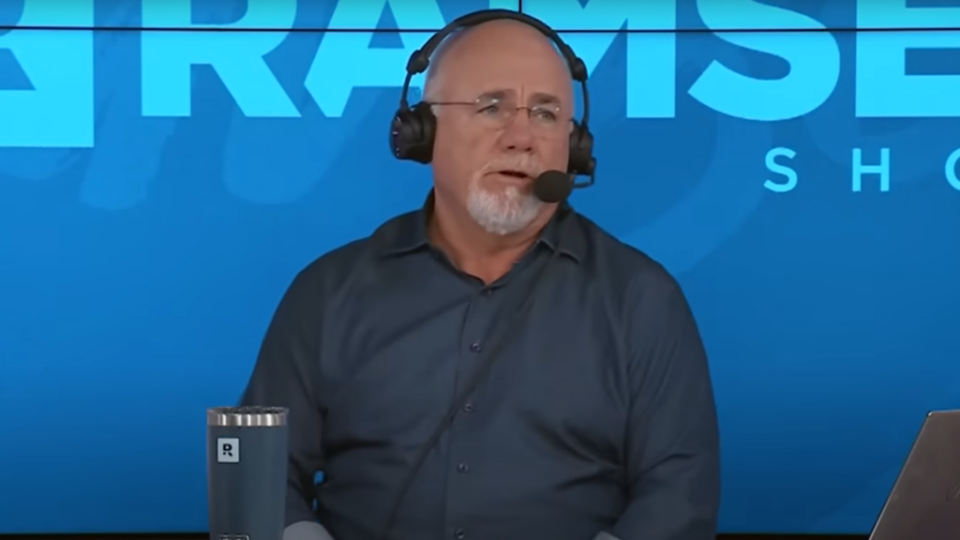

Monetary guru Dave Ramsey just lately gave vital recommendation to Teresa, a 61-year-old lady from Arkansas going through extreme financial challenges. Teresa, whose name was featured on The Ramsey Present earns $67,000 yearly and has about $69,000 in debt, together with pupil and private loans, considered one of which she used to buy a $26,000 tractor.

Ramsey didn’t maintain again when he informed her, “Broke folks haven’t got $26,000 tractors.” He emphasised that Teresa’s reluctance to promote the tractor, even at a loss, retains her from a safe monetary future.

Do not Miss:

Teresa initially inquired about her retirement choices since she needs to retire at 67 and has no cash saved. Ramsey suggested her she should clear up her debt earlier than contemplating retirement. He said, “If I had been in your sneakers, I’d say, ‘I’m so scared, I am going loopy and I am promoting the tractor; I am promoting the automotive and gonna get a $2,000 automotive. I am gonna work like loopy.'”

Teresa realized about Ramsey’s well-known Child Steps to Monetary Peace earlier within the yr — after her “impulsive” $26,000 buy — and desperately desires to enhance her monetary stability.

“Repay all debt (besides the home)” is Child Step #2, two steps earlier than investing 15% of your family earnings into retirement. Ramsey repeatedly emphasised that Teresa should get out of debt earlier than doing the rest.

Getting out of debt is just not simple, significantly while you’re used to residing a particular life-style, and Ramsey stresses this by saying, “You’re about to do some actually troublesome issues. And folks in your life are going to suppose you’ve misplaced your daggum thoughts. However what you’re doing is you’re making an attempt to safe the final twenty years or three many years of your life. And that’s essential to struggle for.”

Trending: Warren Buffett as soon as stated, “In case you do not discover a approach to make cash when you sleep, you’ll work till you die.” These high-yield actual property notes that pay 7.5% – 9% make incomes passive earnings simpler than ever.

Regardless of his pressing recommendation surrounding Teresa’s monetary emergency, Ramsey tells her there’s hope for monetary safety. “It’s not too late, however you’re buying and selling a $26,000 tractor for $150,000 in your retirement. You’re buying and selling an $18,000 automotive for one more $100,000 in your retirement. You may have 1 / 4 million {dollars} put aside with match should you get your butt out of debt now by the point you hit 67, 68 years previous. You will get there.”

Teresa is just not alone in her monetary struggles. Based on AARP, about one in 4 adults over age 50 haven’t any retirement financial savings. Many have blamed inflation, together with rising lease and mortgage funds, as the explanation they’re unable to avoid wasting. AARP’s examine highlights comparable debt struggles to Teresa’s, stating that one-third of adults with bank card debt have a steadiness of over $10,000, and 12% have a steadiness over $20,000.

Ramsey would seemingly inform these struggling to avoid wasting the identical factor: “Promote every part and get out of debt now.” It is scary to look to the long run and never have a retirement account to fall again on, nevertheless it does not have to remain that manner. Whereas many depend on Ramsey’s recommendation, contemplate speaking to a monetary advisor to assist decide your finest choices for getting out of debt shortly and saving for retirement.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & every part else” buying and selling software: Benzinga Professional – Click on right here to start out Your 14-Day Trial Now!

Get the most recent inventory evaluation from Benzinga?

This text Dave Ramsey Tells Caller To ‘Promote Every little thing’ After $26,000 Tractor Buy Places 61-12 months-Outdated In ‘Emergency Mode’ initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.