The marketplace for synthetic intelligence (AI) servers has taken off previously 12 months as cloud corporations and information heart suppliers pour cash into constructing their AI infrastructure and creating generative AI functions. This explains why server producers akin to Dell Applied sciences (NYSE: DELL) and Tremendous Micro Pc (NASDAQ: SMCI) have seen their share costs explode.

Whereas Dell’s inventory worth has almost tripled previously 12 months, Supermicro, as it’s also identified, has shot up a whopping 873%. However what’s stunning is that each corporations proceed to commerce at enticing valuations regardless of their beautiful inventory worth surges previously 12 months.

So for those who had to purchase certainly one of these two AI server performs proper now, which one could be a greater guess? Let’s discover out.

The case for Dell Applied sciences

Dell Applied sciences is the main participant within the international server market. The corporate’s share of the general server market reportedly stood at 19% on the finish of 2022, as per third-party estimates. So it’s not stunning to see why the corporate advantages from the rising demand for AI servers.

Within the fourth quarter of fiscal 2024 (ended Feb. 29, 2024), Dell reported that orders for AI-optimized servers elevated nearly 40% quarter over quarter. The corporate offered $800 million price of AI servers final quarter. This determine ought to proceed to maneuver larger, as Dell’s AI server backlog nearly doubled quarter over quarter to $2.9 billion. With the AI server market forecasted to clock annual income of $150 billion in 2027 in comparison with $30 billion final 12 months, there’s plenty of area for Dell to develop on this market.

It’s price noting that AI servers at present kind a small a part of Dell’s general enterprise. The corporate delivered $22.3 billion in income in fiscal This autumn, down 11% 12 months over 12 months. The year-over-year decline could be attributed to Dell’s shopper options section, by means of which it sells private computer systems (PCs) and workstations.

The PC market was not in nice well being final 12 months, with shipments dropping nearly 14% from 2022. This explains why Dell’s shopper options income was down 12% 12 months over 12 months within the earlier quarter. The excellent news is that this section may return to development in 2024 because of the adoption of AI-enabled PCs. Market analysis agency Canalys expects shipments of AI-enabled PCs to leap from 48 million items this 12 months to 205 million items yearly in 2028.

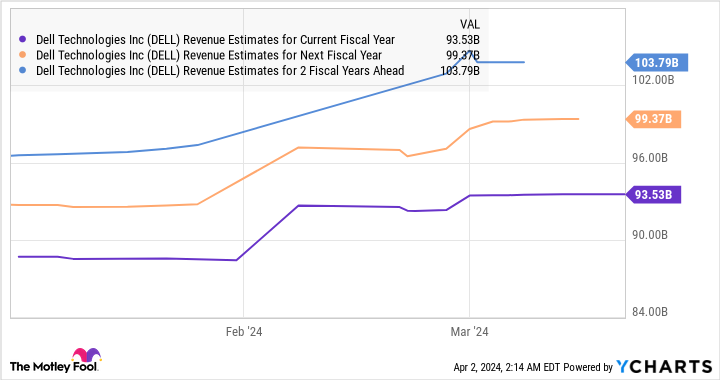

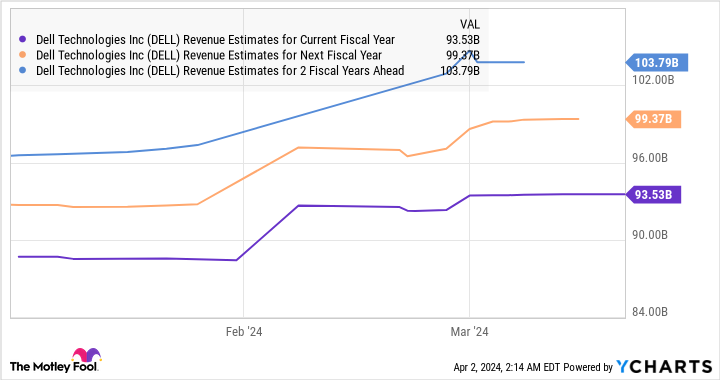

So Dell has two profitable AI-related catalysts which might be possible to assist it return to development from the present fiscal 12 months. The corporate delivered $88.4 billion in income in fiscal 2024, down 14% from the prior 12 months. Nevertheless, as the next chart reveals, its income is ready to start out rising from fiscal 2025.

The case for Tremendous Micro Pc

Tremendous Micro Pc is a a lot smaller firm than Dell. Its income in fiscal 2023 (which led to June final 12 months) was simply $7.1 billion. Nevertheless, being smaller signifies that gross sales of AI servers are shifting the needle in a much bigger approach for Supermicro.

The corporate received greater than 50% of its whole income from promoting AI-related server options within the earlier quarter. This explains why the corporate’s income within the present fiscal 12 months is on observe to greater than double to $14.5 billion. If half of Supermicro’s fiscal 2024 income comes from gross sales of AI servers, it might generate at the least $7.2 billion in gross sales from this fast-growing market. That interprets right into a larger quarterly AI server income run price in comparison with Dell.

Additionally it is price noting that Supermicro may double its income from present ranges on condition that it has expanded its manufacturing operations to assist greater than $25 billion in annual income. The corporate is witnessing a fast rise within the utilization charges of its present manufacturing capability. Supermicro administration stated on the January earnings convention name that “our manufacturing utilization price is about 65% throughout our USA, Netherlands and Taiwan amenities, and they’re rapidly filling.”

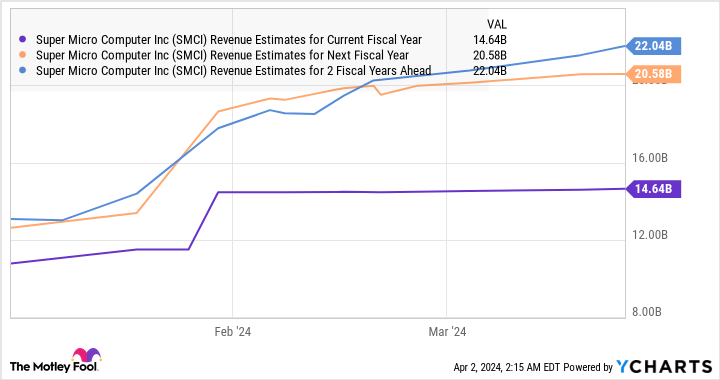

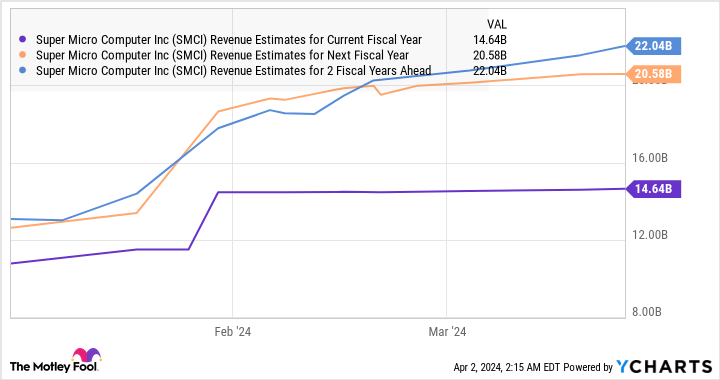

As such, it’s not stunning to see why consensus estimates predict Supermicro’s top-line development to stay strong in fiscal 2024 and past.

It would not be stunning to see Supermicro exceeding the fiscal 2026 consensus estimate. That is as a result of, in administration’s phrases, “next-generation AI and CPU platforms proceed to drive robust ranges of design wins, orders and backlog from top-tier information facilities, rising cloud service suppliers, enterprise/channel, and edge/IoT/telco prospects.”

The decision

I’ve already identified that Supermicro’s smaller measurement is a bonus, because the demand for its AI servers is driving a lot stronger development in comparison with Dell. This explains why analysts forecast Supermicro’s earnings to extend at an annual price of 48% for the subsequent 5 years. Dell, in the meantime, is anticipated to clock almost negligible annual earnings development for the subsequent 5 years.

After all, Dell’s fortunes may change, and its earnings development price may speed up as soon as its AI server enterprise turns into greater and AI-enabled PCs begin driving development within the shopper enterprise. That is why traders in search of a possible AI winner buying and selling at a gorgeous valuation may need to take into account shopping for Dell, as it’s buying and selling at simply 15.7 instances ahead earnings, decrease than Supermicro’s ahead earnings a number of of 36.

Nevertheless, we now have seen that Supermicro is rising at a a lot quicker tempo, and it will possibly justify its richer valuation consequently. So growth-oriented traders can take into account shopping for Supermicro over Dell, as its fast-growing nature may assist ship more healthy good points in the long term.

Must you make investments $1,000 in Dell Applied sciences proper now?

Before you purchase inventory in Dell Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Dell Applied sciences wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $539,230!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

See the ten shares »

*Inventory Advisor returns as of April 4, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a disclosure coverage.

Higher Synthetic Intelligence (AI) Inventory: Dell vs. Tremendous Micro Pc was initially printed by The Motley Idiot