US President Donald Trump might have hit the pause on his commerce vacillations, however there appears to be a lingering deleterious impact on the American Greenback, which has slumped sharply. Cause: waning confidence within the American economic system is resulting in an enormous flight out of the buck to different secure haven currencies and gold.

That is reflective of a breakdown of a elementary assumption underpinning international finance – that when there are critical bouts of volatility within the foreign exchange markets and a spike within the VIX (volatility index), it usually results in a surge in demand for greenback property. Over the past week, the development has been precisely the other.

On Friday, the greenback slumped as traders ditched US property in favour of different alternate secure havens together with the Swiss franc, the Japanese yen and the euro, in addition to gold. Gold recorded a brand new all-time peak, and the Swiss franc notched a contemporary decade excessive, in response to Reuters knowledge.

Additionally, traders dumped Wall Avenue shares in a single day after the sturdy reduction rally on Wednesday within the aftermath of Trump’s pause. Longer-dated US Treasuries are additionally promoting off, placing 10-year yields on target for his or her greatest weekly bounce since 2001, Reuters mentioned.

Impression on the Indian Rupee

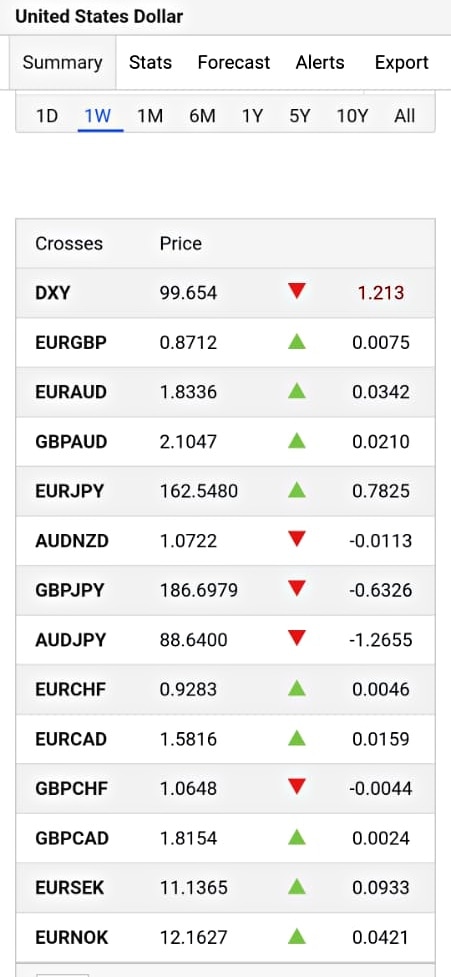

The rupee opened weak on Friday, although it’s projected to strengthen if the sharp decline within the greenback index and a slide in oil costs proceed. The greenback’s slide “will clearly” lend help to the rupee at open, an FX spot dealer at a Mumbai-based financial institution quoted by Reuters mentioned, including that it’s unlikely that the rupee will transfer previous 86. The greenback index, a tracker of the US greenback worth relative to a basket of foreign currency, was down over 3 per cent Thursday, falling to the 99.70 stage – its greatest dip in over 12-months that took it under the 100 stage for the primary time since July 2023.

Bond Market Shock

Trump’s sudden climbdown on reciprocal tariffs is claimed to have been triggered by the selloff in American bonds, as confidence within the US economic system plummeted and bond holders waned. Overseas holders, together with Japanese and Chinese language traders, are amongst these mentioned to have dumped US authorities debt amid spiralling issues over the affect of Trump’s tariffs.

A authorities bond is actually a debt instrument, issued by a sovereign authorities to boost cash from monetary markets to finance public spending, in return for which curiosity is paid. Is there a relation between bond yields and the foreign money worth of a rustic? Larger bond yields and decrease bond costs usually entice investments from different areas, boosting a rustic’s foreign money. The distinction within the rates of interest between two nations then incentivises traders to borrow cash in a low-rate atmosphere and put money into the excessive yielding one. Additionally known as carry commerce, this technique is usually a main issue of foreign money actions.

Story continues under this advert

The US has bonds value greater than $35 trillion in circulation, a lot of which is in overseas palms. America doesn’t usually see rates of interest — or yield — spikes on its debt since its bonds are considered as among the many most secure investments. That appears to be altering now.

The greenback index, a tracker of the US greenback worth relative to a basket of foreign currency, was down over 3 per cent Thursday, falling to the 99.70 stage

The greenback index, a tracker of the US greenback worth relative to a basket of foreign currency, was down over 3 per cent Thursday, falling to the 99.70 stage

Massive-scale selloffs of American bonds may pose an issue for the world’s greatest economic system, making it costlier for it to boost the cash to finance its price range hole. If the American authorities can’t promote its debt, it’s then unable to pay for issues akin to social safety or flagship programmes akin to Medicaid.

The bond spike got here after Trump escalated Washington’s commerce struggle with China. Bloomberg reported on Tuesday that for the primary time in 24 months, traders had began to demand an even bigger premium to carry junk-rated American debt over European equal, reflecting fears of a slowdown on this planet’s largest economic system.

© The Indian Specific Pvt Ltd