June 6 (Reuters) – It is a tense time for bitcoin traders. Watch. Wait. Do not make the primary transfer.

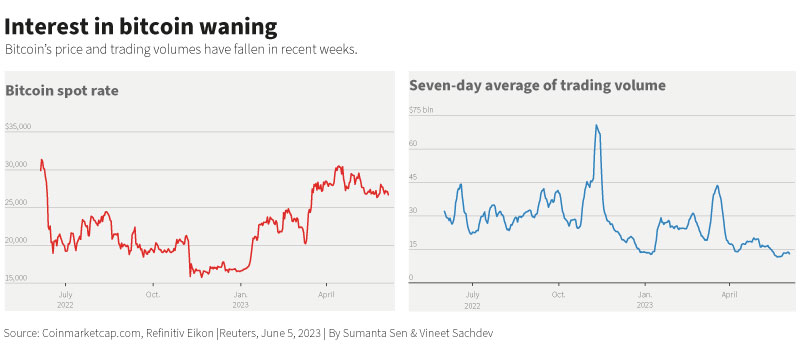

The capricious cryptocurrency’s been uncommonly quiet over the previous 4 weeks, certain within the vary of $28,452 and $25,800. Even the top of the U.S. debt ceiling saga did little to whet threat urge for food.

Bitcoin’s volatility index is close to 64, properly beneath the 2023 peak of 116.5 touched in January, in line with CryptoCompare. Total day by day cryptocurrency spot buying and selling volumes – above $20 billion for a lot of the 12 months – have languished at round $10.6-$12 billion within the final two weeks, information from The Block exhibits.

The information indicators a reluctance of traders and merchants to take positions in both spot or derivatives, stated Noelle Acheson, an economist who has tracked the crypto sector for seven years.

This was echoed by Matthew Weller, international head of analysis at monetary companies group StoneX. “Taking a look at bitcoin’s chart, merchants are ready for a definitive break free from the $27,000 stage that has magnetically pulled costs again constantly,” he stated.

The world’s largest cryptocurrency continues to be the best-performing asset of 2023, with good points of about 62%. But it has slid practically 14% from a peak of $31,035 in April, preserving nervy merchants guessing about its subsequent transfer.

STILL WATERS RUN DEEP?

“The dearth of something attention-grabbing can be attention-grabbing,” stated Luuk Strijers, chief business officer at derivatives change Deribit.

Bitcoin’s 7-day and 30-day implied volatility – choices merchants’ expectation of future worth turbulence – have slid to January lows of beneath 40%, after peaking at 76% and 67% in March, in line with The Block.

“If implied volatility falls to rock-bottom ranges, it could possibly’t go a lot decrease,” Strijers added. “Buying and selling volatility, shopping for choices within the absence of a worth transfer, that is what individuals would possibly do on this market.”

Market positioning signifies the utmost ache stage for the June 2023 choices expiry for bitcoin is at round $24,000, which may act as a assist or resistance stage, in line with analysts at Bitfinex.

“Merchants ought to be ready for potential market turbulence and short-term worth fluctuations within the second half of the month,” they stated.

Long run, in 2024, they count on bitcoin’s halving – a technical adjustment that reduces the speed at which new cash are created – and the U.S. elections to ratchet up volatility.

THE BULLS ARE HIDING

Funding charges, which measure the price of holding bitcoin through futures, have edged decrease, indicating traders are much less keen to pay to be lengthy. It was final buying and selling at 0.0098%, approach beneath the 0.0302% seen in March.

“A bull market is simple, when the whole lot goes up,” stated Thomas Kralow, a crypto hedge fund supervisor at Kralow Capital. “Nevertheless it’s markets like these the place individuals lose cash – due to false beliefs that we’re lastly turning the nook, which is extremely arduous to foretell.”

He added: “Proper now with the drop in volatility, we’ve just a few trades that we’re open to hedge in case bitcoin drops right down to $20,000.”

Reporting by Medha Singh and Lisa Pauline Mattackal in Bengaluru; Modifying by Pravin Char

: .

Opinions expressed are these of the writer. They don’t mirror the views of Reuters Information, which, beneath the Belief Rules, is dedicated to integrity, independence, and freedom from bias.