(Bloomberg) — The bond market is doubling down on the prospect of a US recession after Federal Reserve Chair Jerome Powell warned of a return to larger interest-rate hikes to chill inflation and the financial system.

Most Learn from Bloomberg

As swaps merchants worth in a full share level of Fed hikes over the following 4 conferences, the yield on two-year Treasury notes touched 5.04% on Wednesday, its highest stage since 2007. Critically, longer-dated yields remained stalled, with the 10-year charge remaining below 4%, whereas 30-year bonds have barely budged since Friday.

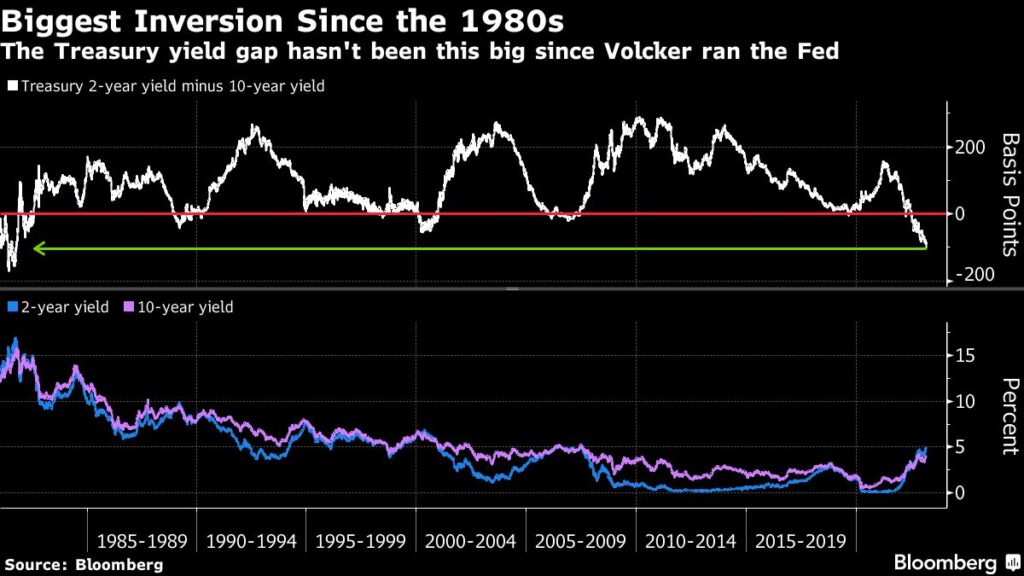

Consequently, the closely-watched unfold between 2- and 10-year yields confirmed a reduction bigger than a share level for the primary time since 1981, when then-Fed Chair Paul Volcker was engineering hikes that broke the again of double-digit inflation at the price of a prolonged recession. An identical dynamic is unfolding now, in keeping with Ken Griffin, the chief govt officer and founding father of hedge fund large Citadel.

“We’ve got the setup for a recession unfolding” because the Fed responds to inflation, Griffin mentioned in an interview in Palm Seashore, Florida.

Longer-dated Treasury yields have didn’t maintain tempo with the surging two-year benchmark since July, making a curve inversion that over the a long time has amassed a report of anticipating recessions within the wake of aggressive Fed-tightening campaigns.

On the whole, such inversions preceded financial downturns by 12 to 18 months. The chances of one other occurence are intensifying after Powell’s feedback point out he’s open to reverting to half-point charge hikes in response to resilient financial information. The Fed’s quarter-point hike on Feb. 1 was the smallest because the early days of the present cycle.

Merchants upgraded the percentages of a half-point charge enhance on March 22 from about one-in-four to round two-in-three, elevating the stakes for February employment information set to be launched on Friday, and the buyer worth index in round per week’s time.

“Charge volatility might be with us till the Fed is actually accomplished,” mentioned George Goncalves, head of US macro technique at MUFG. “Larger vol means it’s important to derisk and put extra of a danger premia again into credit score and equities.”

Dragged Down

US shares prolonged the decline they’ve suffered over the previous month, with the S&P 500 Index notching a 1.5% drop on Tuesday, its largest in two weeks. Hopes that the Fed could be close to the tip of its tightening cycle had boosted the gauge by over 6% in January.

In the meantime the greenback, which tends to profit from each elevated short-end rates of interest and a bid for security when occasions are powerful, additionally surged greater Tuesday, with a Bloomberg gauge rising to its highest stage since early January.

“It’s exhausting to disclaim the hawkishness of the assertion and the message that markets took away,” strategists at NatWest Markets wrote in a be aware to shoppers. Powell “firmly opened the door” for a return to 50-basis-point strikes, though he emphasised the significance of upcoming information releases, that are “more likely to be excessive vol occasions,” in keeping with strategists Jan Nevruzi, John Briggs and Brian Daingerfield.

Powell advised members of Congress on Tuesday that there are “two or three extra essential information releases to investigate” forward of the March deliberations, and “all of that may go into making the choice.”

Additionally in March, Fed policymakers are set to launch up to date quarterly forecasts for the place officers see rates of interest going, also referred to as the dot plot. In December, the median projection was for a peak of round 5.1% and a long-run impartial charge of two.6%.

Some traders assume a recession could be averted whilst progress slows. Both manner, longer-dated Treasuries are seen as a viable shelter with the Fed nonetheless elevating charges.

Brief-maturity yields are the “most weak to repricing greater,” particularly if wage progress resumes rising, favoring a half-point charge enhance, mentioned Ed Al-Hussainy, charges strategist at Columbia Threadneedle Investments. That can drive “extra flattening strain on the curve.”

–With help from Edward Bolingbroke, Katie Greifeld, Felipe Marques and Garfield Reynolds.

(Provides Wednesday yield ranges in second paragraph)

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.