April 25 (Reuters) – What do you get if you cross cryptocurrencies with synthetic intelligence?

A seemingly sentient bitcoin that codes itself within the model of Japanese haikus? Alas not, although you do get billions of {dollars} of buying and selling in a brand new class of crypto tokens.

The machine mania sweeping the tech world amid the launches of bots like ChatGPT and Bard has reached the cryptoverse, with curiosity in tokens tied to AI blockchain tasks surging.

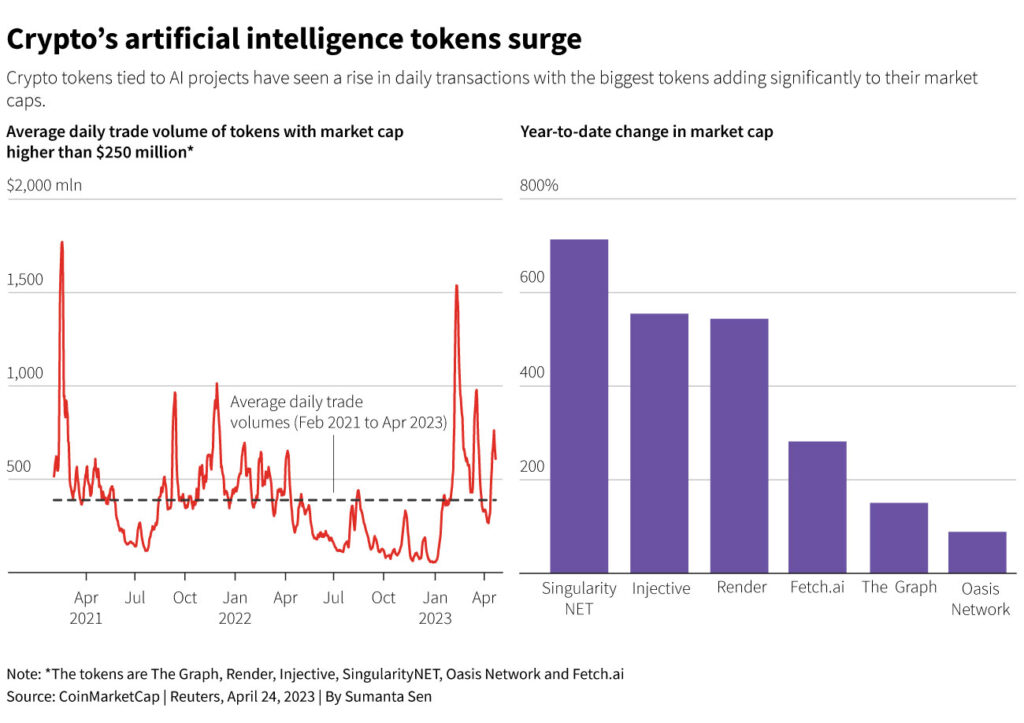

Common day by day volumes for the largest cash together with SingularityNET, Fetch.AI and Render topped $1 billion in early February, hitting a two-year excessive, in line with knowledge agency Kaiko.

AI-linked blockchain merchandise cowl a gamut of providers together with funds, buying and selling fashions, machine-generated non-fungible tokens and blockchain-based marketplaces for AI functions the place customers pay builders in cryptocurrency.

“That is thrilling, it is one of many first occasions machine-learning functions are being introduced on-chain in a giant means,” stated Eric Chen, CEO of decentralized finance platform Injective Labs, although he cautioned: “The digital asset area isn’t any stranger to hype, hypothesis and overzealous expectations.”

To date, the funding returns are robust. The CoinDesk Indices Computing Index, which incorporates AI-linked tokens, has risen 60% this yr with a big spike in February as OpenAI’s ChatGPT noticed a surge in utilization.

Whereas buying and selling volumes retreated in March, they continue to be above the crypto sector’s long-term common, and plenty of tokens have considerably outperformed bitcoin with year-to-date returns starting from 150% to 780%, stated Kaiko analyst Dessislava Aubert.

There’s additionally been elevated funding within the sector, with examples together with CryptoGPT, the place customers can promote their knowledge to AI firms, which raised $10 million in funding this month.

But regardless of the robust returns this yr, the AI-crypto sector stays area of interest – the mixed market cap of CoinGecko’s AI-classified cash is $2.7 billion, dwarfed by the $1.2 trillion whole crypto market.

Some tasks could also be using the AI wave and not using a sustainable plan, with the relative newness of the area which means winners will doubtless be few and much between, market gamers warned.

“There’s a spot for AI and blockchain to see some synergy, however I do not know the way most of the present tasks are utilizing it nicely,” stated Ryan Rasmussen, Bitwise analysis analyst.

“It’s important to look underneath the hood.”

CRYPTO AI: BIG HOPE OR HYPE?

The potential of AI-linked crypto apps has traders hoping they will kind by means of the hype to determine tasks that may assist remedy some issues, drive extra customers to blockchain merchandise and assure some stable returns.

“Some particular AI tasks might really find yourself being the ‘killer app’ for public blockchains,” stated Pranav Kanade, portfolio supervisor at VanEck.

He separates the AI-crypto world into merchandise prone to see near-term adoption as they remedy fast issues, and longer-term bets.

Within the close to time period, the rise of decentralized computing networks might enable customers with unused graphics processing items (GPU) capability to supply capability to different customers that could possibly be used for resource-intensive AI studying fashions, Kanade stated.

Equally, some trade watchers see blockchain-based marketplaces as providing a simple means for system builders to achieve market share and smaller customers to entry new AI tech.

SingularityNET is among the largest such marketplaces and has seen the market cap of its token leap from $52 million to over $414 million this yr.

Different potential long-term use circumstances embrace utilizing blockchain as proof for distinguishing between AI and human-generated content material.

Many traders are conscious they could be in for the lengthy haul, however are hoping a couple of runaway successes will compensate for the danger, stated Todd Groth, head of index analysis at CoinDesk Indices.

“You are investing in tasks, many won’t see the sunshine of day,” he added. “You simply want a couple of names that may do fairly nicely.”

Reporting by Lisa Mattackal and Medha Singh in Bengaluru; Modifying by Vidya Ranganathan and Pravin Char

: .

Opinions expressed are these of the writer. They don’t replicate the views of Reuters Information, which, underneath the Belief Rules, is dedicated to integrity, independence, and freedom from bias.