(Bloomberg) — The greenback rose in early buying and selling on Monday, including to a 3rd week of positive aspects as hawkish feedback by Federal Reserve officers and geopolitical tensions bolstered the attraction of the dollar. Asian shares regarded set for a blended open.

Most Learn from Bloomberg

Australia’s benchmark index fluctuated whereas US fairness futures dropped after the S&P 500 Index declined Friday and slid for a second week. Contracts for Japanese shares pointed to small positive aspects whereas these for Hong Kong fell.

A report from Goldman Sachs Group Inc. tipping a rebound in Chinese language shares added a counterweight to the move of stories damping urge for food for equities. Traders in China can even be looking out for any potential minimize to the nation’s prime mortgage charges Monday.

The greenback made small advances versus most of its Group-of-10 friends following a weekend that noticed no cooling of US-China tensions. Beijing’s prime diplomat labeled the American response to the balloon it shot down “hysterical” whereas his counterpart Antony Blinken stated its entry into his nation’s airspace was “irresponsible.” In the meantime, North Korea test-fired an intercontinental ballistic missile.

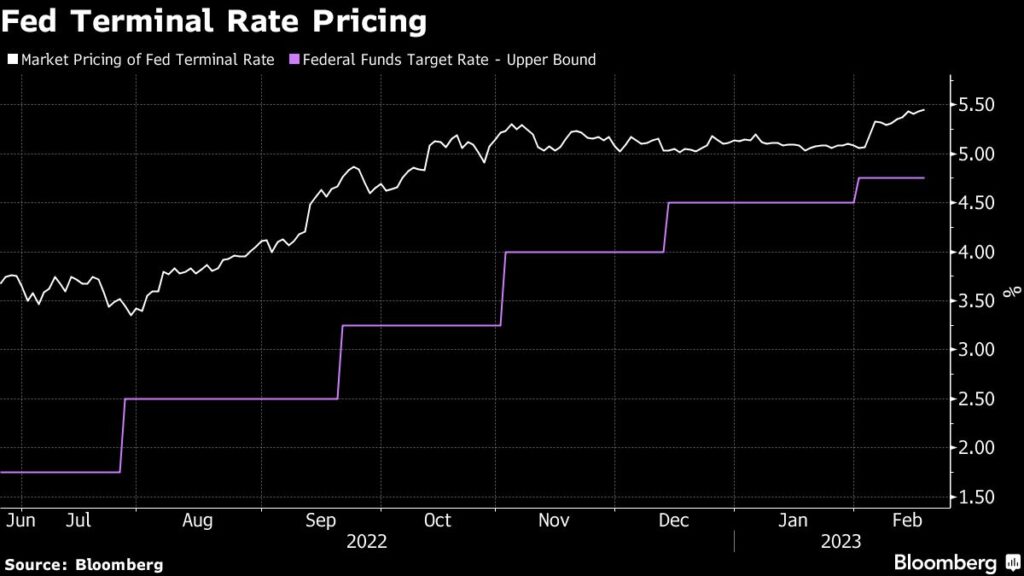

Above and past this, traders are targeted on the shifting outlook for rates of interest, with merchants absolutely pricing in quarter-point rate of interest will increase on the Fed’s subsequent two conferences after policymakers stated Thursday that larger hikes weren’t out of the query.

Federal Reserve Financial institution of Richmond President Thomas Barkin stated Friday that he favored a quarter-point rate of interest hike in February to provide the central financial institution “flexibility” in its quest to tamp down inflation. Fed Governor Michelle Bowman stated charges must hold going greater since inflation stays “a lot too excessive.”

In commodities, oil rose fractionally after capping its longest string of every day losses on the yr final week. Rising US oil inventories and the prospect of additional tightening by the Fed final week eclipsed the elevate from indicators that Chinese language power demand is bettering.

Key occasions this week:

-

Earnings for the week are scheduled to incorporate: Alibaba, Anglo American, AXA, BAE Techniques, Baidu, BASF, BHP, Danone, Deutsche Telekom, EBay, Holcim, House Depot, Hong Kong Exchanges & Clearing, HSBC, Iberdrola, Lloyds Banking Group, Moderna, Munich Re, Newmont, Nvidia, Rio Tinto, Walmart, Warner Bros Discovery

-

China mortgage prime charges, Monday

-

US monetary markets closed for Presidents’ Day vacation, Monday

-

PMIs for Japan, Eurozone, UK, US, Tuesday

-

US present residence gross sales, Tuesday

-

US MBA mortgage purposes, Wednesday

-

The Federal Reserve minutes from Jan. 31-Feb. 1 coverage assembly, Wednesday

-

Eurozone CPI, Thursday

-

US GDP, preliminary jobless claims, Thursday

-

Atlanta Fed President Raphael Bostic speaks, Thursday

-

G-20 finance ministers and central financial institution governors meet in India, Thursday-Friday

-

Japan CPI, Friday

-

BOJ governor-nominee Kazuo Ueda seems earlier than Japan’s decrease home, Friday

A number of the major strikes in markets:

Shares

-

S&P 500 futures fell 0.2% as of 8:19 a.m. Tokyo time. The S&P 500 closed 0.3% decrease on Friday

-

Nasdaq 100 futures fell 0.3%. The Nasdaq 100 closed 0.7% decrease on Friday

-

Nikkei 225 futures rose 0.2%

-

Australia’s S&P/ASX 200 Index was little modified

-

Hold Seng Index futures fell 0.6%

Currencies

-

The euro fell 0.1% to $1.0683

-

The Japanese yen fell 0.1% to 134.30 per greenback

-

The offshore yuan was little modified at 6.8789 per greenback

-

The Australian greenback fell 0.2% to $0.6866

Cryptocurrencies

-

Bitcoin fell 0.6% to $24,399.31

-

Ether fell 0.2% to $1,683.52

Bonds

Commodities

-

West Texas Intermediate crude rose 0.1% to $76.42 a barrel

-

Gold rose 0.3% to $1,842.36 an oz. on Friday

This story was produced with the help of Bloomberg Automation.

Most Learn from Bloomberg Businessweek

©2023 Bloomberg L.P.