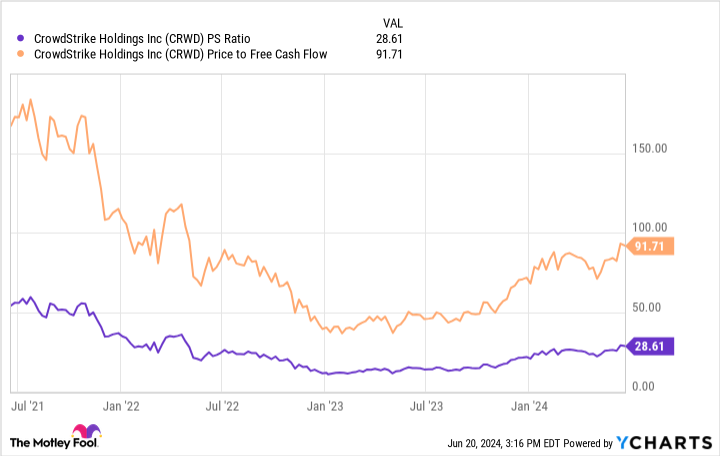

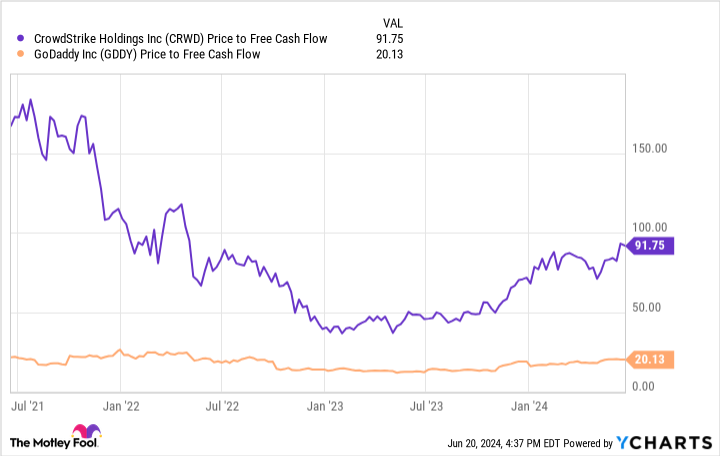

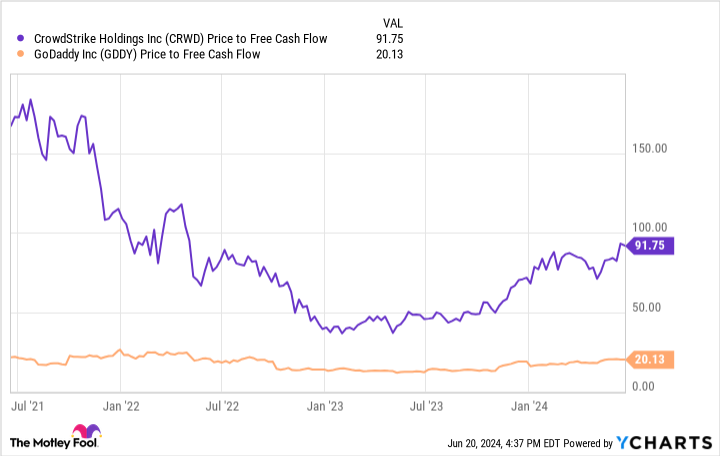

Nonetheless, one may nitpick CrowdStrike as an funding on account of its lofty valuation. Overpaying for an funding — even for shares of a nice enterprise — can negatively impression future returns. And buying and selling at a price-to-sales (P/S) ratio of almost 30 and a price-to-free-cash-flow ratio of almost 100, CrowdStrike inventory is pricey right now.

To be honest, it might nonetheless work out for buyers. The cybersecurity area is a gigantic alternative and CrowdStrike is likely one of the finest gamers. Due to this fact, its long-term development and income could justify its valuation.

Nonetheless, for buyers involved about this valuation threat right now, web site firm GoDaddy (NYSE: GDDY) is getting included within the S&P 500 alongside CrowdStrike. And it is a significantly better discount purchase right now, as I will clarify.

Why buyers ought to have a look at GoDaddy inventory

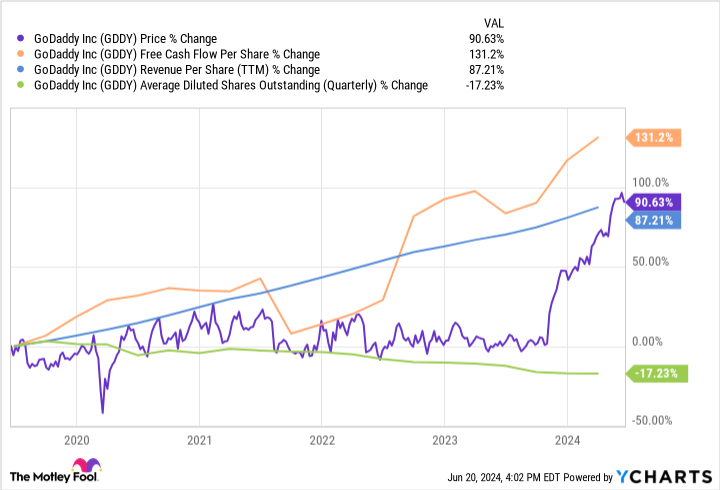

Over the past three years, shares of GoDaddy are quietly up about 60%, which is nearly double the 31% return for the S&P 500. And when buyers contemplate the fabric issues that make shares go up, GoDaddy inventory is rising for the suitable causes.

For starters, GoDaddy continues rising though it has been round a very long time. In 2022, the corporate’s income was up 7% yr over yr, and it was up 4% in 2023. Then within the first quarter of 2024, income grew by one other 7% in comparison with the prior-year interval.

Some buyers would possibly scoff at a single-digit development charge for GoDaddy. And in isolation, it is true that the corporate’s income development did not transfer the needle a lot. However its free money circulation has fared significantly better due to the place the expansion is coming from — extra on that in a second. Think about that free-cash-flow development exceeded income development in 2022, 2023, and in Q1, which is a stable pattern at this level.

Furthermore, due to utilizing its money circulation to purchase again inventory, GoDaddy has diminished its share rely, which boosts its free money circulation per share. That is vital for particular person shareholders as a result of their possession stakes are thereby getting extra priceless.

In abstract, GoDaddy diminished its share rely, grew its income, and grew its free money circulation. And its free money circulation per share went up sooner than its inventory value, which implies its latest market-beating efficiency is justified.

The actual query for buyers right now is whether or not GoDaddy can proceed rising income and free money circulation whereas decreasing its share rely. And I imagine the reply is “sure.”

GoDaddy makes most of its cash with area identify providers — that is its top-of-mind service, and 92% of its clients in 2023 purchased a website identify from the corporate. Nonetheless, GoDaddy more and more gives providers for beginning, rising, and advertising and marketing a enterprise, together with with merchandise for constructing web sites, accepting funds, and extra.

These complementary merchandise are no-brainers for GoDaddy and have boosted revenue margins — this explains why free money circulation is rising sooner than income. And the corporate’s latest synthetic intelligence (AI) instruments are additional boosting the adoption of its newer merchandise, in line with administration.

Consequently, GoDaddy expects free-cash-flow development to maintain outpacing income development. Administration expects to generate $4.5 billion cumulative free money circulation by way of the tip of 2026. Furthermore, administration remains to be licensed to repurchase $1.1 billion in shares as of the tip of Q1, to additional cut back the share rely.

Buying and selling at simply 20 instances its free money circulation, GoDaddy inventory is a much better discount than CrowdStrike inventory, because the chart beneath exhibits.

It is not as thrilling or as high-growth as CrowdStrike. However GoDaddy is rising its free money circulation at a decent charge, and the valuation is kind of cheap. This mix of worthwhile development and pretty priced shares may yield sturdy inventory returns from right here, which is why I imagine buyers ought to give GoDaddy inventory a tough look now.

Do you have to make investments $1,000 in GoDaddy proper now?

Before you purchase inventory in GoDaddy, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and GoDaddy wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of June 10, 2024

Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends CrowdStrike. The Motley Idiot recommends GoDaddy. The Motley Idiot has a disclosure coverage.

CrowdStrike Inventory Is Getting Added to the S&P 500. However This Different New S&P 500 Addition Might Be a Higher Discount Purchase. was initially printed by The Motley Idiot