Reserve Financial institution of India (RBI) Governor Shaktikanta Das Sunday mentioned the institution of digital banking items (DBUs) will additional increase the digital infrastructure within the nation and enhance buyer expertise in doing banking transactions.

Prime Minister Narendra Modi as we speak devoted 75 DBUs to the nation. Finance Minister Nirmala Sitharaman, in her Union Funds speech for 2022-23, had introduced organising of 75 DBUs in as many districts of the nation to commemorate 75 years of India’s independence.

DBUs are being arrange by business banks to make sure that the advantages of digital banking attain each nook and nook of the nation. It’s a joint initiative of the federal government, the RBI, the Indian Banks Affiliation and the taking part banks.

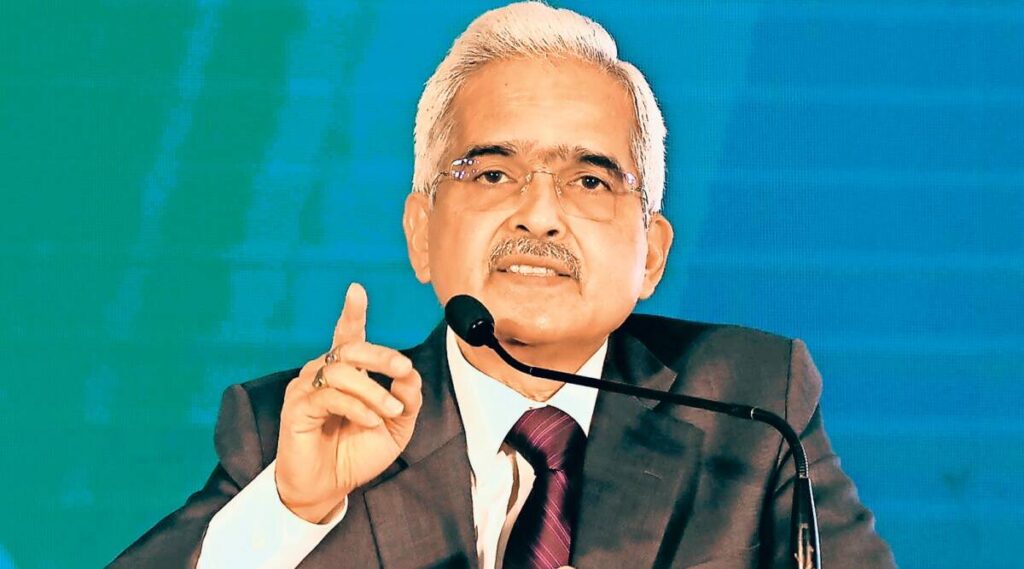

“The institution of DBUs is a step to additional increase the digital infrastructure within the nation. It will act as an enabler within the digital ecosystem and can enhance buyer expertise by facilitating seamless banking transactions,” Das mentioned on the digital launch of those DBUs.

These items will increase the efforts to advertise monetary inclusion by offering banking providers in a paperless, environment friendly, secure and safe surroundings, he mentioned.

The DBUs will present particular monetary providers which embrace financial savings, credit score, funding and insurance coverage. On the credit score supply entrance, they’ll present end-to-end digital processing of small ticket retail and MSME loans, ranging from on-line purposes to disbursals.

Das mentioned the services in these items shall be offered in two modes – self-service and assisted modes – with self-service mode being obtainable around the clock.

DBUs will allow clients to have value efficient, handy entry and enhanced digital expertise of banking services. They are going to unfold digital monetary literacy and particular emphasis shall be given to buyer training on cyber safety consciousness and safeguards.

Das mentioned banks are additionally free to have interaction the providers of digital enterprise facilitators and enterprise correspondents to increase the footprint of DBUs.

He mentioned lately, digital banking has emerged as a most popular channel for delivering banking providers within the nation and the Reserve Financial institution has been taking progressive measures to enhance availability of digital infrastructure for banking providers.

In the meantime, personal sector lender ICICI Financial institution mentioned it has arrange 4 DBUs that are in Dehradun (Uttarakhand), Karur (Tamil Nadu), Kohima (Nagaland) and Puducherry.

HDFC Financial institution mentioned it has opened 4 items – one every in Haridwar, Chandigarh, Faridabad and South 24 Parganas (West Bengal). Axis Financial institution mentioned it has opened one unit in Itarsi (Madhya Pradesh) and one other two in Bundi and Bhilwara (Rajasthan).

State-run Union Financial institution of India mentioned it has operationalised six DBUs – Rajahmundry and Machilipatnam (Andhra Pradesh), Palakkad (Kerala), Sagar (Madhya Pradesh), Nagpur, Agartala.

Financial institution of Baroda has opened eight DBUs in Indore, Kanpur Dehat, Karauli, Kota, Leh, Silvassa, Vadodara and Varanasi.