Ought to traders put together for a winter stuffed with persistent headwinds? Inflation stays excessive, rising rates of interest are placing a squeeze on capital in addition to making shopper credit score dearer, and each the China COVID lockdowns and the Russian warfare in Ukraine proceed to crimp international provide chains.

However despite the fact that the markets are going through critical headwinds, not each inventory goes to react by falling. In response to the analysts at Wall Road large Deutsche Financial institution, two fascinating shares are more likely to see substantial positive factors going ahead.

Turning to the TipRanks database, we discover that each are Purchase-rated, and each have proven heavy losses in latest months, severely underperforming the broader markets. Even so, the Deutsche Financial institution analysts imagine that these shares have room to realize in 2023, on the order of 40% or extra. Listed here are the small print.

BlackSky Expertise (BKSY)

We’ll begin with a microcap satellite tv for pc intelligence firm, BlackSky. This firm owns and operates a number one community of low earth orbit small satellites, and might seize imagery in an economical, environment friendly matter wherever and at any time when its clients require. BlackSky’s providers embrace information processing on its Spectra AI software program platform, which might combine information from third-party sensors for important insights and analytics. The corporate’s buyer base consists of US and worldwide governmental companies, in addition to international business companies and organizations.

BlackSky controls a considerable constellation of small satellites, and the corporate can deliver a number of benefits to its clients. These embrace a 90-minute common product supply, a 60 minutes common on satellite tv for pc revisits, and as much as 15 satellite tv for pc revisits per location per day. As well as, BlackSky can present direct satellite tv for pc downlinks to each ground- and maritime-based operations.

All of this provides as much as a strong enterprise in a singular area of interest. BlackSky leveraged this to a powerful 113% year-over-year income achieve in 3Q22, to a complete of $16.9 million. This achieve was powered by strong positive factors in imagery and software program analytical providers, which elevated their share of complete income to 89%. Whereas BlackSky, like many cutting-edge tech corporations, operates at a web loss, the EPS of -$0.12 beat the Road’s -$0.20 forecast.

Nonetheless, whereas BlackSky confirmed some spectacular development numbers this yr, together with a significant contract with the US authorities’s Nationwide Reconnaissance Workplace (NRO), loss-making corporations have been out of favor in 2022, and the corporate’s shares have fallen sharply. Yr-to-date, BKSY is down 62%.

Protecting BlackSky for Deutsche Financial institution, analyst Edison Yu notes that the corporate has had its difficulties not too long ago – but additionally that it has constructed up loads of momentum to hold by means of the following yr.

“BlackSky has been inconsistent operationally however is laser targeted on leveraging its flagship Spectra AI software program to generate precious actionable insights and is supported by profitable authorities/protection contracts which we imagine finally make it a sexy strategic goal given the present depressed valuation… BlackSky is benefitting from larger buyer exercise associated to Russia/Ukraine battle and in addition different contracts coming in stronger… BlackSky is rising its sale pressure and community of companions, which ought to deliver onboard extra clients,” Yu opined.

Contemplating BlackSky’s potential going ahead, Yu charges the inventory a Purchase together with a $3 value goal to point his confidence in a one-year achieve of 75%. (To look at Yu’s monitor file, click on right here)

Turning now to the remainder of the Road, different analysts additionally like what they’re seeing. 4 Buys and no Holds or Sells add as much as a Sturdy Purchase consensus score. The shares are buying and selling for $1.71 and their $4.25 common value goal suggests a possible upside of ~148% for the following 12 months. (See BSKY inventory forecast on TipRanks)

Coherent Company (COHR)

The second inventory we’ll have a look at, Coherent, has a brand new ticker however a protracted historical past. Till July of this yr, the corporate was often called II-VI, and held an vital place within the silicon semiconductor chip business. It nonetheless lives in that area of interest, designing and manufacturing precision tools for engineered supplies and optoelectronic part programs. However on July 1 of this yr, the corporate accomplished its acquisition of Coherent, Inc., and beginning on September 8, the mixed agency adopted the Coherent identify and commenced utilizing the COHR ticker on the NASDAQ. Although the corporate has taken on new branding, a brand new identify, and a brand new ticker, it would proceed to make use of the II-VI inventory historical past in continuity with COHR.

On the enterprise finish, the brand new agency has added Coherent, Inc.’s laser expertise to its personal high-tech precision machining and optoelectronics. General, the mix is anticipated to deliver added worth to enterprise clients within the chip sector.

In the newest quarter, Q1 of fiscal yr 2023, Coherent noticed a big sequential soar in revenues, from $887 million in fiscal 4Q22 to $1.34 billion within the present interval. This was a q/q achieve of 51%; year-over-year, the income achieve got here in at 68%. The sturdy income achieve was supported by y/y natural income development of 20%. Trying ahead, Coherent can depend on a file work backlog of $3.05 billion, up 119% from the year-ago quarter.

Like many others, the inventory has suffered badly in 2022; COHR shares are down greater than 49% because the flip of the yr.

Nonetheless, noting the share value drop and the problems worrying traders, Deutsche Financial institution’s Sidney Ho takes an upbeat stance.

“COHR shares have underperformed the broader market year-to-date on fears that the expansion of its natural enterprise will decelerate and the newly-acquired legacy Coherent enterprise has an excessive amount of publicity to GDP-driven markets, whereas debt leverage post-deal can also be too excessive. Nonetheless, primarily based on the corporate’s outlook and thru our latest work, we imagine traders’ issues to be overly pessimistic,” Ho defined.

“We additionally imagine among the development drivers in Comms, silicon carbide (SiC), sensing, semicap and show are underappreciated by traders, which can doubtless greater than offset dangers related to the remainder of enterprise,” the analyst added.

Contemplating the disconnect between the corporate’s share efficiency and its sturdy potential, Ho charges COHR as a Purchase going ahead, and units a $50 value goal that means a one-year upside potential of ~44%. (To look at Ho’s monitor file, click on right here)

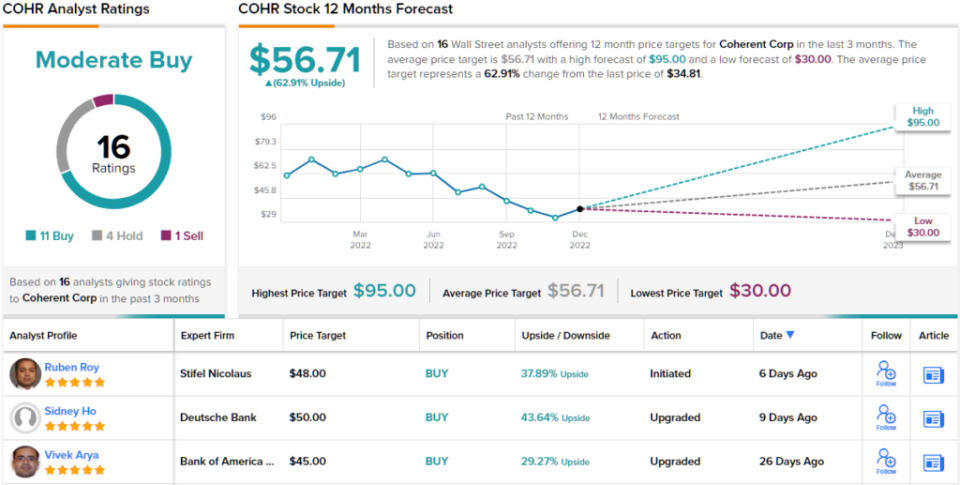

General, this chip-related tech firm has picked up 16 latest opinions from the Road’s analysts, and these embrace 11 Buys, 4 Holds, and 1 Promote, for a Reasonable Purchase consensus score. The typical value goal is $56.71, implying a bullish 63% upside from the present share value of $34.81. (See COHR inventory forecast on TipRanks)

To seek out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a newly launched instrument that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your individual evaluation earlier than making any funding.